This simple card trick could save you from paying more!

By

Seia Ibanez

- Replies 52

We're no strangers to the convenience of modern technology. One such marvel that has made our lives easier is the humble card—a trusty companion for everything from a morning coffee run to settling the electricity bill.

But, as with all good things, there's a catch that can sometimes leave a sour taste in our wallets: the dreaded payment surcharge.

Now, you might be thinking, 'What's a few extra cents on top of my purchase?'

But let's not forget, those cents can quickly turn into dollars, and before you know it, you're part of the nearly $1 billion Australians who lose annually to card surcharges, according to data from the Reserve Bank of Australia (RBA).

The RBA also reported a 77.5 per cent increase in the application of card surcharges since 2019.

It's enough to make you want to stash your card and revert to the cash and chequebooks.

But fear not, for there's a nifty little trick that could help you keep those surcharges at bay, and it's as simple as inserting your card instead of tapping it.

Many have become accustomed to the tap-and-go convenience, but this method often uses the Visa or Mastercard network, which can come with higher surcharges.

Instead, if you have a debit card, it's likely equipped with a 'dual network' capability. This means you can process your payment through the EFTPOS system, which often incurs lower fees—and sometimes none at all!

To take advantage of this cost-saving option, simply insert your card and select the 'savings' option.

Now, it's important to note that while EFTPOS surcharges can be lower, they're not extinct. Some businesses may still apply a fee, albeit a smaller one.

For those who use digital wallets on their phones, you might be able to tweak the settings to prefer ETPOS for tap payments—though this feature isn't universally available, so it's worth checking with your card provider.

The good news is that the RBA is working on implementing 'least-cost routing' (LCR), which will automatically process payments using the cheapest network.

While it's not a standard practice everywhere yet, many payment providers have already jumped on board.

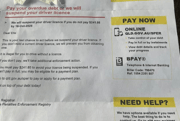

But what about when you're out and about and you're not sure if a surcharge applies?

The Australian Competition and Consumer Commission (ACCC) mandated that businesses must disclose any additional costs ‘at the earliest possible point before consumers make their order or purchase’.

‘Under the Australian Consumer Law, all businesses must display clear and accurate prices and must not mislead consumers about their prices," an ACCC spokesperson said.

‘This includes being clear and up-front about any additional costs that might apply, as well as when an additional charge is optional or can only be calculated contingent on certain information customers need to provide during the transaction.’

If you ever encounter an excessive surcharge, don't hesitate to contact the business.

If they're charging more than what it costs them to process the payment, they could be in breach of regulations.

Should you need to take it further, you can lodge a complaint with your state's fair-trading body or report it to the ACCC here.

Have you tried this card trick to save on surcharges? Do you have other tips and tricks for keeping those extra charges at bay? Share your experiences in the comments below!

But, as with all good things, there's a catch that can sometimes leave a sour taste in our wallets: the dreaded payment surcharge.

Now, you might be thinking, 'What's a few extra cents on top of my purchase?'

But let's not forget, those cents can quickly turn into dollars, and before you know it, you're part of the nearly $1 billion Australians who lose annually to card surcharges, according to data from the Reserve Bank of Australia (RBA).

The RBA also reported a 77.5 per cent increase in the application of card surcharges since 2019.

It's enough to make you want to stash your card and revert to the cash and chequebooks.

But fear not, for there's a nifty little trick that could help you keep those surcharges at bay, and it's as simple as inserting your card instead of tapping it.

Many have become accustomed to the tap-and-go convenience, but this method often uses the Visa or Mastercard network, which can come with higher surcharges.

Instead, if you have a debit card, it's likely equipped with a 'dual network' capability. This means you can process your payment through the EFTPOS system, which often incurs lower fees—and sometimes none at all!

To take advantage of this cost-saving option, simply insert your card and select the 'savings' option.

Now, it's important to note that while EFTPOS surcharges can be lower, they're not extinct. Some businesses may still apply a fee, albeit a smaller one.

For those who use digital wallets on their phones, you might be able to tweak the settings to prefer ETPOS for tap payments—though this feature isn't universally available, so it's worth checking with your card provider.

The good news is that the RBA is working on implementing 'least-cost routing' (LCR), which will automatically process payments using the cheapest network.

While it's not a standard practice everywhere yet, many payment providers have already jumped on board.

But what about when you're out and about and you're not sure if a surcharge applies?

The Australian Competition and Consumer Commission (ACCC) mandated that businesses must disclose any additional costs ‘at the earliest possible point before consumers make their order or purchase’.

‘Under the Australian Consumer Law, all businesses must display clear and accurate prices and must not mislead consumers about their prices," an ACCC spokesperson said.

‘This includes being clear and up-front about any additional costs that might apply, as well as when an additional charge is optional or can only be calculated contingent on certain information customers need to provide during the transaction.’

If you ever encounter an excessive surcharge, don't hesitate to contact the business.

If they're charging more than what it costs them to process the payment, they could be in breach of regulations.

Should you need to take it further, you can lodge a complaint with your state's fair-trading body or report it to the ACCC here.

Key Takeaways

- Australians could potentially save a substantial amount on fees by avoiding card surcharges, which contribute to nearly a billion dollars in costs annually.

- To reduce surcharges, customers can consider paying in cash, using bank transfers or opting for the EFTPOS system by swiping or inserting their card and selecting the 'savings' option.

- The ACCC requires businesses to be upfront about any surcharges, which should be disclosed at the earliest possible opportunity before a transaction is completed.

- If consumers encounter what they believe to be excessive surcharges, they can contact the business directly and, if unresolved, may lodge a complaint with their state's fair-trading body or the ACCC.

Last edited: