What Aussies are cutting from their budgets due to cost of living increases

- Replies 26

As living costs continue to rise across Australia, many households are forced to find ways to save money and make their budgets stretch further.

This may include cutting back on non-essential spending, such as streaming services and takeaway coffees, but for many Aussie families, it also means cutting back on grocery staples such as fresh fruit, vegetables and even meat.

Posting to the popular social media forum Reddit, one person who goes by @HalfManHalfCyborg online asked what people had stopped buying recently due to price increases.

And the responses they received revealed some shocking cutbacks.

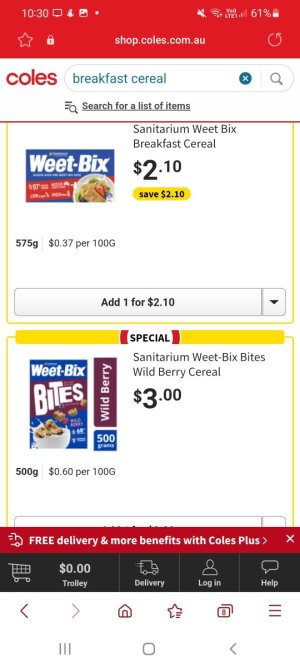

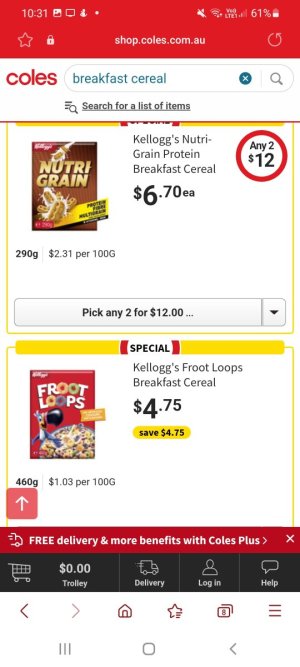

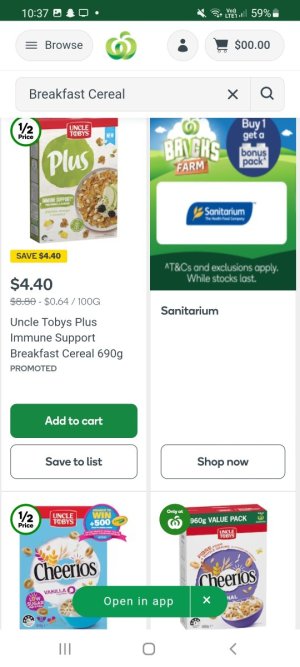

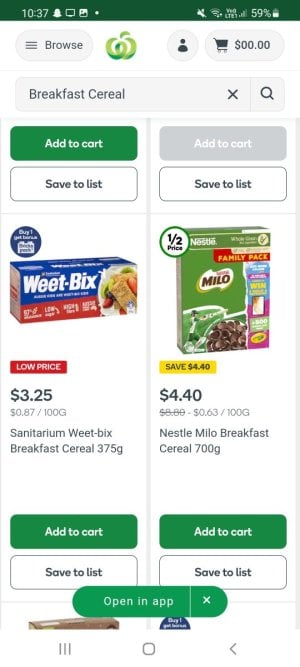

‘Cereal. One of those larger sizes…cost over $9 now,’ wrote one.

Someone responded under this comment and said that cutting back on cereal was one of the ‘worst things’ in their opinion.

‘I want to eat breakfast every day and I don’t especially want something hot or cooked. Cereal to the rescue, right? Ten bucks a box…Flaked wheat is a luxury now?’ They added.

Others shared that they stopped buying certain fruits such as watermelon. ‘I love watermelon, but I’m not paying $20+ per melon. It’s ridiculous,’ one admitted.

Some said they had to cut back on fresh fruit and vegetables altogether and were generally shopping less.

‘Stuff is just way too expensive. I no longer do a weekly shop. I just do it every now and then, and only what I need for the next few days,’ one wrote.

One grocery item staple people skip out on is meat. Many Aussies shared that they can ‘no longer afford even common cuts’.

‘Even mince seems pricey now,’ one explained. Another stated they’d become an ‘economic vegetarian’ after seeing the price tags on certain food items.

Others reminisced about days when food was more ‘affordable’. Adding on to this statement, one Redditor shared that they remembered as a kid, they always have ‘so many lamb cutlets and T-bones’ when barbecuing. They even had leftovers lasting them for a week.

‘Cutlets are now priced like Rolex watches for a bit of meat and bone,’ they added.

Deb Shroot, a Financial Counsellor with Financial Counselling Australia, noticed a big change around early March last year – just as fuel prices began to spike.

