Why cash still matters: Woolworths incident sparks debate on cashless society

- Replies 35

These days, it feels like cash is slowly but surely disappearing as a viable form of payment as more and more Aussies go cashless.

The convenience of card payment is definitely attractive, but it comes at a cost. While we can use credit cards, we’re often charged hefty service and transaction fees that can add up rather quickly.

Plus, you have the increased risk of your credit card details being taken by hackers if you use them online—a risk that isn't present with in-person cash transactions.

That's why it's so important for us all to keep our access to cash available, but that can be difficult when big retailers impose cash-out limits.

Recently, we wrote about a shopper who was left seething when he was refused a $500 cash-out request at an unnamed Woolworths store.

The frustrated customer took to the Facebook page 'Call Out Cashless Business' to vent and said: 'I went to Woolworths and tried to get $500 cash out; they said that they had very little cash and we could withdraw $100 as everyone was withdrawing cash.'

He then added that upon the cashier opening the register, 'It had plenty of money in it.'

This comment attracted a variety of reactions from others in the comments section, some pointing out that it would be excessive to expect $500 to be in the register at all times, whereas others felt that the retailer was just not doing their job well enough.

'$500 is a lot to expect to withdraw from a supermarket. It's not a bank,' commented a fellow shopper.

Another agreed and added, 'It's a safety issue. They aren't allowed that amount in the till.'

Members of the SDC also commented on the incident, with member @JKM_Storyteller saying, 'Honestly, I don't think it's fair to expect supermarkets to be treated like a bank where you can rock up and do a cash withdrawal over the counter. And using their checkouts as ATMs? Nah.'

Member @darylfoxcroft joined the conversation and added, 'If Woolies gave everyone $500 cash out when it was requested, how long would it be before the cashiers ran out of cash to make the change? Perhaps he should have used an ATM.'

Other current and former supermarket workers also shared their own experiences, noting that the register must always contain a certain amount and that it was part of their job to be able to manage customer cash outs accordingly—something this cashier had failed to do.

'I used to work at a supermarket. We have to have over a set amount in our tills at all times. $500 is a lot, and the cashiers can't always do that,' an ex-cashier explained in the comments section.

Still, others argued that there's actually nothing wrong with wanting such a large cash out and that, as a form of payment, it is still entitled to customer service and cash out from tills just as much as any form of card payment.

'You can get cash out at the self-service. l do it all the time before l get my groceries, it's so easy,' one user commented, while another said: 'Cash is still a currency here in Australia, maybe these stores need to be reminded.'

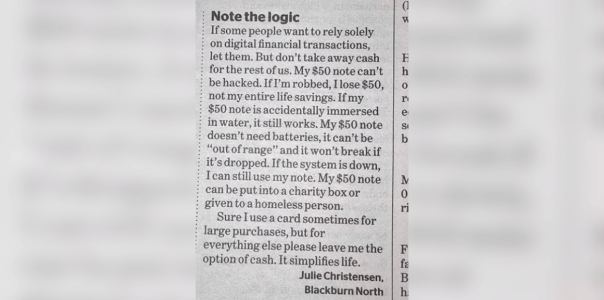

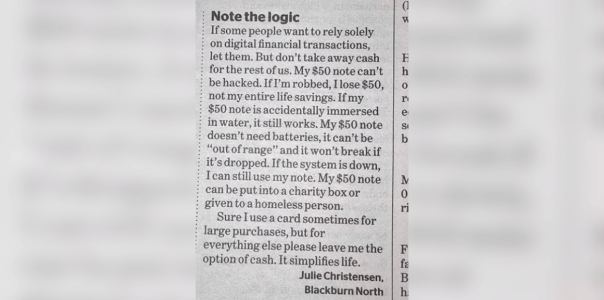

One Blackburn North resident, Julie, wrote a letter to a local newspaper in which she lamented the fact that, while some people prefer digital transactions, it's still not fair to take away cash options from the rest of us.

She argued that data hacking is an issue, whereas if one was to be robbed of their physical cash, it would only amount to the sum in their wallet—whereas digital banking could take your entire life savings.

Her letter then touched on the faults or perceived impracticalities of digital banking by phone, such as not having any batteries whilst all digital transactions require that or dropping your phone and breaking it, which is not the case with cash.

'My $50 note doesn't need batteries, it can't be “out of range”, and it won't break if it's dropped. If the system is down, I can still use my note,' she said.

Finally, her letter concluded with her agreement that, despite the convenience of card payment, physical cash should still be available as an option in all retailers.

'For everything else, please leave me the option of cash. It simplifies life,' she went on to say.

The message was echoed in far north Queensland, where flyers shared on Twitter and Facebook invited residents of the Cassowary Coast region to band together and go cold turkey on card payments for ten days in order to raise awareness about cash still being a viable form of payment.

This was in response to a recently announced cashless policy put in place by the local council on July 1, wherein cash was not accepted at council-organised events, the swimming pool, nor in-person payments at the library and council office.

