Buying and selling online? Protect your PayID and avoid falling for this scam!

We know that shopping online is becoming the preferred choice for many these days, especially with delivery and Click & Collect allowing customers to shop from phones or computers. The convenience goes the other way, too—it’s easy to get into selling items online.

That being said, buying and selling online means being aware of and avoiding certain pitfalls and schemes that target unsuspecting people, like the PayID scam.

It’s getting more popular in Australia, with almost $45 million reported lost by unsuspecting victims in 2022, and this year, over $32 million already lost.

As useful as it is to sell unwanted items online to get a quick return on what you don’t need, it’s always better to be safe than sorry.

With that in mind, let's discuss the scam and what we need to be aware of to protect your PayIDs and not fall victim to this scheme.

What is a PayID?

Introduced in Australia in 2018, a PayID is a legitimate form of electronic payment intended to make it faster and easier to transfer money from one person to another.

Essentially, a PayID allows you to use your phone number, email address or Australian Business Number (ABN) as a form of identification to make authorised payments.

A detailed explanation can also be found below:

The bank will verify your identification, and you just need to link it to the PayID so you can transfer funds securely.

With this, you don’t need to memorise your bank account and Bank-State-Branch (BSB) numbers, and you reduce the possibility of incorrect payment entry.

So, how does the PayID scam work?

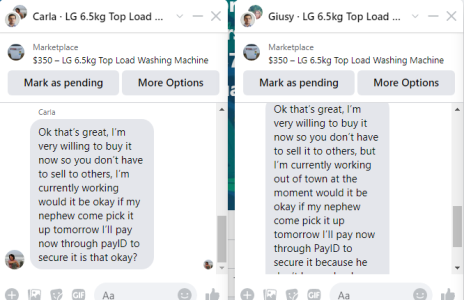

Let’s say you’re selling an item online. A scammer will reach out and express interest in the item. They typically don’t question the price you listed, and won’t even ask to see the item.

The scammer will ask to pay via PayID. Once you’ve shared it (usually a phone number or an email address), a few things will happen.

The scammer will say they made the payment, but it didn’t get through because your PayID account is unsuitable. They will ask you to ‘upgrade’ your account and/or make an additional payment to release the funds.

They may claim they paid an extra amount and ask you to reimburse them. If you send money, this will go to the scammer’s purse.

Furthermore, some scammers can even generate fake text messages and email threads that look like they’re from PayID, prompting victims to make the transfer.

We wrote an article about this early this year, where a Facebook Marketplace seller received offers from a suspected scammer. You can read the article here.

There are also stories from our members who were targeted by this scam. Here are some of their experiences:

Member @Pommyoz wrote: ‘Oh yes! And nearly got caught. It’s such a shame because Marketplace and Gumtree are such easy sites to navigate to sell, unlike eBay. But the price of this is beware of scammers And cash only please or forget it, mate.’

Member @mcc53 also shared: ‘Sadly, I was sucked in by the FB Market place scammers. It seemed genuine initially - just a matter of setting up a Pay ID for payment to occur. Unfortunately, it went downhill after I sent them money supposedly required to top up the account with as it “became” a business account. Then they wanted me to send more money to them to top it up some more. Screenshots were sent to me, the scammer even called me several times to make sure I was doing what he told me to do. That’s when I called my bank and the realisation that I had been scammed. I felt sick. [The] bank wasn’t very confident about getting my money back . This will be a hard lesson learned…’

. This will be a hard lesson learned…’

Member @Joydie said: ‘I wrote to Seniors’ Discount Club more than a month ago warning members about this scam. It happened to my husband three times in the space of a week. On the first occasion, he contacted the CBA Bank because they asked him to pay with PayID. Being unfamiliar with this, he wanted assurance from the bank that it was legitimate. The lady he spoke to at the CBA described the scam to him. However, despite the fact that he made clear that he was aware of the scam, they continued to try their luck. The best way to avoid these pests is to put ‘cash on pickup’ in the ad.’

How can you protect yourself?

The best way to protect yourself is to stay vigilant. Make sure you are aware of these warning signs to avoid them:

So, if you find yourself in a situation where something seems off, do not take the risk.

Should you ever fall victim to this or any other type of scam, be sure to reach out to your bank or financial institution immediately and report any financial losses.

You may also contact Services Australia's Scams and Identity Theft Helpdesk on 1800 941 126 or send a report to the Australian Competition and Consumer Commission here.

If the worst case happens, seek advice from the Australian Financial Complaints Authority if you’re unhappy with how your bank has responded to your situation.

It’s important that we’re all aware and conscious of the threats lurking online, so hopefully, this article has shed some light on the PayID scam.

As much as possible, let's keep an eye out for each other and ensure that no sale comes at a price too high for our members. You can share your experiences in our Scam Watch forum.

Have you had a similar experience or know someone who fell victim to a scam? Share them in the comments below!

That being said, buying and selling online means being aware of and avoiding certain pitfalls and schemes that target unsuspecting people, like the PayID scam.

