This family lost $80,000 in minutes by falling for a tricky bank scam

- Replies 14

Losing money can be a devastating experience, whether it’s a few hundred dollars or even tens of thousands.

Sadly, this was the reality for one family of five who lost around $80,000 in just a matter of minutes to a tricky spoofing scam.

It all started on November 13 when Rachel Jorgensen was out shopping for groceries.

Suddenly, her phone rang. On the other end of the line was someone claiming to be an employee of Suncorp Bank.

According to the employee, Rachel and her husband Michael’s account had been compromised, so, they would need to transfer funds to a new account.

‘She spoke to me about it and said to the guy on the phone, “Look, how do I know that you’re not a scammer yourself?”’ Michael said.

At a glance, the alleged employee was calling from a number that matched Suncorp’s.

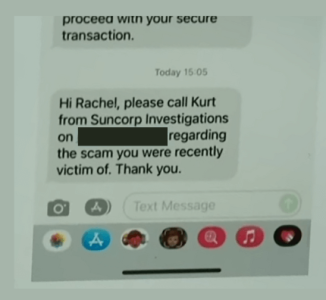

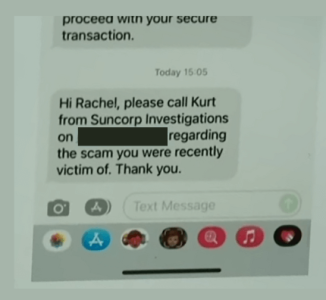

What’s more, messages sent by the employee appeared in the same message thread as the bank’s on Rachel’s phone, which made a convincing case that the person they were in contact with was indeed a Suncorp employee.

The employee managed to persuade Rachel into increasing her daily transaction limit.

Soon enough, Rachel came to a conclusion you probably have at this point: the man was a fraud.

But it was too late for the mum of three — unauthorised transactions had already been stealing their money.

‘It was three separate transactions totalling almost $80,000,’ Rachel shared.

Michael added: ‘It was devastating. Our hearts sank. We’re just like “What’ll this do to us and our three kids?”’

The Jorgensens immediately contacted Suncorp to flag the scammer and prevent further damage to their account, but to make matters worse, the couple claimed they could not reach the bank’s fraud team.

‘We were on the phone for over four hours to them and their different departments trying to create some sort of urgency and to figure out what to do next,’ said Rachel.

After a week’s worth of waiting, Rachel and Michael managed to retrieve $21,000 before the bank closed the case.

Understandably, the couple is upset over the $59,000 that remains up in the air.

‘It’s been disgusting,’ Michael said of the way their case was handled.

‘We’ve been loyal customers of theirs over the last 12 years, we have lots of accounts and insurances with them, and their duty of care is just not there,’ Rachel added in dismay.

In a statement, Suncorp addressed the crucial delay in reaching their fraud team that the Jorgensens alleged.

‘The customer’s inability to speak directly to a fraud team member did not inhibit recovery action.’ the bank said.

‘Our process is designed to be recovery-focused, we prioritise contacting the other bank to which the payments were sent.’

Suncorp also warned that it will never ask customers to transfer funds to another account regardless of how legitimate messages may seem.

We hope the Jorgensens get most, if not all, of their hard-earned money back.

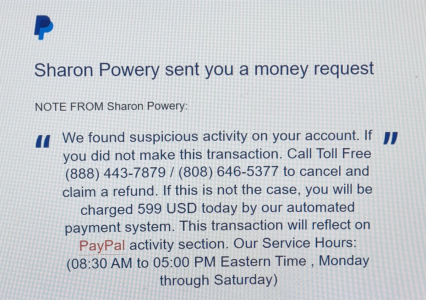

Now, you might be thinking: ‘How did those scammers pretend to be Suncorp?’

The answer is called ‘spoofing’.

Spoofing is defined in general as someone assuming characteristics from another person or institution to take on a fake identity.

What happened in the case of the Jorgensens is called Caller ID spoofing, where scammers assumed the identity of Suncorp by phone.

They do this by using services that allow the masking of information sent to the caller ID function that phones use.

These services, known here as Calling Line Identification, are legal in Australia according to the Australian Communications and Media Authority (ACMA), except when used for purposes like tricking people out of their money.

Now, what makes Caller ID spoofing more difficult to deal with is that scammers using this method have been known to come prepared. They can tell you information about your account that no one else would know including how much you have or your recent transactions.

It’s unknown how they manage to come by this information, but one popular theory is they manage to do so by phishing the details right out of unsuspecting users by sending emails that ask for sensitive information.

The ACMA underscores that institutions such as banks will never ask for financial details over the phone.

It is advised for Aussies to immediately drop calls that sound suspicious and reach services like the Australian Competition and Consumer Commission’s ScamWatch and IDCare.

