What you need to know before the April 1 health insurance premium rise

- Replies 30

55 per cent of Australians have health insurance. Do you?

Rising healthcare costs have put pressure on private health insurers* to increase premiums. At a time when the cost of living is a pressing concern for many Australians, particularly those over 60 who are often on fixed incomes, the prospect of rising health insurance premiums* can be particularly daunting.

However, there's some potentially good news* on the horizon that could ease this financial burden.

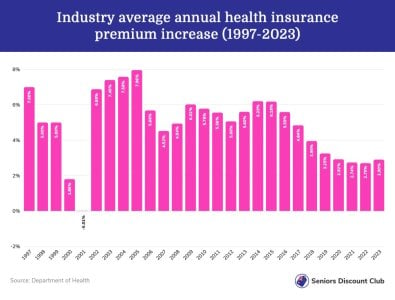

The government has drawn a line, rejecting the health insurance industry's proposal for a significant increase in premiums, which could have seen rates rise by as much as 6 per cent. This would have marked the largest hike in at least six years and added additional strain to household budgets already stretched thin by inflation and other economic pressures.

By rejecting the proposed 6 per cent hike, Health Minister Mark Butler hopes to ease the cost of living pressures and ensure health insurance remains affordable.

But this isn’t yet set in stone, which is why we recommend comparing your health insurance options*: whether you’re already covered or not. The April 1 premium increase is fast approaching, and now is the time to act.

Experts estimate over a million Australians have taken up cover since 2020 due to factors like long public hospital wait times, with 55 per cent of Australians now holding health insurance cover. But large premium hikes risk pricing some out of the system.

If you don’t have health insurance* yet, what are you missing out on?

Here’s a short list of private patient costs that Medicare doesn’t cover*:

Health insurance delivers the highest return compared to other forms of insurance, with 86 cents in every dollar spent on premiums going back to members in benefits*.

Expected price hike: What do we know?

Private Healthcare Australia CEO Dr Rachel David said any approved premium rise for 2024 is likely to fall well short of other types of insurance, such as home and car insurance (14 per cent rise) and electricity (13 per cent rise).

According to Dr David, ‘Health funds are working closely with the Federal Government to keep health insurance premiums as low as possible in 2024.’

‘The Federal Government, the Department of Health, and the Australian Prudential Regulation Authority are rightly subjecting health fund pricing to detailed scrutiny and negotiating to get premiums as low as possible.’

So, what can you do?

Why we trust Compare Club*

They’re one of our long-term partners* with whom we have personally compared health insurers! You can read about Maddie’s experience here*.

The team at Compare Club* will make sure you have the health cover you need while paying a price you’re comfortable with*.

You get the peace of mind that comes with working with trusted professionals who have the years of experience* needed to navigate the complicated health insurance system and keep you from any further confusion.

So why not reach out to Compare Club* today and find out if you’re eligible for a better deal?

You won’t lose anything by comparing; you only stand to save*! After all, if you don’t like the quote you receive from Compare Club*, you don’t have to do anything.

With the right choices, you could keep more money in your pocket* while still getting important healthcare protections in place.

*Please note, members, that this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission to write an article or post a deal. We do this to assist with the costs of running the SDC. Thank you!

Rising healthcare costs have put pressure on private health insurers* to increase premiums. At a time when the cost of living is a pressing concern for many Australians, particularly those over 60 who are often on fixed incomes, the prospect of rising health insurance premiums* can be particularly daunting.

However, there's some potentially good news* on the horizon that could ease this financial burden.

The government has drawn a line, rejecting the health insurance industry's proposal for a significant increase in premiums, which could have seen rates rise by as much as 6 per cent. This would have marked the largest hike in at least six years and added additional strain to household budgets already stretched thin by inflation and other economic pressures.

By rejecting the proposed 6 per cent hike, Health Minister Mark Butler hopes to ease the cost of living pressures and ensure health insurance remains affordable.

But this isn’t yet set in stone, which is why we recommend comparing your health insurance options*: whether you’re already covered or not. The April 1 premium increase is fast approaching, and now is the time to act.

Experts estimate over a million Australians have taken up cover since 2020 due to factors like long public hospital wait times, with 55 per cent of Australians now holding health insurance cover. But large premium hikes risk pricing some out of the system.

If you don’t have health insurance* yet, what are you missing out on?

Here’s a short list of private patient costs that Medicare doesn’t cover*:

- Hospital accommodation

- Operating theatre fees

- Recovery room fees

- Inpatient services (e.g. physiotherapy, etc.)

- Choice of doctor/specialist

- Choice of a shared or private room

- Private ambulances

- Dental surgery

Health insurance delivers the highest return compared to other forms of insurance, with 86 cents in every dollar spent on premiums going back to members in benefits*.

Expected price hike: What do we know?

Private Healthcare Australia CEO Dr Rachel David said any approved premium rise for 2024 is likely to fall well short of other types of insurance, such as home and car insurance (14 per cent rise) and electricity (13 per cent rise).

According to Dr David, ‘Health funds are working closely with the Federal Government to keep health insurance premiums as low as possible in 2024.’

‘The Federal Government, the Department of Health, and the Australian Prudential Regulation Authority are rightly subjecting health fund pricing to detailed scrutiny and negotiating to get premiums as low as possible.’

So, what can you do?

- Consider policies with lower annual limits* that still provides substantial cover if your needs allow.

- Review optional extras* you may not need.

- Ask your provider if you're eligible for means-tested discounts*.

- Check which tier covers the services you need*.

- Basic*: The cheapest cover includes ambulance and emergency services.

- Bronze*: 18 types of surgery and treatments, including joint reconstructions and dental surgery.

- Silver*: 26 types of surgery and treatments, including dental surgeries.

- Gold*: 38 types of surgery and treatments, including hip replacements.

- Contact Compare Club* for free expert help comparing health insurers.

- If your needs fall between tiers, ask Compare Club’s experts* about ‘Plus’ policies that cover items from higher tiers at a lower cost.

Why we trust Compare Club*

They’re one of our long-term partners* with whom we have personally compared health insurers! You can read about Maddie’s experience here*.

The team at Compare Club* will make sure you have the health cover you need while paying a price you’re comfortable with*.

You get the peace of mind that comes with working with trusted professionals who have the years of experience* needed to navigate the complicated health insurance system and keep you from any further confusion.

So why not reach out to Compare Club* today and find out if you’re eligible for a better deal?

You won’t lose anything by comparing; you only stand to save*! After all, if you don’t like the quote you receive from Compare Club*, you don’t have to do anything.

With the right choices, you could keep more money in your pocket* while still getting important healthcare protections in place.

*Please note, members, that this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission to write an article or post a deal. We do this to assist with the costs of running the SDC. Thank you!