It’s getting more popular in Australia, with almost $45 million reported lost by unsuspecting victims in 2022, and this year, over $32 million already lost.

As useful as it is to sell unwanted items online to get a quick return on what you don’t need, it’s always better to be safe than sorry.

With that in mind, let's discuss the scam and what we need to be aware of to protect your PayIDs and not fall victim to this scheme.

What is a PayID?

Introduced in Australia in 2018, a PayID is a legitimate form of electronic payment intended to make it faster and easier to transfer money from one person to another.

Essentially, a PayID allows you to use your phone number, email address or Australian Business Number (ABN) as a form of identification to make authorised payments.

A detailed explanation can also be found below:

The bank will verify your identification, and you just need to link it to the PayID so you can transfer funds securely.

With this, you don’t need to memorise your bank account and Bank-State-Branch (BSB) numbers, and you reduce the possibility of incorrect payment entry.

So, how does the PayID scam work?

Let’s say you’re selling an item online. A scammer will reach out and express interest in the item. They typically don’t question the price you listed, and won’t even ask to see the item.

The scammer will ask to pay via PayID. Once you’ve shared it (usually a phone number or an email address), a few things will happen.

The scammer will say they made the payment, but it didn’t get through because your PayID account is unsuitable. They will ask you to ‘upgrade’ your account and/or make an additional payment to release the funds.

They may claim they paid an extra amount and ask you to reimburse them. If you send money, this will go to the scammer’s purse.

Furthermore, some scammers can even generate fake text messages and email threads that look like they’re from PayID, prompting victims to make the transfer.

We wrote an article about this early this year, where a Facebook Marketplace seller received offers from a suspected scammer. You can read the article here.

There are also stories from our members who were targeted by this scam. Here are some of their experiences:

Member @Pommyoz wrote: ‘Oh yes! And nearly got caught. It’s such a shame because Marketplace and Gumtree are such easy sites to navigate to sell, unlike eBay. But the price of this is beware of scammers And cash only please or forget it, mate.’

Member @mcc53 also shared: ‘Sadly, I was sucked in by the FB Market place scammers. It seemed genuine initially - just a matter of setting up a Pay ID for payment to occur. Unfortunately, it went downhill after I sent them money supposedly required to top up the account with as it “became” a business account. Then they wanted me to send more money to them to top it up some more. Screenshots were sent to me, the scammer even called me several times to make sure I was doing what he told me to do. That’s when I called my bank and the realisation that I had been scammed. I felt sick. [The] bank wasn’t very confident about getting my money back

Member @Joydie said: ‘I wrote to Seniors’ Discount Club more than a month ago warning members about this scam. It happened to my husband three times in the space of a week. On the first occasion, he contacted the CBA Bank because they asked him to pay with PayID. Being unfamiliar with this, he wanted assurance from the bank that it was legitimate. The lady he spoke to at the CBA described the scam to him. However, despite the fact that he made clear that he was aware of the scam, they continued to try their luck. The best way to avoid these pests is to put ‘cash on pickup’ in the ad.’

How can you protect yourself?

The best way to protect yourself is to stay vigilant. Make sure you are aware of these warning signs to avoid them:

Tip

PayID is a free service, and NO FEES will ever need to be paid.

PayID is only administered through individual banks and will not contact customers via emails or texts.

Be aware of fake text messages and emails that look like they’re from PayID.

Beware of buyers asking for goods to be delivered to third parties.

Beware of buyers being too eager to buy and unwilling to negotiate.

PayID is only administered through individual banks and will not contact customers via emails or texts.

Be aware of fake text messages and emails that look like they’re from PayID.

Beware of buyers asking for goods to be delivered to third parties.

Beware of buyers being too eager to buy and unwilling to negotiate.

So, if you find yourself in a situation where something seems off, do not take the risk.

Should you ever fall victim to this or any other type of scam, be sure to reach out to your bank or financial institution immediately and report any financial losses.

You may also contact Services Australia's Scams and Identity Theft Helpdesk on 1800 941 126 or send a report to the Australian Competition and Consumer Commission here.

If the worst case happens, seek advice from the Australian Financial Complaints Authority if you’re unhappy with how your bank has responded to your situation.

Key Takeaways

- Scammers have been targeting unsuspecting online buyers and sellers, with over $32 million reported lost through fraudulent schemes in 2023.

- PayID is a popular method used by scammers, where they claim to send money and ask for reimbursement due to ‘additional charges’. Consumers are warned not to trust anyone asking for an additional payment to release funds through PayID as it's a free service and does not require fees.

- Scammers even send fake text messages, prompting victims to make transfers.

- Victims of a PayID scam are urged to contact their bank or financial institution immediately and report any financial losses to the authorities.

It’s important that we’re all aware and conscious of the threats lurking online, so hopefully, this article has shed some light on the PayID scam.

As much as possible, let's keep an eye out for each other and ensure that no sale comes at a price too high for our members. You can share your experiences in our Scam Watch forum.

Have you had a similar experience or know someone who fell victim to a scam? Share them in the comments below!