Cash or card? Coles' bold new checkout policy might affect how you pay in the future!

- Replies 52

In an era dominated by digital advancements, the debate over cashless transactions has ignited fervent discussions worldwide.

Some argue that transitioning to a cashless society brings forth numerous benefits, including enhanced convenience, security, and efficiency, while others raise concerns regarding issues of accessibility, privacy, and potential exclusion of marginalised communities.

Amidst the debate, Coles is the latest major retailer to navigate the shifting tides of consumer payment preferences.

A leaked internal memo revealed that Coles Liquor, which includes Liquorland, Vintage Cellars, and First Choice, is preparing its staff for a significant, albeit temporary, shift to 'card only' transactions.

This move comes as Armaguard, a primary cash transport service provider, faces potential insolvency due to the declining use of physical currency.

The 'industry-wide challenges' cited by a Coles spokesperson are set to impact the supermarket and liquor store giant from Wednesday, March 27 to Friday, April 5.

During this period, Coles staff were instructed to pivot to 'card only payments' should their cash reserves dwindle, and to inform customers of the change with a 'card only' notice at active registers.

When asked why customers cannot make cash payments, the memo advised employees to respond with: ‘Our change reserves have been impacted by a decline in cash transactions, along with industry-wide challenges with cash-movement services. All card purchases are still accepted.’

However, Coles was quick to clarify that this adjustment did not signify a total transition to a cashless operation, and emphasised that the temporary alteration would probably affect only a small portion of customers.

‘We are not transitioning to cashless transactions,’ a spokesperson asserted.

‘Due to industry-wide challenges with cash movements, we are taking some temporary steps to prepare for disruption to Armaguard services. Cash transactions continue to be available in all Coles supermarkets and Coles Liquor stores.’

Australian Banking Association CEO Anna Bligh indicated that major banks, along with Coles and Woolworths, are involved in a short-term bailout deal with Armaguard to navigate these challenges.

This is reflective of a broader trend, with the Reserve Bank reporting a steep decline in cash usage for consumer payments, from 70 per cent in 2007 to a mere 13 per cent in 2022.

Coles isn't alone in its move towards card-centric transactions.

Several KFC outlets in New South Wales, and select McDonald’s restaurants in Melbourne also adopted a card-preferred policy, citing security concerns.

While businesses in Australia are not legally required to accept cash, the Australian Competition and Consumer Commission (ACCC) mandated that they must be ‘clear and upfront about the types of payments they accept’.

Despite this, a study by Waave found that 71 per cent of Australians are concerned about the country transitioning to a cashless society, with 41 per cent expressing they are ‘extremely concerned’.

Additionally, Baby Boomers, regional residents, and lower-income households expressed the most anxiety.

The implications of this shift are far-reaching.

Coles' Kununurra store in Western Australia has already paused cash-out services due to a surge in demand for cash following local bank closures, according to a spokesperson.

This is a microcosm of a larger trend, with the Australian Prudential Regulation Authority noting the closure of 424 bank branches and the removal of 718 ATMs in the year leading up to June 2023.

Do you believe cash should remain king at the checkout, members? Share your thoughts and experiences with us in the comments below.

Do you believe cash should remain king at the checkout, members? Share your thoughts and experiences with us in the comments below.

Some argue that transitioning to a cashless society brings forth numerous benefits, including enhanced convenience, security, and efficiency, while others raise concerns regarding issues of accessibility, privacy, and potential exclusion of marginalised communities.

Amidst the debate, Coles is the latest major retailer to navigate the shifting tides of consumer payment preferences.

A leaked internal memo revealed that Coles Liquor, which includes Liquorland, Vintage Cellars, and First Choice, is preparing its staff for a significant, albeit temporary, shift to 'card only' transactions.

This move comes as Armaguard, a primary cash transport service provider, faces potential insolvency due to the declining use of physical currency.

The 'industry-wide challenges' cited by a Coles spokesperson are set to impact the supermarket and liquor store giant from Wednesday, March 27 to Friday, April 5.

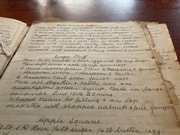

A leaked internal Coles memo revealed staff were advised how to handle customer queries on a temporary transition to ‘card only’ transactions. Credits: Shutterstock

During this period, Coles staff were instructed to pivot to 'card only payments' should their cash reserves dwindle, and to inform customers of the change with a 'card only' notice at active registers.

When asked why customers cannot make cash payments, the memo advised employees to respond with: ‘Our change reserves have been impacted by a decline in cash transactions, along with industry-wide challenges with cash-movement services. All card purchases are still accepted.’

However, Coles was quick to clarify that this adjustment did not signify a total transition to a cashless operation, and emphasised that the temporary alteration would probably affect only a small portion of customers.

‘We are not transitioning to cashless transactions,’ a spokesperson asserted.

‘Due to industry-wide challenges with cash movements, we are taking some temporary steps to prepare for disruption to Armaguard services. Cash transactions continue to be available in all Coles supermarkets and Coles Liquor stores.’

Australian Banking Association CEO Anna Bligh indicated that major banks, along with Coles and Woolworths, are involved in a short-term bailout deal with Armaguard to navigate these challenges.

This is reflective of a broader trend, with the Reserve Bank reporting a steep decline in cash usage for consumer payments, from 70 per cent in 2007 to a mere 13 per cent in 2022.

Coles isn't alone in its move towards card-centric transactions.

Several KFC outlets in New South Wales, and select McDonald’s restaurants in Melbourne also adopted a card-preferred policy, citing security concerns.

While businesses in Australia are not legally required to accept cash, the Australian Competition and Consumer Commission (ACCC) mandated that they must be ‘clear and upfront about the types of payments they accept’.

Despite this, a study by Waave found that 71 per cent of Australians are concerned about the country transitioning to a cashless society, with 41 per cent expressing they are ‘extremely concerned’.

Additionally, Baby Boomers, regional residents, and lower-income households expressed the most anxiety.

The implications of this shift are far-reaching.

Coles' Kununurra store in Western Australia has already paused cash-out services due to a surge in demand for cash following local bank closures, according to a spokesperson.

This is a microcosm of a larger trend, with the Australian Prudential Regulation Authority noting the closure of 424 bank branches and the removal of 718 ATMs in the year leading up to June 2023.

Key Takeaways

- Coles supermarket is preparing for a potential disruption to cash transport services, with a temporary 'card only' policy due to industry-wide issues, including the potential insolvency of Armaguard.

- Staff at Coles Liquor stores were instructed to convert to card only payments and display notices if cash reserves are low during the affected period.

- The Coles spokesperson confirmed this does not signal a permanent move to cashless transactions and that cash is still accepted at their stores.

- There is a decline in the use of cash for transactions in Australia, with a significant number of Australians concerned about the move towards a cashless society.