Expert tips for avoiding scammers: Stop them before they steal YOUR money!

- Replies 4

The digital age brings with it many marvels such as the internet and instantaneous communication.

For all the help technology has done though, one undeniable side effect is that it can be used by criminals to trick others out of their money through scams.

The Australian Competition and Consumer Commission's (ACCC) Scamwatch revealed that reported scams cost Australians over $560 million last year.

That figure is quite a big jump from 2021 when $324 million was lost to scammers.

Despite the astronomical amounts, still, it can be quite difficult to grasp the effects of scams until you have the unfortunate experience of coming across one.

Some of our members like @Nana Zorak have bravely admitted to being victimised by the criminals behind these scams and came forward to warn others from meeting the same fate.

And while you, reading this at home, are thinking ‘Well that’s not happening to me!’, the reality is more of us are likely to fall victim than we think, according to CyberCX Director of Cyber Intelligence Katherine Mansted.

‘The reality is scammers have become more sophisticated,’ she said in an interview with Mamamia.

‘Back in the day, scammers didn't often bother to use proper English and proper grammar. They didn't have the same tools they do now, unfortunately.’

‘They might spoof your bank's numbers so it looks like a text is coming from your bank... We also see scammers investing in some pretty sophisticated business operations.’

‘So it might not just be an email or a text, sometimes it's an email or a text that prompts you to call a call centre. And you might even talk to a real person who is asking you to take a particular action that's actually a scam. So they're getting better.’

With this shocking thought in mind, here are four key ways you can protect yourself from these criminals.

Avoid giving out personal information over the phone

When you receive calls from unfamiliar numbers, Mansted recommends taking a few seconds to pause before providing any personal or financial details.

Rather than immediately trusting the person on the other end of the line, she said to tell the caller you’ll call them back and then check the legitimacy of the number first.

You can do this by searching up the number you were called from on the website of the institution that purportedly called you. If the call really did come from them, you won’t have any issue contacting them through the number on their website.

‘Sometimes my bank or the ATO (Australian Taxation Office) has called me and I break that form of communication and I start it again through a channel I trust, and we get on with our conversation,’ Mansted shared.

‘If it's a scammer, then by doing that you've saved yourself... It also just gives you that bit of a slowdown, so you can have a think before you take any action.’

Don’t panic and assess the situation

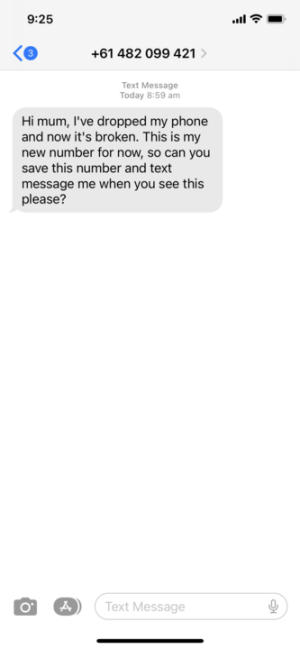

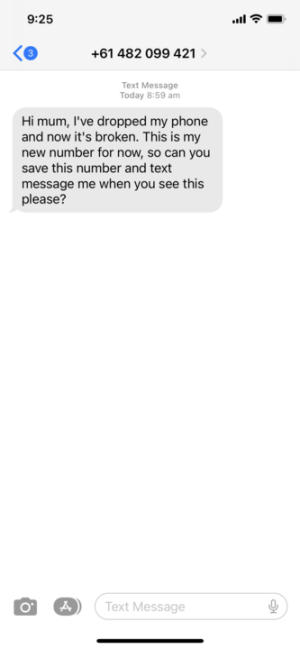

Scammers try to exploit our fear especially when they interact with us over the phone or text, as reported in scams like the ‘Hi Mum’ text scam where someone’s child apparently loses their phone or are being held under threat of force unless the parents shell out large amounts of money.

Due to the assumed urgent nature of the setup, sometimes some people forget to pause and assess the details of the situation.

‘We need to be able to step back and break that fear of missing out or fear of harm and take the steps to validate what we're seeing,’ said Mansted.

‘(Scammers) are confidence tricksters. If we know how they work, how they operate, we can actually outsmart them.’

Learn to spot the red flags

Once you’ve managed to get a grasp of things, that’s the prime time to get the ol’ noggin working.

One thing to look out for according to National Australia Bank’s Security Advisory Awareness Manager, Tessa Bowles, is if the communication is trying to establish that you must act quickly or else face a consequence.

‘They may say things like “you need to confirm your details”, or “your access to your accounts will be restricted”, or “you need to update or verify your details to continue banking”,’ Bowles said.

‘A bank will never pressure you to do that. If you are uncertain about the legitimacy of a call, we encourage you to hang up and call the bank back on the publicly listed number on their website.’

Stay updated with the latest scams doing the rounds

‘Every day, we’re seeing scammers directly targeting people through texts, emails, phone calls, computer messages and other sneaky tactics,’ Bowles said, adding that they’ve seen investment scams, romance scams, and impersonation scams recently going around victimising Aussies.

But one can never be too careful with these scammers constantly up to no good, so Mansted and Bowles shared with Mamamia other scams that Aussies can expect to see more of.

‘One thing we're seeing a lot of and we saw a lot of 2022 coming out of a pandemic, as people are looking for a job change or a way to get rich quick, was recruitment scams,’ Mansted said.

In 2022, Aussies lost $9.7 million to recruitment scams that offer quick employment usually in exchange for a fee.

‘The easy way to avoid those is to again, stop and think before you take action. In particular, don't pay money to an organisation, or give them an upfront investment.

‘And if someone's contacting you via an encrypted chat app like WhatsApp, it's a good chance that they're probably not a recruiter.’

Bank scams are also something to be aware of according to Bowles.

‘Criminals can send messages with the sender’s name set to “NAB”, or other organisations, which means their messages can appear in the same thread as other official texts sent from NAB,’ said Bowles.

One Aussie recently lost her entire savings after falling victim to a scam that she thought was from NAB.

‘When a customer receives a text message or call impersonating NAB, it means a criminal has “spoofed” our number and is impersonating us. NAB’s systems have not been breached in any way.’

Speaking of scams, the Australian Taxation Office also issued a warning recently against scammers impersonating ATO employees and contacting people to get their money and personal information.

ScamWatch also warned that a new PayID scam has been circulating again that alleges an overpayment being made and a refund eventually being requested.

‘Remember, PayID is managed by your bank so you will never be contacted directly. If you’re unsure about an email or message, reach out to your bank and don't make any payments,’ they said.

If ever you do find yourself tricked by a scammer, immediately report the incident to authorities here. It is also highly advised to change access credentials in cases where personal details are involved.

Now, on the note of keeping tabs on the latest tricks scammers use, be sure to check out our Scam Watch forum!

After all, it’s better to be safe than sorry in today’s times with scammers constantly in search of their next victim.

So, what do you think about these tips against scammers? If ever you’ve encountered a scam, what did you do about it?

Share your thoughts and experiences below!

For all the help technology has done though, one undeniable side effect is that it can be used by criminals to trick others out of their money through scams.

The Australian Competition and Consumer Commission's (ACCC) Scamwatch revealed that reported scams cost Australians over $560 million last year.

That figure is quite a big jump from 2021 when $324 million was lost to scammers.

Despite the astronomical amounts, still, it can be quite difficult to grasp the effects of scams until you have the unfortunate experience of coming across one.

Some of our members like @Nana Zorak have bravely admitted to being victimised by the criminals behind these scams and came forward to warn others from meeting the same fate.

And while you, reading this at home, are thinking ‘Well that’s not happening to me!’, the reality is more of us are likely to fall victim than we think, according to CyberCX Director of Cyber Intelligence Katherine Mansted.

Our Maddie received a ‘Hi Mum!’ text scam last December which prompted her to warn others immediately. Image Credit: SDC/@Maddie

‘The reality is scammers have become more sophisticated,’ she said in an interview with Mamamia.

‘Back in the day, scammers didn't often bother to use proper English and proper grammar. They didn't have the same tools they do now, unfortunately.’

‘They might spoof your bank's numbers so it looks like a text is coming from your bank... We also see scammers investing in some pretty sophisticated business operations.’

‘So it might not just be an email or a text, sometimes it's an email or a text that prompts you to call a call centre. And you might even talk to a real person who is asking you to take a particular action that's actually a scam. So they're getting better.’

With this shocking thought in mind, here are four key ways you can protect yourself from these criminals.

Avoid giving out personal information over the phone

When you receive calls from unfamiliar numbers, Mansted recommends taking a few seconds to pause before providing any personal or financial details.

Rather than immediately trusting the person on the other end of the line, she said to tell the caller you’ll call them back and then check the legitimacy of the number first.

