Are you vulnerable to this dangerous text scam? Find out how one Sydney mum's $8900 nightmare was prevented

- Replies 16

If there’s one thing you should never forget when it comes to the internet, it’s that you should always remain vigilant. That’s even more true today as cybercriminals are growing more and more sophisticated, often disguising themselves as family members to get access to our sensitive information.

Recently, one Sydney mum almost fell victim to a dangerous scam that’s been doing the rounds, where fraudsters impersonate family members in the hope of getting money.

64-year-old Lisa (not her real name), who wishes to remain anonymous, was moments away from transferring $5000 to a scammer posing as her son before a moment of quick thinking saved her from becoming the next victim of this ‘Hi Mum’ scam.

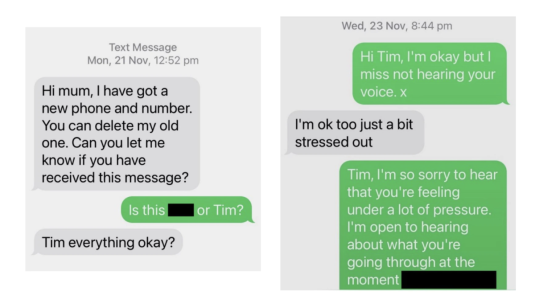

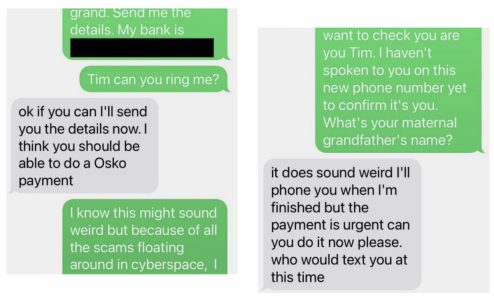

It began with a seemingly innocent text from her son.

‘Hi, mum. I have got a new phone and number. You can delete my old one. Can you let me know if you received this message?’ it read.

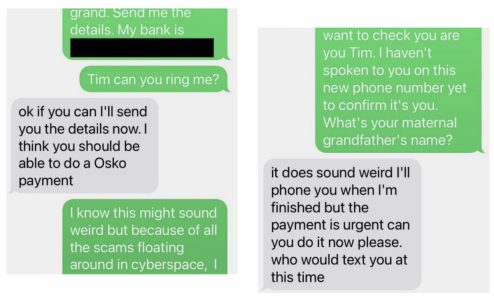

Once Lisa asked which of her two sons was texting her, the hacker had a name and claimed to be her eldest son, Tim. In the following texts, the scammer claimed to be ‘stressed out’. After Lisa tried to comfort her son, they said they were having banking issues before asking to borrow $8900.

‘I hadn’t heard from Tim in a while. He had recently bought a home and was moving house. He was trying to get their kids into new schools, so when this text came out of the blue, I thought it was a bit odd but I really wanted to help him,’ Lisa told NCA NewsWire.

Although the request was out of character, Lisa assumed her son was reaching out as a ‘last resort’.

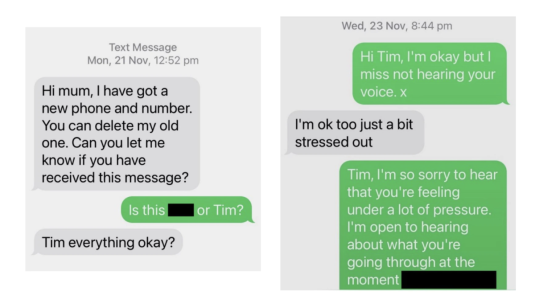

Lisa was about to hit send when she had second thoughts and asked for the name of Tim’s maternal grandfather. ‘It was just a little voice that thought, ‘Is that really him’?’ she said.

After Lisa asked the question, the hacker went notably silent. That’s when she realised that the text was not from her son at all.

‘I felt really bad asking him the first time. I could feel myself cringing. When he didn’t answer it the first time, I thought something is going on because that should just roll off the tongue,’ she said.