You may also be on the lookout for more of these nasty scams by checking our Scam Watch forum.

What is your reaction to the Jorgensens story? Have you encountered a suspicious call in the past asking for something similar? What did you do?

Tell us your thoughts and experiences below!

Source: YouTube/7News Australia

Sadly, this was the reality for one family of five who lost around $80,000 in just a matter of minutes to a tricky spoofing scam.

It all started on November 13 when Rachel Jorgensen was out shopping for groceries.

Suddenly, her phone rang. On the other end of the line was someone claiming to be an employee of Suncorp Bank.

According to the employee, Rachel and her husband Michael’s account had been compromised, so, they would need to transfer funds to a new account.

‘She spoke to me about it and said to the guy on the phone, “Look, how do I know that you’re not a scammer yourself?”’ Michael said.

At a glance, the alleged employee was calling from a number that matched Suncorp’s.

What’s more, messages sent by the employee appeared in the same message thread as the bank’s on Rachel’s phone, which made a convincing case that the person they were in contact with was indeed a Suncorp employee.

Rachel and Michael Jorgensen are in disbelief after a scammer tricked them by phone. Screengrab Credit: YouTube/7News Australia

The employee managed to persuade Rachel into increasing her daily transaction limit.

Soon enough, Rachel came to a conclusion you probably have at this point: the man was a fraud.

But it was too late for the mum of three — unauthorised transactions had already been stealing their money.

‘It was three separate transactions totalling almost $80,000,’ Rachel shared.

Michael added: ‘It was devastating. Our hearts sank. We’re just like “What’ll this do to us and our three kids?”’

The Jorgensens immediately contacted Suncorp to flag the scammer and prevent further damage to their account, but to make matters worse, the couple claimed they could not reach the bank’s fraud team.

‘We were on the phone for over four hours to them and their different departments trying to create some sort of urgency and to figure out what to do next,’ said Rachel.

After a week’s worth of waiting, Rachel and Michael managed to retrieve $21,000 before the bank closed the case.

Understandably, the couple is upset over the $59,000 that remains up in the air.

‘It’s been disgusting,’ Michael said of the way their case was handled.

‘We’ve been loyal customers of theirs over the last 12 years, we have lots of accounts and insurances with them, and their duty of care is just not there,’ Rachel added in dismay.

Rachel received messages from the scammer appearing under Suncorp’s number. Screengrab Credit: YouTube/7News Australia

In a statement, Suncorp addressed the crucial delay in reaching their fraud team that the Jorgensens alleged.

‘The customer’s inability to speak directly to a fraud team member did not inhibit recovery action.’ the bank said.

‘Our process is designed to be recovery-focused, we prioritise contacting the other bank to which the payments were sent.’

Suncorp also warned that it will never ask customers to transfer funds to another account regardless of how legitimate messages may seem.

We hope the Jorgensens get most, if not all, of their hard-earned money back.

Now, you might be thinking: ‘How did those scammers pretend to be Suncorp?’

The answer is called ‘spoofing’.

Spoofing is defined in general as someone assuming characteristics from another person or institution to take on a fake identity.

What happened in the case of the Jorgensens is called Caller ID spoofing, where scammers assumed the identity of Suncorp by phone.

They do this by using services that allow the masking of information sent to the caller ID function that phones use.

Suncorp denies that the delays the Jorgensens experienced in reaching their fraud team affected their recovery of the stolen money. Screengrab Credit: YouTube/7News Australia

These services, known here as Calling Line Identification, are legal in Australia according to the Australian Communications and Media Authority (ACMA), except when used for purposes like tricking people out of their money.

Now, what makes Caller ID spoofing more difficult to deal with is that scammers using this method have been known to come prepared. They can tell you information about your account that no one else would know including how much you have or your recent transactions.

It’s unknown how they manage to come by this information, but one popular theory is they manage to do so by phishing the details right out of unsuspecting users by sending emails that ask for sensitive information.

The ACMA underscores that institutions such as banks will never ask for financial details over the phone.

Key Takeaways

- A family of five has lost almost $80,000 in a spoofing scam.

- The scammer called Rachel Jorgensen, pretending to be a Suncorp Bank employee, and told her that her bank account had been compromised.

- The scammer then talked Rachel through increasing her daily transaction limit and made three strange transactions totalling almost $80,000.

- The Jorgensens immediately contacted Suncorp but could not reach the fraud team. After a week, $21,000 had been recovered but they were told the case was closed.

- Suncorp says it will never ask customers to transfer funds to another bank account no matter how legitimate the request may seem.

You may also be on the lookout for more of these nasty scams by checking our Scam Watch forum.

What is your reaction to the Jorgensens story? Have you encountered a suspicious call in the past asking for something similar? What did you do?

Tell us your thoughts and experiences below!

Source: YouTube/7News Australia