Social media erupts as wealthy 88-year-old widow asks for pension support

- Replies 101

Here at the SDC, we know how hard it can be to receive a stable income. To relieve the constant insecurity, many older adults around Australia rely on a pension, as provided by the government, to ensure they can live comfortably in their later years.

However, with onerous restrictions and requirements to qualify for a pension, not everyone can access the payments.

Case in point: an 88-year-old widow who recently sent a question to money columnist Noel Whittaker, asking how she can get access to a pension after her husband's passing.

It was an innocent enough question about the age pension—but it would be one that divided opinion and sparked outrage among Aussies on social media.

'My husband and I received a part pension, but he passed away, and I now have all the assets but no pension,' she wrote, adding that she was 88 and owned her own home.

'I have $680,000 in savings and $180,000 in shares. My income is $25,000 p.a. Is there anything I can do to get a part pension?'

Unfortunately, the woman's question landed her at the centre of online outrage.

One Twitter user made a joke that the question was the type that would drive Whittaker to drink, saying: 'How often do you think Fairfax's money columnist has to drink a straight shot of hard liquor before answering a question like this every week.'

A cheeky reply to another 'Ask Noel' column's headline, 'We have $1m in assets. Can we get the age pension?' saw a user profess that 'They would have willingly died of alcohol poisoning before answering this.'

Meanwhile, another commented: 'Lady, you're 88. Where are you getting 25k per year if not investments? You'll be fine,' one Twitter user wrote.

A few criticised the woman, with many accusing her of being 'entitled', greedy, and seemingly seeking to get her hands on more money.

'The problem with old people these days is they're too entitled. Back in my day, old people reused their tea bags and were grateful,' someone wrote.

Though still puzzled by the question, some people offered more sincere responses to the woman. They suggested she could 'cash in' her shares or withdraw some of her savings and 'enjoy life for the next few years'.

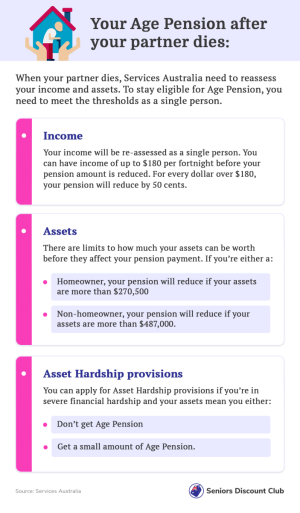

Amidst the online backlash, Noel Whittaker responded and stated that the woman's question highlighted a hard lesson: how a surviving partner can lose their pension if 'all the money' in a will was passed on to them rather than 'being judiciously spread among family members'.

He revealed that according to the woman's current financial situation, she might not be eligible for an aged pension. However, he did state that if her funds are managed in the right way, she should be able to qualify for a Commonwealth Seniors Health Card.

Pensions have become a sensitive topic for Australians due to recent major changes made to the eligibility thresholds for receiving payments. These changes came into effect on July 1 of this year.

If you want to learn more about this topic, feel free to check out the articles we've written before, which are listed below:

Members, if you're educated about the conditions that qualify you for a pension, it'll go a long way in helping you secure a steady retirement income.

Depending on your situation—whether you're single, a sole parent, a couple, or a carer—you may be able to receive the Age Pension, Carer Payment, Disability Support Pension, or other income support payments.

Our advice? Use the Services Australia website to help you figure out what payments and services you're eligible for, and get in touch with the department if you need to know more.

We would like to know your thoughts on the topic discussed in this article. Did you find it helpful and informative? Please feel free to share your comments with us; we value and appreciate your feedback!

However, with onerous restrictions and requirements to qualify for a pension, not everyone can access the payments.

Case in point: an 88-year-old widow who recently sent a question to money columnist Noel Whittaker, asking how she can get access to a pension after her husband's passing.

It was an innocent enough question about the age pension—but it would be one that divided opinion and sparked outrage among Aussies on social media.

An Australian widow has sparked outrage over her 'entitled' question about the pension to a money columnist. Credit: Shutterstock.

'My husband and I received a part pension, but he passed away, and I now have all the assets but no pension,' she wrote, adding that she was 88 and owned her own home.

'I have $680,000 in savings and $180,000 in shares. My income is $25,000 p.a. Is there anything I can do to get a part pension?'

Unfortunately, the woman's question landed her at the centre of online outrage.

One Twitter user made a joke that the question was the type that would drive Whittaker to drink, saying: 'How often do you think Fairfax's money columnist has to drink a straight shot of hard liquor before answering a question like this every week.'

A cheeky reply to another 'Ask Noel' column's headline, 'We have $1m in assets. Can we get the age pension?' saw a user profess that 'They would have willingly died of alcohol poisoning before answering this.'

Meanwhile, another commented: 'Lady, you're 88. Where are you getting 25k per year if not investments? You'll be fine,' one Twitter user wrote.

A few criticised the woman, with many accusing her of being 'entitled', greedy, and seemingly seeking to get her hands on more money.

'The problem with old people these days is they're too entitled. Back in my day, old people reused their tea bags and were grateful,' someone wrote.

Though still puzzled by the question, some people offered more sincere responses to the woman. They suggested she could 'cash in' her shares or withdraw some of her savings and 'enjoy life for the next few years'.

Amidst the online backlash, Noel Whittaker responded and stated that the woman's question highlighted a hard lesson: how a surviving partner can lose their pension if 'all the money' in a will was passed on to them rather than 'being judiciously spread among family members'.

He revealed that according to the woman's current financial situation, she might not be eligible for an aged pension. However, he did state that if her funds are managed in the right way, she should be able to qualify for a Commonwealth Seniors Health Card.

Pensions have become a sensitive topic for Australians due to recent major changes made to the eligibility thresholds for receiving payments. These changes came into effect on July 1 of this year.

If you want to learn more about this topic, feel free to check out the articles we've written before, which are listed below:

- Pension age increase draws ire from unions and older Aussies: 'Should not be a one size fits all.'

- Reevaluating Retirement: Should 70 be the New Standard Age for Pensions?

- Australian Seniors React To Upcoming Change: Pension Age and Income Tests Alterations on July 1, 2023.

Key Takeaways

- An 88-year-old Australian widow caused controversy with her question to a money columnist about how she could acquire part of a pension despite owning significant assets.

- Many social media users criticised, mocked and even deemed the woman as 'entitled' for seeking financial advice.

- Amidst the comments, some users gave constructive feedback, suggesting the lady either liquidate her assets or start spending her savings.

- Noel Whittaker, the columnist, suggested that the woman's predicament highlighted how leaving all money to the surviving partner in a will could result in the loss of their pension and suggested possible solutions.

Members, if you're educated about the conditions that qualify you for a pension, it'll go a long way in helping you secure a steady retirement income.

Depending on your situation—whether you're single, a sole parent, a couple, or a carer—you may be able to receive the Age Pension, Carer Payment, Disability Support Pension, or other income support payments.

Our advice? Use the Services Australia website to help you figure out what payments and services you're eligible for, and get in touch with the department if you need to know more.

We would like to know your thoughts on the topic discussed in this article. Did you find it helpful and informative? Please feel free to share your comments with us; we value and appreciate your feedback!