While Lisa was able to narrowly avoid the deception, many aren’t so fortunate. According to an ACCC report, Australians lost a staggering $1.8 billion to scams in 2021. The report, which is based on an analysis of more than 560,000 reports and data from Scamwatch, ReportCyber, major banks and money remitters, and other government agencies, estimates that actual losses were much higher than the amount reported.

A Scamwatch spokesperson went on to report that the Australian Competition and Consumer Commission (ACCC) had received more than 9700 reports of ‘“Hi Mum’” scams in 2022, totalling losses of nearly $7.2 million.

Worse yet, a new variant of the scam now includes cyber criminals who use an alpha-tag/ senderID (where the message will appear as if it’s been sent from your ‘Mum’ or ‘Dad’). This makes the scam even more difficult to spot, as the message appears to be from a genuine family member.

But that’s not the only scam going around.

Overall, investment scams were the leading cause of financial losses ($701 million), followed by payment redirection scams ($227 million) and romance scams ($142 million).

‘Scam activity continues to rise, and [in 2021] a record number of Australians lost a record amount of money,’ ACCC Deputy Chair Delia Rickard said. ‘Scammers are the most opportunistic of all criminals: they exploit natural disasters, pandemics, and the search for love.’

Ms Rickard also noted that scams cause serious emotional harm to individuals, families, and businesses in addition to financial losses.

Women reported the most scams, but men lost more money than women, and men's losses to investment scams were double women's losses. People aged 65 and over reported the highest losses and reported losses steadily increased with age.

Scamwatch data also shows that people experiencing vulnerability and hardship reported record levels of losses in 2021. People with disabilities reported twice as many scams and a 102% increase in financial losses to $19.6 million. Indigenous Australians reported 43% more scams and 142% more losses, and people from culturally and linguistically diverse communities reported an 88% increase in losses.

The ACCC has been working with government agencies, domestic and international law enforcement, and major banks and telecommunications providers to share intelligence, disrupt scams, and raise awareness in the community. This effort led to the Flubot scam being stopped, and the telecommunications sector's Reducing Scam Calls Industry Code blocking more than 357 million scam calls.

Scamwatch data also shows that between 2020 and 2021 there was a 60% reduction in losses from inheritance and unexpected money scams, and only a 1% increase in losses from travel, prizes and lottery scams. However, Ms Rickard noted that there are still gaps in the system that scammers can exploit - losses from investment scams increased by 169% during the same period.

‘If an investment opportunity seems too good to be true, we urge all Australians to not go anywhere near it,’ Ms Rickard said.

Lisa’s story is the perfect reminder to stay on top of security when it comes to sensitive information, whether it’s via the internet or text. If you ever feel that you are the victim of a scam, don’t hesitate to call your local authorities for help, and never be afraid to ask for verification before giving out any information.

Regional Australia Bank recommends the following tips to avoid falling for the ‘Hi Mum’ scam.

Recently, one Sydney mum almost fell victim to a dangerous scam that’s been doing the rounds, where fraudsters impersonate family members in the hope of getting money.

64-year-old Lisa (not her real name), who wishes to remain anonymous, was moments away from transferring $5000 to a scammer posing as her son before a moment of quick thinking saved her from becoming the next victim of this ‘Hi Mum’ scam.

It began with a seemingly innocent text from her son.

‘Hi, mum. I have got a new phone and number. You can delete my old one. Can you let me know if you received this message?’ it read.

The 'Hi Mum' scam has been doing the rounds lately. Don't get caught out! Source: News.com.au / Supplied

Once Lisa asked which of her two sons was texting her, the hacker had a name and claimed to be her eldest son, Tim. In the following texts, the scammer claimed to be ‘stressed out’. After Lisa tried to comfort her son, they said they were having banking issues before asking to borrow $8900.

‘I hadn’t heard from Tim in a while. He had recently bought a home and was moving house. He was trying to get their kids into new schools, so when this text came out of the blue, I thought it was a bit odd but I really wanted to help him,’ Lisa told NCA NewsWire.

