How this simple phone call cost an unfortunate woman $21,000 within seconds

Marie Marshall is a woman who prides herself on her selfless, hardworking nature. For 66 years, she’s put the needs of others ahead of her own and has saved diligently for her retirement. Sadly, her dream of a peaceful retirement is now slipping away from her after she fell victim to a cruel phone scam.

The scam began when Marie received a call from a man claiming to be from the Commonwealth Bank’s (CBA) fraud department.

'He had an Indian accent, but spoke clearly in English and appeared highly educated and very patient,' she said. 'He was able to quote my account numbers and balances.'

The scammer told Marie that her account had been compromised by suspicious transactions.

‘In order to secure my accounts and funds, he said I’d need to open a new CBA account and transfer all my money there,’ Marie recalled.

To make the situation appear more legitimate, the scammer told Marie she would need to confirm her ID using an app. Ironically, he warned that this was more secure than providing details over the phone, which is 'what scammers do'.

It was after Marie downloaded this app (actually a type of virus known as a ‘trojan horse’) that the scammer had access to her phone, using it to completely drain her savings–a total of $21,000.

While some were able to be recovered after it was put into a Westpac account, the majority of her savings are still missing. Marie was left with a mere $4 in her purse.

‘I had no idea I’d been scammed until two days later,’ she explained.

The realisation came when she read a post on social media that appeared to be about her exact situation. Unable to log in to her bank account, Marie drove to a nearby ATM and discovered her pin did not work.

‘I was heartbroken and highly distraught,’ Marie recounted.

Marie and her daughter went to her nearest Commonwealth branch to file a complaint and start an investigation. However, after the investigation, the bank informed Marie that her funds were not recoverable.

While CBA has offered Marie $4,490.15 as compensation, they have allegedly stated that she has to pay the money the scammer spent, which totals $2,535.

‘I don’t feel that CBA’s response has been acceptable,’ she mentioned.

Marie narrates how this scam has changed her life: ‘I plan to retire on the pension and a small amount of superannuation. I don’t own a home. The savings the scammer stole would have been used to buy a car, as well as paying off some bills.’

Since then, Marie has received many phone calls from unknown numbers, and her social media page has been hacked, which led to the loss of her photos and contacts.

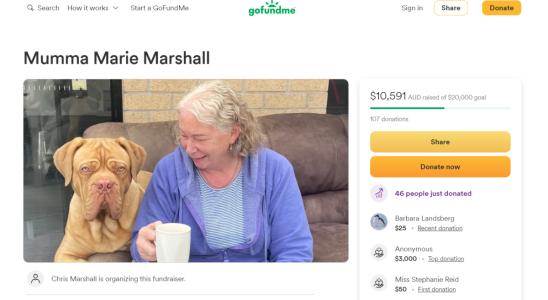

Her family has since opened a GoFundMe page to help her through this difficult time. As of writing, donations have reached more than $10,000.

She also shared the mental toll this ordeal has caused her: ‘Since the scam, I’ve gone through such a hard time. I was so embarrassed, and I felt so stupid that I fell for the scam. I’d always been so careful with money,’ Marie said.

‘I was quite teary and quiet since it occurred, and I fell into a state of mild depression, which my family monitored closely,’ she added.

Members, Marie’s story is a heartbreaking reminder to stay alert to phone scams and be informed of other techniques scammers use nowadays.

In light of this, we’ve compiled a list of tips to protect yourself:

If you come across anything suspicious, don't be shy to ask us here at the SDC about it. You can post at our Scam Watch forum so other members can stay informed.

You may also contact Services Australia's Scams and Identity Theft Helpdesk on 1800 941 126 or send a report to Australian Competition and Consumer Commission here.

If the worst case happens, seek advice from the Australian Financial Complaints Authority if you’re unhappy with how your bank has responded to your situation.

Members, do you have any tips or stories about phone scams? Share them in the comments below!

