Australian Elder Abuse organisation concerned after jump of financial abuse cases in 2022

- Replies 3

[CONTENT WARNING: This article contains distressing themes. Please be advised.]

The number of senior residents who are requesting and receiving legal assistance to deal with financial abuse is on the rise, with lawyers from Legal Aid NSW reporting that a sum of nearly $2 million in client funds was recovered over the last year.

The same period of time saw self-referrals rise by 20 per cent.

In light of the recent developments, Legal Aid NSW is urging elderly Australians to contact services such as the Elder Abuse Service (EAS) for free legal help and advice, or visit them at the 2023 Seniors Festival Expo to acquire additional information.

According to the Elder Abuse Prevalence Study conducted in 2021, roughly one-sixth of around 7000 Australians aged 65 or older have experienced some sort of abuse in the year leading up to the research.

Of this, 2.1 per cent or around 150 said they were being abused financially, while 14.6 per cent or just over 1000 said they were psychologically abused and neglected.

Another finding of the study is that family, more specifically adult children, are the most common perpetrators of abuse at 20 per cent.

‘The fact that it’s often the people closest to them who are committing the abuse is particularly concerning, as this can create a desire by the victim to keep the abuse a secret to avoid shame, embarrassment and negative repercussions for the perpetrator – especially when it comes to family members,’ said study co-author Dr Rae Kaspiew.

The study’s findings are similar to what NSW Legal Aid Elder Abuse Service (EAS) Senior Solicitor Mary Lovelock has noted, with the most common elder abuse cases they've encountered those involving a 'granny flat' financial arrangement.

In this setup, a senior gives out substantial amounts of money to family with the understanding that they will be taken care of in return. However, the relative does not keep their end of the bargain.

'We have had several clients come to us with this issue, who are on the verge of homelessness. It can cause significant financial and mental stress for already vulnerable people,' Lovelock said.

There are also cases of elder financial abuse wherein money has been taken under Power of Attorney, where loans have gone unpaid and properties have been fraudulently transferred, as well as debts and refunds being conducted fraudulently in the name of the older person in an effort to keep money.

Previously, an 81-year-old pensioner with dementia racked up $23,000 in debt after her aged care worker used her debit card for a span of 12 months.

Other examples of elder financial abuse include gaslighting seniors to think they aren’t capable of managing their own finances or even something as simple as not returning change when shopping on behalf of an older person, according to the Council On The Ageing in Victoria.

Because elder abuse is not always easy to identify, Lovelock said that it is essential that seniors seek legal counsel in order to understand and determine their rights.

'We have helped hundreds of seniors recoup money and defend their rights. We are here to support you and everything you say to a solicitor is confidential under client-professional privilege,' she added.

Although each state and territory has specific laws and regulations related to elder abuse, there are some general principles established under common law. These include the right to be financially independent as well as autonomy and control over physical, financial and medical decisions.

If victims of elder abuse are concerned their financial assets are at risk of being misappropriated or misused, they can arrange for an independent guardian to oversee the management of their funds.

It is essential that vulnerable seniors contact agencies like NSW Legal Aid’s Elder Abuse Service (EAS) for free legal help to understand their rights and gain access to legal protection.

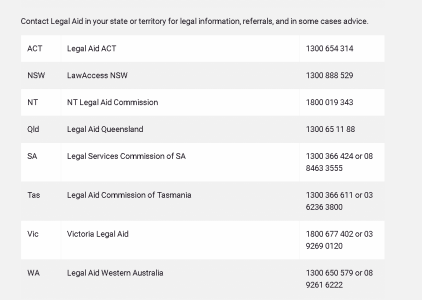

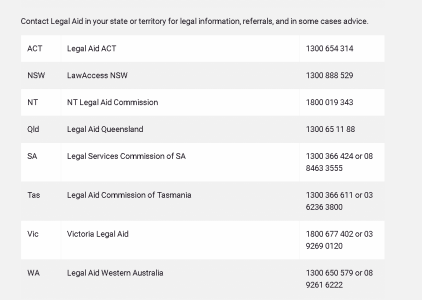

We encourage our readers who are or know someone who is experiencing financial abuse or fraud to contact their state or territory’s legal information service.

They may also want to reach the National Elder Abuse phone line at 1800 353 374 (ELDER Help), which will automatically reroute calls to their area’s elder abuse support service.