She told reporters: ‘It started with fuel prices soaring above the $2 mark, followed by eight consecutive interest rate rises and rising grocery prices – that have all combined to really put the squeeze on people’s spending.’

Ms Shroot said that a steady increase in people seeking financial counselling was noted, and people were ‘really cutting back on what they’d consider as essentials’, such as home, car, and health insurance.

The financial advisor also shared that people are now resorting to ‘buy now, pay later’ schemes to buy groceries, clothing, or pay utility bills.

‘But because buy now, pay later is far too easy to access, we’re seeing a lot of people losing track of those agreements and running into serious problems,’ she added.

While these offers (plus the availability of credit cards) seem to be the perfect solution for buying necessities, it’s also easy to fall into debt if you’re not careful. One woman shared her unfortunate experience with a ‘buy now, pay later’ scheme which led her to a staggering debt of $40,000. You can read more on that here.

In response to this growing financial strain, the federal government has implemented a range of measures to provide financial assistance and support to Australians struggling to make ends meet. These include welfare payments, emergency payments and other types of government benefits, as well as subsidies, grants and concessional loans. Foodbank, the largest food assistance organisation in Australia, also works alongside other frontline organisations to ensure low-income Australians have access to nutritious meals.

What tips do you have to help manage your budget? Tell us in the comments!

What tips do you have to help manage your budget? Tell us in the comments!

This may include cutting back on non-essential spending, such as streaming services and takeaway coffees, but for many Aussie families, it also means cutting back on grocery staples such as fresh fruit, vegetables and even meat.

Posting to the popular social media forum Reddit, one person who goes by @HalfManHalfCyborg online asked what people had stopped buying recently due to price increases.

And the responses they received revealed some shocking cutbacks.

‘Cereal. One of those larger sizes…cost over $9 now,’ wrote one.

Someone responded under this comment and said that cutting back on cereal was one of the ‘worst things’ in their opinion.

‘I want to eat breakfast every day and I don’t especially want something hot or cooked. Cereal to the rescue, right? Ten bucks a box…Flaked wheat is a luxury now?’ They added.

Others shared that they stopped buying certain fruits such as watermelon. ‘I love watermelon, but I’m not paying $20+ per melon. It’s ridiculous,’ one admitted.

Some said they had to cut back on fresh fruit and vegetables altogether and were generally shopping less.

‘Stuff is just way too expensive. I no longer do a weekly shop. I just do it every now and then, and only what I need for the next few days,’ one wrote.

One grocery item staple people skip out on is meat. Many Aussies shared that they can ‘no longer afford even common cuts’.

‘Even mince seems pricey now,’ one explained. Another stated they’d become an ‘economic vegetarian’ after seeing the price tags on certain food items.

Others reminisced about days when food was more ‘affordable’. Adding on to this statement, one Redditor shared that they remembered as a kid, they always have ‘so many lamb cutlets and T-bones’ when barbecuing. They even had leftovers lasting them for a week.

‘Cutlets are now priced like Rolex watches for a bit of meat and bone,’ they added.

Deb Shroot, a Financial Counsellor with Financial Counselling Australia, noticed a big change around early March last year – just as fuel prices began to spike.

She told reporters: ‘It started with fuel prices soaring above the $2 mark, followed by eight consecutive interest rate rises and rising grocery prices – that have all combined to really put the squeeze on people’s spending.’

Ms Shroot said that a steady increase in people seeking financial counselling was noted, and people were ‘really cutting back on what they’d consider as essentials’, such as home, car, and health insurance.

The financial advisor also shared that people are now resorting to ‘buy now, pay later’ schemes to buy groceries, clothing, or pay utility bills.

‘But because buy now, pay later is far too easy to access, we’re seeing a lot of people losing track of those agreements and running into serious problems,’ she added.

While these offers (plus the availability of credit cards) seem to be the perfect solution for buying necessities, it’s also easy to fall into debt if you’re not careful. One woman shared her unfortunate experience with a ‘buy now, pay later’ scheme which led her to a staggering debt of $40,000. You can read more on that here.

In response to this growing financial strain, the federal government has implemented a range of measures to provide financial assistance and support to Australians struggling to make ends meet. These include welfare payments, emergency payments and other types of government benefits, as well as subsidies, grants and concessional loans. Foodbank, the largest food assistance organisation in Australia, also works alongside other frontline organisations to ensure low-income Australians have access to nutritious meals.

Key Takeaways

- Australians have taken to social media to share what items they are cutting back on due to rising inflation.

- Many are cutting back on staples like cereal, meat, fresh fruit and vegetables.

- Financial Counselling Australia reported an increase in people seeking financial counselling and people resorting to ‘buy now, pay later’ agreements to cover essentials.