You can do this by searching up the number you were called from on the website of the institution that purportedly called you. If the call really did come from them, you won’t have any issue contacting them through the number on their website.

‘Sometimes my bank or the ATO (Australian Taxation Office) has called me and I break that form of communication and I start it again through a channel I trust, and we get on with our conversation,’ Mansted shared.

‘If it's a scammer, then by doing that you've saved yourself... It also just gives you that bit of a slowdown, so you can have a think before you take any action.’

Don’t panic and assess the situation

Scammers try to exploit our fear especially when they interact with us over the phone or text, as reported in scams like the ‘Hi Mum’ text scam where someone’s child apparently loses their phone or are being held under threat of force unless the parents shell out large amounts of money.

Due to the assumed urgent nature of the setup, sometimes some people forget to pause and assess the details of the situation.

‘We need to be able to step back and break that fear of missing out or fear of harm and take the steps to validate what we're seeing,’ said Mansted.

‘(Scammers) are confidence tricksters. If we know how they work, how they operate, we can actually outsmart them.’

Experts advise taking a step back and assessing the situation when an ‘emergency’ involving loved ones pops out all of a sudden. Image Credit: Pexels/SHVETS production

Learn to spot the red flags

Once you’ve managed to get a grasp of things, that’s the prime time to get the ol’ noggin working.

One thing to look out for according to National Australia Bank’s Security Advisory Awareness Manager, Tessa Bowles, is if the communication is trying to establish that you must act quickly or else face a consequence.

‘They may say things like “you need to confirm your details”, or “your access to your accounts will be restricted”, or “you need to update or verify your details to continue banking”,’ Bowles said.

‘A bank will never pressure you to do that. If you are uncertain about the legitimacy of a call, we encourage you to hang up and call the bank back on the publicly listed number on their website.’

Stay updated with the latest scams doing the rounds

‘Every day, we’re seeing scammers directly targeting people through texts, emails, phone calls, computer messages and other sneaky tactics,’ Bowles said, adding that they’ve seen investment scams, romance scams, and impersonation scams recently going around victimising Aussies.

But one can never be too careful with these scammers constantly up to no good, so Mansted and Bowles shared with Mamamia other scams that Aussies can expect to see more of.

‘One thing we're seeing a lot of and we saw a lot of 2022 coming out of a pandemic, as people are looking for a job change or a way to get rich quick, was recruitment scams,’ Mansted said.

In 2022, Aussies lost $9.7 million to recruitment scams that offer quick employment usually in exchange for a fee.

‘The easy way to avoid those is to again, stop and think before you take action. In particular, don't pay money to an organisation, or give them an upfront investment.

‘And if someone's contacting you via an encrypted chat app like WhatsApp, it's a good chance that they're probably not a recruiter.’

Bank scams are also something to be aware of according to Bowles.

‘Criminals can send messages with the sender’s name set to “NAB”, or other organisations, which means their messages can appear in the same thread as other official texts sent from NAB,’ said Bowles.

One Aussie recently lost her entire savings after falling victim to a scam that she thought was from NAB.

‘When a customer receives a text message or call impersonating NAB, it means a criminal has “spoofed” our number and is impersonating us. NAB’s systems have not been breached in any way.’

Speaking of scams, the Australian Taxation Office also issued a warning recently against scammers impersonating ATO employees and contacting people to get their money and personal information.

ScamWatch also warned that a new PayID scam has been circulating again that alleges an overpayment being made and a refund eventually being requested.

‘Remember, PayID is managed by your bank so you will never be contacted directly. If you’re unsure about an email or message, reach out to your bank and don't make any payments,’ they said.

Key Takeaways

- Scams can be hard to detect as they are becoming increasingly sophisticated.

- Always carefully assess any texts, emails, or phone calls claiming to be from an official source or asking for personal information.

- Look out for suspicious links and inadequate or incorrect information in the message.

- If you suspect a message is a scam, do not engage with the sender; instead, report it to the relevant government agency.

If ever you do find yourself tricked by a scammer, immediately report the incident to authorities here. It is also highly advised to change access credentials in cases where personal details are involved.

Now, on the note of keeping tabs on the latest tricks scammers use, be sure to check out our Scam Watch forum!

After all, it’s better to be safe than sorry in today’s times with scammers constantly in search of their next victim.

So, what do you think about these tips against scammers? If ever you’ve encountered a scam, what did you do about it?

Share your thoughts and experiences below!