Aussie Seniors Shocked as Car Insurance Skyrockets by 18% in 2023! Here's Your Game Plan…

- Replies 13

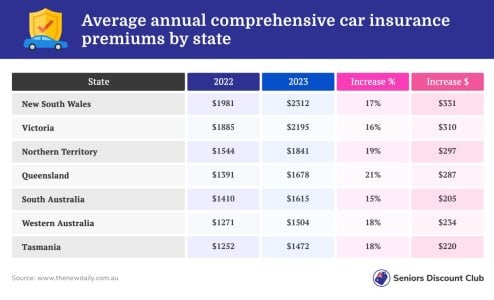

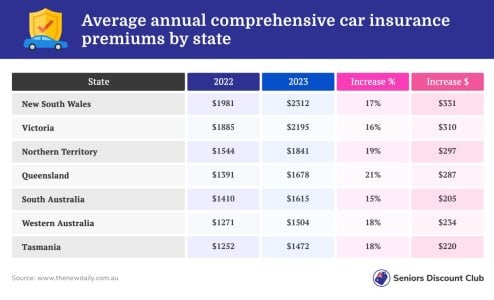

It's no secret that the cost of living is on the rise, and for Australian seniors, the pinch is being felt particularly in the realm of car insurance. "The average increase we're seeing nationally is 18 per cent compared to last year," says Canstar’s Steve Mickenbecker. That's an average increase of $274 per policy!

But don't despair. There's a silver lining to this cloud, and it comes in the form of 'Compare the Market*'. This savvy comparison business is helping many seniors save big on their car insurance* by comparing up to 10 different car insurance companies. One customer even saved a whopping $418 on her policy!

So, how can you take advantage of these potential savings? Adrian Taylor, Executive General Manager of General Insurance at Compare the Market*, shares some insider tips.

"Your renewal policy should show both last year’s premium and your new premium, meaning you can instantly see how much more you’re being asked to pay," advises Adrian. "Make note of the difference to see how big the new change is before comparing car insurance."

But it's not just about comparing apples to apples. Adrian suggests considering who is driving your car. "Generally, drivers under the age of 25 will likely increase the premium you pay. If you can restrict the age of drivers on your policy, this may help you save money."

And don't forget about the potential savings from pay-as-you-drive policies, no claim bonuses and discounts, and purchasing cover online*. Plus, you can increase your excess to reduce your premiums, although this means your excess will be more expensive if you make a claim.

Remember, you don't have to wait for your renewal to save money. You can cancel your existing policies at any time and switch insurers. Just be aware of any cancellation fees that may apply.

With car insurance premiums on the rise, it's more important than ever to shop around and find the best deal. So why not give 'Compare the Market*' a try? You might just find yourself with a little extra cash in your pocket.

*Please note, members, this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission to write an article or post a deal. We simply do this to assist with the costs of running the SDC. Thank you!

But don't despair. There's a silver lining to this cloud, and it comes in the form of 'Compare the Market*'. This savvy comparison business is helping many seniors save big on their car insurance* by comparing up to 10 different car insurance companies. One customer even saved a whopping $418 on her policy!

Car insurance rates are surging across the country, with double digit percentage increases compared to 2022

So, how can you take advantage of these potential savings? Adrian Taylor, Executive General Manager of General Insurance at Compare the Market*, shares some insider tips.

"Your renewal policy should show both last year’s premium and your new premium, meaning you can instantly see how much more you’re being asked to pay," advises Adrian. "Make note of the difference to see how big the new change is before comparing car insurance."

But it's not just about comparing apples to apples. Adrian suggests considering who is driving your car. "Generally, drivers under the age of 25 will likely increase the premium you pay. If you can restrict the age of drivers on your policy, this may help you save money."

And don't forget about the potential savings from pay-as-you-drive policies, no claim bonuses and discounts, and purchasing cover online*. Plus, you can increase your excess to reduce your premiums, although this means your excess will be more expensive if you make a claim.

Remember, you don't have to wait for your renewal to save money. You can cancel your existing policies at any time and switch insurers. Just be aware of any cancellation fees that may apply.

With car insurance premiums on the rise, it's more important than ever to shop around and find the best deal. So why not give 'Compare the Market*' a try? You might just find yourself with a little extra cash in your pocket.

*Please note, members, this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission to write an article or post a deal. We simply do this to assist with the costs of running the SDC. Thank you!

Last edited: