Driving Less Than 10,000 km a Year? Discover How You Could Save Hundreds on Car Insurance!

- Replies 13

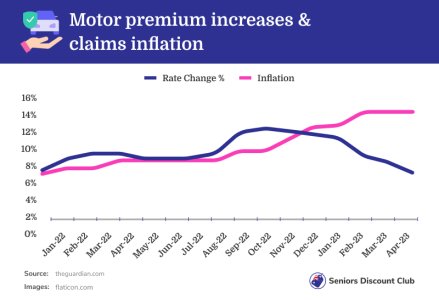

Are you a senior Australian driving less than 10,000 km a year? If so, you might be paying too much for your car insurance and could benefit by switching to a pay-as-you-drive policy*. With the average car insurance premium rising by $274 in 2023 compared to 2022, it's time to take a closer look at your policy.

According to Canstar’s Steve Mickenbecker, "The average increase we're seeing nationally is 18 per cent compared to last year." But don't worry, there's a solution that could save you hundreds of dollars: pay-as-you-go car insurance.

'Compare the Market*', a leading comparison business, has helped customers save significantly on their car insurance. They compare as many as 10 different car insurance companies to help find a better deal. One customer even saved a whopping $418 on her car insurance!

So, how can seniors save on car insurance? Here are some tips from Compare the Market*:

1. Pay-as-you-drive policies: If you don’t drive often throughout the year, these policies come with a discounted premium.

2. Increase your excess: Choosing a higher excess can reduce your insurance premiums. However, this means your excess will be more expensive if you make a claim.

3. Restrict the age of drivers: This can help reduce the price of premiums, but it means your children or grandchildren might not be allowed to drive your car.

4. No claim bonuses and discounts: If you haven’t made a car insurance claim in a set number of years, you can make use of a no claim bonus.

5. Purchase cover online: Some insurance companies offer discounts if you purchase your car insurance through their website.

6. Compare insurance annually*: Car insurance policies almost always increase in price every year, even if you haven’t made a claim. Comparing policies every year can help you find a better deal elsewhere.

Adrian Taylor, Executive General Manager of General Insurance at Compare the Market, "Your renewal policy should show both last year’s premium and your new premium, meaning you can instantly see how much more you’re being asked to pay. Make note of the difference to see how big the new change is before comparing car insurance."

So, if you're a senior Australian driving less than 10,000 km a year, don't let your car insurance premiums drive you up the wall. Visit Compare The Market today* and discover how much you could save on your car insurance.

*Please note, members, this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission to write an article or post a deal. We simply do this to assist with the costs of running the SDC. Thank you!

According to Canstar’s Steve Mickenbecker, "The average increase we're seeing nationally is 18 per cent compared to last year." But don't worry, there's a solution that could save you hundreds of dollars: pay-as-you-go car insurance.

'Compare the Market*', a leading comparison business, has helped customers save significantly on their car insurance. They compare as many as 10 different car insurance companies to help find a better deal. One customer even saved a whopping $418 on her car insurance!

So, how can seniors save on car insurance? Here are some tips from Compare the Market*:

1. Pay-as-you-drive policies: If you don’t drive often throughout the year, these policies come with a discounted premium.

2. Increase your excess: Choosing a higher excess can reduce your insurance premiums. However, this means your excess will be more expensive if you make a claim.

3. Restrict the age of drivers: This can help reduce the price of premiums, but it means your children or grandchildren might not be allowed to drive your car.

4. No claim bonuses and discounts: If you haven’t made a car insurance claim in a set number of years, you can make use of a no claim bonus.

5. Purchase cover online: Some insurance companies offer discounts if you purchase your car insurance through their website.

6. Compare insurance annually*: Car insurance policies almost always increase in price every year, even if you haven’t made a claim. Comparing policies every year can help you find a better deal elsewhere.

Adrian Taylor, Executive General Manager of General Insurance at Compare the Market, "Your renewal policy should show both last year’s premium and your new premium, meaning you can instantly see how much more you’re being asked to pay. Make note of the difference to see how big the new change is before comparing car insurance."

So, if you're a senior Australian driving less than 10,000 km a year, don't let your car insurance premiums drive you up the wall. Visit Compare The Market today* and discover how much you could save on your car insurance.

*Please note, members, this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission to write an article or post a deal. We simply do this to assist with the costs of running the SDC. Thank you!

Last edited: