Major bank threatens account closure over unexplained home cash

By

Gian T

- Replies 106

Australians have long prided themselves on their right to privacy, especially when it comes to their hard-earned money.

But a recent incident involving one of the country’s biggest banks has left many customers feeling rattled, with some even questioning whether our financial institutions have gone too far in their quest to comply with government regulations.

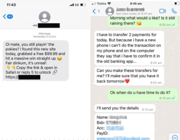

A high-profile property researcher, Louis Christopher, recently took to social media to share his shock and outrage after receiving an unexpected email from the Commonwealth Bank (CBA).

The message demanded that he provide detailed information about his finances—including whether he keeps cash at home—or risk having his accounts restricted or even closed.

The email, which Christopher described as 'disgusting' and 'Orwellian', was part of the bank’s efforts to comply with Know Your Customer (KYC) requirements, overseen by the government’s financial intelligence agency, Austrac.

These rules are designed to prevent money laundering and terrorism financing, but for many everyday Aussies, the experience can feel intrusive and unsettling.

Christopher, who has been a loyal CBA customer since 1978, said the email came without warning.

At first, he thought it might be a scam. But after calling the bank directly, he was stunned to learn the request was genuine.

The bank’s representative asked him a series of highly personal questions:

How did he build up his wealth? Why had he made certain cash withdrawals? Did he keep cash at home, and if so, why? And what was the purpose of certain transactions to third parties?

'I was shocked they would ask me if I’m holding cash at home and why—I regard sharing that info as a security risk,' Christopher told reporters.

'How have I generated my wealth? That’s my business unless they’ve got more than a slight suspicion I’m doing something illegal, in which case it should require a court order.'

He reluctantly answered the questions but made it clear he was unhappy.

'The ironic thing was at the end of all this. They wanted to share the information from the phone call with regulatory authorities as well as with other third-party credit providers. I had to say yes under duress.'

Christopher’s experience isn’t unique. After sharing his story online, he was inundated with similar tales from other Australians who had their accounts frozen or faced probing questions from their banks.

Many are left feeling powerless, especially when the threat of losing access to their own money is on the table.

So why are banks suddenly so interested in your personal finances? The answer lies in Australia’s strict anti-money laundering and counter-terrorism financing laws.

Under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006, banks are required to collect, verify, and maintain up-to-date information about their customers.

This includes not just when you open an account but on an ongoing basis.

A CBA spokesperson explained: 'We are required to manage our customers’ accounts in line with the law. Ensuring we have a customer’s most up-to-date and correct details also helps us to keep them safe and protect them from fraud.'

While most Australians support efforts to crack down on crime, many feel that the pendulum has swung too far.

The idea that a bank can freeze your account or demand to know why you keep cash at home—without any evidence of wrongdoing—has left some customers feeling like they’re being treated as suspects rather than valued clients.

Christopher summed up the sentiment: 'Banks should not be allowed to freeze people’s accounts unless it’s via a court order. It is a human right and it should not be done on a whim of some manager.'

He also pointed out the practical risks: 'I said [the cash] is for a rainy day. I’m a bit concerned because other people have given ambiguous answers and have had their accounts frozen.'

If you receive an unexpected email or call from your bank requesting personal financial information, stay calm and take careful steps to protect yourself.

Verify the request by contacting your bank through a trusted source rather than responding directly; understand your rights, including the right to know why the information is needed and how it will be used; be cautious with your responses, ask for clarification if needed, and keep a record of the conversation; and if you believe your account has been unfairly restricted or closed, consider lodging a complaint with the bank’s ombudsman or seeking legal advice.

This incident also raises broader questions about the future of cash in Australia.

With banks and governments pushing for a 'cashless society', some Aussies worry that their ability to keep and use cash is being eroded.

For many over-60s, cash is not just a convenience—it’s a way to budget, maintain privacy, and feel secure in uncertain times.

But as banks ramp up their scrutiny of cash transactions, it’s clear that the days of 'no questions asked' banking are over.

Whether this makes us safer or simply more anxious is a question that’s yet to be answered.

