Why Aussies are furious over this newspaper column about wealthy retirees

- Replies 41

We understand finances can be a cause of concern when it comes to retirement. Superannuation, pension, and savings are some of the factors that can worry those approaching or already in retirement.

However, in a recent newspaper column in the Sun Herald, a wealthy retired couple boasting millions in their Self-Managed Super Fund (SMSF) has sparked outrage among everyday Aussies for seeking financial advice that some interpret as 'greedy'.

According to the column, the couple, aged 78 and 79, wrote to financial expert George Cochrane to ask for guidance about their investment situation. In 2017, the man's holdings were valued at $1,599,956, and combined with his wife's $675,590, they together held just under $2.3 million.

Fast forward a few years, and their superannuation total has grown to an astonishing amount well above $3 million, placing them in the top 0.5% of Australians.

This staggering growth means that their fund will be taxed at a higher rate starting July 2025, as announced by the Albanese government in February.

To avoid this, the man asked Cochrane whether they should sell some of their shares to remain below the $3 million threshold, saying, 'What will be the tax implications if my SMSF reaches $4 million and my wife's $1.8 million? Should we sell some of our shares to stay below the $3 million threshold?'

As you can imagine, this request for advice didn't sit well with many Australians who are struggling to make ends meet or juggle multiple jobs to save for their retirement. Critics argue that this couple seems more concerned with avoiding higher taxes, while many people are grappling with the rising costs of living.

The Albanese government's proposed changes will only affect around 80,000 super savers or the top 0.5% of Australians. The remaining 99.5% of Aussies will continue to benefit from the 'same generous tax breaks', meaning the 15% concessional rate will remain unchanged for them.

George Cochrane didn't offer specific guidance to the couple but instead responded by saying, 'If your super benefit is valued at $4 million in July 2025, and your wife's is $1.8 million, then 69% of the fund's income will fall into your account.'

He continued: 'Of this, 75% of your income will be untaxed and 25% taxed at 30%, including any capital gains tax. Your wife's benefit remains untaxed.'

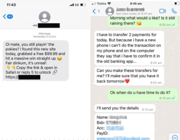

The news of this column spread to social media; an excerpt of the column was posted on Twitter with the caption: 'Honestly, if you want to get your blood up about generational inequality in Australia, may I recommend the letters on the Money page of the Sun Herald.'

And sure enough, it generated quite a stir. Social media users flocked to criticise the couple, with comments such as Bl**dy heck the dilemma! Sickens me, not what super was intended for' and 'They're both nearly 80, getting to spend what they already have will be an achievement, and they're worrying about generating more.'

'I've always found this column loaded with whinging people who have too much money a real insult to general society. All they want to do is get free advice on how to rort the system when they can easily afford a financial advisor. Vile people,' another commented.

Not everyone, however, was unsympathetic. One reader stood up for the couple, saying that those leaving negative comments were 'simply envious', adding that it was only natural that others wished to have such wealth to retire with.

Whatever your stance, this column has undoubtedly opened a conversation about generational wealth and the perceived divide between everyday Australians and the top 0.5%. While it's important to consider future financial situations, it's also necessary to remain aware of the struggles faced by many of our fellow Aussies.

What do you all think about this story, members? Do you think the couple was being 'greedy' by seeking advice on how to grow their money, or do you believe there was nothing wrong with asking for guidance?

We're eager to hear your thoughts on this matter, so please share them in the comments below. And as usual, let's maintain a friendly and courteous atmosphere while engaging in conversations with one another!

However, in a recent newspaper column in the Sun Herald, a wealthy retired couple boasting millions in their Self-Managed Super Fund (SMSF) has sparked outrage among everyday Aussies for seeking financial advice that some interpret as 'greedy'.

According to the column, the couple, aged 78 and 79, wrote to financial expert George Cochrane to ask for guidance about their investment situation. In 2017, the man's holdings were valued at $1,599,956, and combined with his wife's $675,590, they together held just under $2.3 million.

Fast forward a few years, and their superannuation total has grown to an astonishing amount well above $3 million, placing them in the top 0.5% of Australians.

A pair of multi-millionaire retirees have infuriated struggling Aussies with 'greedy' questions in a newspaper money column. Credit: Pexels/Anastasia Shuraeva.

This staggering growth means that their fund will be taxed at a higher rate starting July 2025, as announced by the Albanese government in February.

To avoid this, the man asked Cochrane whether they should sell some of their shares to remain below the $3 million threshold, saying, 'What will be the tax implications if my SMSF reaches $4 million and my wife's $1.8 million? Should we sell some of our shares to stay below the $3 million threshold?'

As you can imagine, this request for advice didn't sit well with many Australians who are struggling to make ends meet or juggle multiple jobs to save for their retirement. Critics argue that this couple seems more concerned with avoiding higher taxes, while many people are grappling with the rising costs of living.

The Albanese government's proposed changes will only affect around 80,000 super savers or the top 0.5% of Australians. The remaining 99.5% of Aussies will continue to benefit from the 'same generous tax breaks', meaning the 15% concessional rate will remain unchanged for them.

George Cochrane didn't offer specific guidance to the couple but instead responded by saying, 'If your super benefit is valued at $4 million in July 2025, and your wife's is $1.8 million, then 69% of the fund's income will fall into your account.'

He continued: 'Of this, 75% of your income will be untaxed and 25% taxed at 30%, including any capital gains tax. Your wife's benefit remains untaxed.'

The news of this column spread to social media; an excerpt of the column was posted on Twitter with the caption: 'Honestly, if you want to get your blood up about generational inequality in Australia, may I recommend the letters on the Money page of the Sun Herald.'

And sure enough, it generated quite a stir. Social media users flocked to criticise the couple, with comments such as Bl**dy heck the dilemma! Sickens me, not what super was intended for' and 'They're both nearly 80, getting to spend what they already have will be an achievement, and they're worrying about generating more.'

'I've always found this column loaded with whinging people who have too much money a real insult to general society. All they want to do is get free advice on how to rort the system when they can easily afford a financial advisor. Vile people,' another commented.

Not everyone, however, was unsympathetic. One reader stood up for the couple, saying that those leaving negative comments were 'simply envious', adding that it was only natural that others wished to have such wealth to retire with.

Key Takeaways

- A couple with millions in superannuation has come under fire after writing to a newspaper asking for financial help.

- This angered some Aussies, who criticised the couple for looking for ways to keep their pockets deep while others were struggling through the cost of living crisis.

- The Albanese government announced changes in February that would double the tax amount for superannuation accounts with more than $3 million, affecting the top 0.5% of super savers.

Whatever your stance, this column has undoubtedly opened a conversation about generational wealth and the perceived divide between everyday Australians and the top 0.5%. While it's important to consider future financial situations, it's also necessary to remain aware of the struggles faced by many of our fellow Aussies.

What do you all think about this story, members? Do you think the couple was being 'greedy' by seeking advice on how to grow their money, or do you believe there was nothing wrong with asking for guidance?

We're eager to hear your thoughts on this matter, so please share them in the comments below. And as usual, let's maintain a friendly and courteous atmosphere while engaging in conversations with one another!