The scam began when Marie received a call from a man claiming to be from the Commonwealth Bank’s (CBA) fraud department.

'He had an Indian accent, but spoke clearly in English and appeared highly educated and very patient,' she said. 'He was able to quote my account numbers and balances.'

The scammer told Marie that her account had been compromised by suspicious transactions.

‘In order to secure my accounts and funds, he said I’d need to open a new CBA account and transfer all my money there,’ Marie recalled.

To make the situation appear more legitimate, the scammer told Marie she would need to confirm her ID using an app. Ironically, he warned that this was more secure than providing details over the phone, which is 'what scammers do'.

It was after Marie downloaded this app (actually a type of virus known as a ‘trojan horse’) that the scammer had access to her phone, using it to completely drain her savings–a total of $21,000.

While some were able to be recovered after it was put into a Westpac account, the majority of her savings are still missing. Marie was left with a mere $4 in her purse.

‘I had no idea I’d been scammed until two days later,’ she explained.

The realisation came when she read a post on social media that appeared to be about her exact situation. Unable to log in to her bank account, Marie drove to a nearby ATM and discovered her pin did not work.

‘I was heartbroken and highly distraught,’ Marie recounted.

Marie and her daughter went to her nearest Commonwealth branch to file a complaint and start an investigation. However, after the investigation, the bank informed Marie that her funds were not recoverable.

While CBA has offered Marie $4,490.15 as compensation, they have allegedly stated that she has to pay the money the scammer spent, which totals $2,535.

‘I don’t feel that CBA’s response has been acceptable,’ she mentioned.

Marie narrates how this scam has changed her life: ‘I plan to retire on the pension and a small amount of superannuation. I don’t own a home. The savings the scammer stole would have been used to buy a car, as well as paying off some bills.’

Since then, Marie has received many phone calls from unknown numbers, and her social media page has been hacked, which led to the loss of her photos and contacts.

Her family has since opened a GoFundMe page to help her through this difficult time. As of writing, donations have reached more than $10,000.

She also shared the mental toll this ordeal has caused her: ‘Since the scam, I’ve gone through such a hard time. I was so embarrassed, and I felt so stupid that I fell for the scam. I’d always been so careful with money,’ Marie said.

‘I was quite teary and quiet since it occurred, and I fell into a state of mild depression, which my family monitored closely,’ she added.

Members, Marie’s story is a heartbreaking reminder to stay alert to phone scams and be informed of other techniques scammers use nowadays.

In light of this, we’ve compiled a list of tips to protect yourself:

- Don’t answer calls from unknown numbers.

- Consider an app that identifies which numbers are call centres and which are scammers.

- Hang up on anyone who calls asking for your personal information, including bank details.

- Be wary of anyone who pushes you to make decisions quickly or ask you to keep it a secret.

- Unless your bank has contacted you first, don’t transfer any money if someone requests it over the phone.

If you come across anything suspicious, don't be shy to ask us here at the SDC about it. You can post at our Scam Watch forum so other members can stay informed.

You may also contact Services Australia's Scams and Identity Theft Helpdesk on 1800 941 126 or send a report to Australian Competition and Consumer Commission here.

If the worst case happens, seek advice from the Australian Financial Complaints Authority if you’re unhappy with how your bank has responded to your situation.

Key Takeaways

- A woman named Marie Marshall fell victim to a phone scam, losing her life savings amounting to $21,000.

- The scammer posed as a representative from the Commonwealth Bank fraud department, led her to download an app, and gained access to her account information.

- After learning about the scam, Marie was left distraught and heartbroken. She has been receiving ongoing calls from unknown numbers and her Facebook account has been hacked.

- The Commonwealth Bank, after completing their investigation, informed Marie that her funds were not recoverable and she must pay back all the money the scammer had spent along with the fees on her credit card. The bank has offered compensation of $4,490.15 while stating that $2,535.00 had to be paid back.

Members, do you have any tips or stories about phone scams? Share them in the comments below!