Have you ever been asked by your bank to explain your transactions or why you keep cash at home? Do you think these new rules go too far, or are they a necessary part of keeping our financial system safe? Share your experiences and thoughts in the comments below.

But a recent incident involving one of the country’s biggest banks has left many customers feeling rattled, with some even questioning whether our financial institutions have gone too far in their quest to comply with government regulations.

A high-profile property researcher, Louis Christopher, recently took to social media to share his shock and outrage after receiving an unexpected email from the Commonwealth Bank (CBA).

The message demanded that he provide detailed information about his finances—including whether he keeps cash at home—or risk having his accounts restricted or even closed.

The email, which Christopher described as 'disgusting' and 'Orwellian', was part of the bank’s efforts to comply with Know Your Customer (KYC) requirements, overseen by the government’s financial intelligence agency, Austrac.

These rules are designed to prevent money laundering and terrorism financing, but for many everyday Aussies, the experience can feel intrusive and unsettling.

Christopher, who has been a loyal CBA customer since 1978, said the email came without warning.

The bank’s representative asked him a series of highly personal questions:

How did he build up his wealth? Why had he made certain cash withdrawals? Did he keep cash at home, and if so, why? And what was the purpose of certain transactions to third parties?

'I was shocked they would ask me if I’m holding cash at home and why—I regard sharing that info as a security risk,' Christopher told reporters.

'How have I generated my wealth? That’s my business unless they’ve got more than a slight suspicion I’m doing something illegal, in which case it should require a court order.'

He reluctantly answered the questions but made it clear he was unhappy.

'The ironic thing was at the end of all this. They wanted to share the information from the phone call with regulatory authorities as well as with other third-party credit providers. I had to say yes under duress.'

Christopher’s experience isn’t unique. After sharing his story online, he was inundated with similar tales from other Australians who had their accounts frozen or faced probing questions from their banks.

Many are left feeling powerless, especially when the threat of losing access to their own money is on the table.

So why are banks suddenly so interested in your personal finances? The answer lies in Australia’s strict anti-money laundering and counter-terrorism financing laws.

Under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006, banks are required to collect, verify, and maintain up-to-date information about their customers.

A CBA spokesperson explained: 'We are required to manage our customers’ accounts in line with the law. Ensuring we have a customer’s most up-to-date and correct details also helps us to keep them safe and protect them from fraud.'

While most Australians support efforts to crack down on crime, many feel that the pendulum has swung too far.

The idea that a bank can freeze your account or demand to know why you keep cash at home—without any evidence of wrongdoing—has left some customers feeling like they’re being treated as suspects rather than valued clients.

Christopher summed up the sentiment: 'Banks should not be allowed to freeze people’s accounts unless it’s via a court order. It is a human right and it should not be done on a whim of some manager.'

If you receive an unexpected email or call from your bank requesting personal financial information, stay calm and take careful steps to protect yourself.

Verify the request by contacting your bank through a trusted source rather than responding directly; understand your rights, including the right to know why the information is needed and how it will be used; be cautious with your responses, ask for clarification if needed, and keep a record of the conversation; and if you believe your account has been unfairly restricted or closed, consider lodging a complaint with the bank’s ombudsman or seeking legal advice.

This incident also raises broader questions about the future of cash in Australia.

With banks and governments pushing for a 'cashless society', some Aussies worry that their ability to keep and use cash is being eroded.

But as banks ramp up their scrutiny of cash transactions, it’s clear that the days of 'no questions asked' banking are over.

Whether this makes us safer or simply more anxious is a question that’s yet to be answered.

Key Takeaways

- CommBank (Commonwealth Bank) threatened to close a customer’s account unless he explained why he was holding cash at home and provided details about his source of wealth.

- The high-profile property researcher Louis Christopher criticised the bank’s actions as 'Orwellian' and 'disgusting', saying he felt the request was a security risk and an invasion of privacy.

- The bank’s questions were part of Know Your Customer (KYC) requirements, which Austrac oversees under the Anti-Money Laundering and Counter-Terrorism Financing Act.

- CommBank stated they are legally required to verify and update customers’ information to comply with regulations and help protect against fraud and criminal activity.