Although the request was out of character, Lisa assumed her son was reaching out as a ‘last resort’.

Lisa was about to hit send when she had second thoughts and asked for the name of Tim’s maternal grandfather. ‘It was just a little voice that thought, ‘Is that really him’?’ she said.

Don't be afraid to ask questions to make sure you're talking to someone authentic. Source: News.com.au / Supplied

After Lisa asked the question, the hacker went notably silent. That’s when she realised that the text was not from her son at all.

‘I felt really bad asking him the first time. I could feel myself cringing. When he didn’t answer it the first time, I thought something is going on because that should just roll off the tongue,’ she said.

While Lisa was able to narrowly avoid the deception, many aren’t so fortunate. According to an ACCC report, Australians lost a staggering $1.8 billion to scams in 2021. The report, which is based on an analysis of more than 560,000 reports and data from Scamwatch, ReportCyber, major banks and money remitters, and other government agencies, estimates that actual losses were much higher than the amount reported.

A Scamwatch spokesperson went on to report that the Australian Competition and Consumer Commission (ACCC) had received more than 9700 reports of ‘“Hi Mum’” scams in 2022, totalling losses of nearly $7.2 million.

Worse yet, a new variant of the scam now includes cyber criminals who use an alpha-tag/ senderID (where the message will appear as if it’s been sent from your ‘Mum’ or ‘Dad’). This makes the scam even more difficult to spot, as the message appears to be from a genuine family member.

But that’s not the only scam going around.

Overall, investment scams were the leading cause of financial losses ($701 million), followed by payment redirection scams ($227 million) and romance scams ($142 million).

‘Scam activity continues to rise, and [in 2021] a record number of Australians lost a record amount of money,’ ACCC Deputy Chair Delia Rickard said. ‘Scammers are the most opportunistic of all criminals: they exploit natural disasters, pandemics, and the search for love.’

Ms Rickard also noted that scams cause serious emotional harm to individuals, families, and businesses in addition to financial losses.

Women reported the most scams, but men lost more money than women, and men's losses to investment scams were double women's losses. People aged 65 and over reported the highest losses and reported losses steadily increased with age.

Scamwatch data also shows that people experiencing vulnerability and hardship reported record levels of losses in 2021. People with disabilities reported twice as many scams and a 102% increase in financial losses to $19.6 million. Indigenous Australians reported 43% more scams and 142% more losses, and people from culturally and linguistically diverse communities reported an 88% increase in losses.

The ACCC has been working with government agencies, domestic and international law enforcement, and major banks and telecommunications providers to share intelligence, disrupt scams, and raise awareness in the community. This effort led to the Flubot scam being stopped, and the telecommunications sector's Reducing Scam Calls Industry Code blocking more than 357 million scam calls.

Scamwatch data also shows that between 2020 and 2021 there was a 60% reduction in losses from inheritance and unexpected money scams, and only a 1% increase in losses from travel, prizes and lottery scams. However, Ms Rickard noted that there are still gaps in the system that scammers can exploit - losses from investment scams increased by 169% during the same period.

‘If an investment opportunity seems too good to be true, we urge all Australians to not go anywhere near it,’ Ms Rickard said.

Lisa’s story is the perfect reminder to stay on top of security when it comes to sensitive information, whether it’s via the internet or text. If you ever feel that you are the victim of a scam, don’t hesitate to call your local authorities for help, and never be afraid to ask for verification before giving out any information.

Regional Australia Bank recommends the following tips to avoid falling for the ‘Hi Mum’ scam.

- Be suspicious when it comes to unexpected messages or requests for money—even if they appear to come from someone you know and trust

- Contact the family member directly using an alternative method, such as their known phone or email, to validate their request before taking any action

- Always ask questions about who they are before giving out any personal information or sending any funds

- Be sceptical if there is pressure for an immediate response

- Never give out bank account information or credit card numbers over the phone

- Verify the story with other family members before responding

- If you think something is wrong, trust your instincts—don't send any money!