In related news, persons with disabilities have also sadly been the subject of abuse in group homes in the last couple of years — and one expert has laid out several ways they can be treated with better care and dignity.

In related news, persons with disabilities have also sadly been the subject of abuse in group homes in the last couple of years — and one expert has laid out several ways they can be treated with better care and dignity.

So, what is your reaction to this story? Do you think there are adequate resources and access to services for seniors at risk of abuse?

Tell us your thoughts below!

Source: YouTube/Compass: Guiding action on elder abuse

The number of senior residents who are requesting and receiving legal assistance to deal with financial abuse is on the rise, with lawyers from Legal Aid NSW reporting that a sum of nearly $2 million in client funds was recovered over the last year.

The same period of time saw self-referrals rise by 20 per cent.

In light of the recent developments, Legal Aid NSW is urging elderly Australians to contact services such as the Elder Abuse Service (EAS) for free legal help and advice, or visit them at the 2023 Seniors Festival Expo to acquire additional information.

According to the Elder Abuse Prevalence Study conducted in 2021, roughly one-sixth of around 7000 Australians aged 65 or older have experienced some sort of abuse in the year leading up to the research.

Of this, 2.1 per cent or around 150 said they were being abused financially, while 14.6 per cent or just over 1000 said they were psychologically abused and neglected.

Another finding of the study is that family, more specifically adult children, are the most common perpetrators of abuse at 20 per cent.

‘The fact that it’s often the people closest to them who are committing the abuse is particularly concerning, as this can create a desire by the victim to keep the abuse a secret to avoid shame, embarrassment and negative repercussions for the perpetrator – especially when it comes to family members,’ said study co-author Dr Rae Kaspiew.

Over a thousand elderly respondents in one study said they experienced abuse. Image Credit: Pexels/Cottonbro studio

The study’s findings are similar to what NSW Legal Aid Elder Abuse Service (EAS) Senior Solicitor Mary Lovelock has noted, with the most common elder abuse cases they've encountered those involving a 'granny flat' financial arrangement.

In this setup, a senior gives out substantial amounts of money to family with the understanding that they will be taken care of in return. However, the relative does not keep their end of the bargain.

'We have had several clients come to us with this issue, who are on the verge of homelessness. It can cause significant financial and mental stress for already vulnerable people,' Lovelock said.

There are also cases of elder financial abuse wherein money has been taken under Power of Attorney, where loans have gone unpaid and properties have been fraudulently transferred, as well as debts and refunds being conducted fraudulently in the name of the older person in an effort to keep money.

Previously, an 81-year-old pensioner with dementia racked up $23,000 in debt after her aged care worker used her debit card for a span of 12 months.

Other examples of elder financial abuse include gaslighting seniors to think they aren’t capable of managing their own finances or even something as simple as not returning change when shopping on behalf of an older person, according to the Council On The Ageing in Victoria.

Because elder abuse is not always easy to identify, Lovelock said that it is essential that seniors seek legal counsel in order to understand and determine their rights.

'We have helped hundreds of seniors recoup money and defend their rights. We are here to support you and everything you say to a solicitor is confidential under client-professional privilege,' she added.

The Australian Human Rights Commission has a directory of where seniors may seek legal advice in cases of abuse. Image Credit: Australian Human Rights Commission

Although each state and territory has specific laws and regulations related to elder abuse, there are some general principles established under common law. These include the right to be financially independent as well as autonomy and control over physical, financial and medical decisions.

If victims of elder abuse are concerned their financial assets are at risk of being misappropriated or misused, they can arrange for an independent guardian to oversee the management of their funds.

It is essential that vulnerable seniors contact agencies like NSW Legal Aid’s Elder Abuse Service (EAS) for free legal help to understand their rights and gain access to legal protection.

We encourage our readers who are or know someone who is experiencing financial abuse or fraud to contact their state or territory’s legal information service.

They may also want to reach the National Elder Abuse phone line at 1800 353 374 (ELDER Help), which will automatically reroute calls to their area’s elder abuse support service.

Key Takeaways

- Financial abuse of seniors is on the rise.

- Elder abuse is most often perpetrated by family members such as children or grandchildren.

- Seniors can seek legal help from the organisations like NSW's Elder Abuse Service for free.

So, what is your reaction to this story? Do you think there are adequate resources and access to services for seniors at risk of abuse?

Tell us your thoughts below!

Source: YouTube/Compass: Guiding action on elder abuse