The organisers are hopeful that the event will effectively raise awareness about the ongoing necessity for Australians to have access to cash. They anticipate that it will also prompt the council to reconsider and reverse its current cashless policy.

Members, we're curious to hear your take on this topic. Are you leaning towards embracing the cashless revolution for your transactions? Or are you more inclined to stick with good ol' cash in your pocket? Drop your thoughts in the comments section!

The convenience of card payment is definitely attractive, but it comes at a cost. While we can use credit cards, we’re often charged hefty service and transaction fees that can add up rather quickly.

Plus, you have the increased risk of your credit card details being taken by hackers if you use them online—a risk that isn't present with in-person cash transactions.

That's why it's so important for us all to keep our access to cash available, but that can be difficult when big retailers impose cash-out limits.

Recently, we wrote about a shopper who was left seething when he was refused a $500 cash-out request at an unnamed Woolworths store.

The frustrated customer took to the Facebook page 'Call Out Cashless Business' to vent and said: 'I went to Woolworths and tried to get $500 cash out; they said that they had very little cash and we could withdraw $100 as everyone was withdrawing cash.'

He then added that upon the cashier opening the register, 'It had plenty of money in it.'

This comment attracted a variety of reactions from others in the comments section, some pointing out that it would be excessive to expect $500 to be in the register at all times, whereas others felt that the retailer was just not doing their job well enough.

'$500 is a lot to expect to withdraw from a supermarket. It's not a bank,' commented a fellow shopper.

Another agreed and added, 'It's a safety issue. They aren't allowed that amount in the till.'

Members of the SDC also commented on the incident, with member @JKM_Storyteller saying, 'Honestly, I don't think it's fair to expect supermarkets to be treated like a bank where you can rock up and do a cash withdrawal over the counter. And using their checkouts as ATMs? Nah.'

Member @darylfoxcroft joined the conversation and added, 'If Woolies gave everyone $500 cash out when it was requested, how long would it be before the cashiers ran out of cash to make the change? Perhaps he should have used an ATM.'

Other current and former supermarket workers also shared their own experiences, noting that the register must always contain a certain amount and that it was part of their job to be able to manage customer cash outs accordingly—something this cashier had failed to do.

'I used to work at a supermarket. We have to have over a set amount in our tills at all times. $500 is a lot, and the cashiers can't always do that,' an ex-cashier explained in the comments section.

Still, others argued that there's actually nothing wrong with wanting such a large cash out and that, as a form of payment, it is still entitled to customer service and cash out from tills just as much as any form of card payment.

'You can get cash out at the self-service. l do it all the time before l get my groceries, it's so easy,' one user commented, while another said: 'Cash is still a currency here in Australia, maybe these stores need to be reminded.'

A woman detailed the benefits of carrying and paying with cash in a letter sent to a local newspaper. Credit: Facebook.

One Blackburn North resident, Julie, wrote a letter to a local newspaper in which she lamented the fact that, while some people prefer digital transactions, it's still not fair to take away cash options from the rest of us.

She argued that data hacking is an issue, whereas if one was to be robbed of their physical cash, it would only amount to the sum in their wallet—whereas digital banking could take your entire life savings.

Her letter then touched on the faults or perceived impracticalities of digital banking by phone, such as not having any batteries whilst all digital transactions require that or dropping your phone and breaking it, which is not the case with cash.

'My $50 note doesn't need batteries, it can't be “out of range”, and it won't break if it's dropped. If the system is down, I can still use my note,' she said.

Finally, her letter concluded with her agreement that, despite the convenience of card payment, physical cash should still be available as an option in all retailers.

'For everything else, please leave me the option of cash. It simplifies life,' she went on to say.

The message was echoed in far north Queensland, where flyers shared on Twitter and Facebook invited residents of the Cassowary Coast region to band together and go cold turkey on card payments for ten days in order to raise awareness about cash still being a viable form of payment.

This was in response to a recently announced cashless policy put in place by the local council on July 1, wherein cash was not accepted at council-organised events, the swimming pool, nor in-person payments at the library and council office.

The organisers are hopeful that the event will effectively raise awareness about the ongoing necessity for Australians to have access to cash. They anticipate that it will also prompt the council to reconsider and reverse its current cashless policy.

Key Takeaways

- A Woolworths customer turned to Facebook to express his frustration after he was denied a $500 cash out at Woolworths.

- While the shopper claimed the register at the supermarket had plenty of cash, it's understood the cash-out limit varies depending on the store, with Metro stores only allowed to give their customers up to a $200 cash out.

- Some people sided with the supermarket, explaining that safety issues and store policies prevent high cash-out amounts, while others sympathised with the man and recounted similar experiences at other supermarkets.

- This event prompted discussion about the importance of cash in society, with one woman writing a letter to a Melbourne newspaper arguing for the continued acceptance of cash and far north Queensland locals protesting a council's cashless policy.

Members, we're curious to hear your take on this topic. Are you leaning towards embracing the cashless revolution for your transactions? Or are you more inclined to stick with good ol' cash in your pocket? Drop your thoughts in the comments section!