Skyrocketing Home Insurance Premiums Shock Aussies: Here's Your Secret Weapon to Fight Back!

- Replies 27

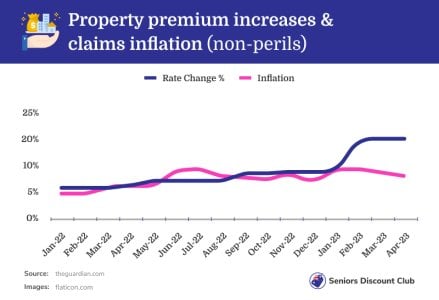

In a shocking revelation, a national survey by Choice found that nearly 87% of home and contents insurance policyholders have seen their premiums rise with their most recent renewal notice. The Actuaries Institute’s research further confirms this alarming trend, revealing a 28% increase in median home insurance premiums in the year to March, averaging at a staggering $1,894 across all states*.

For high-risk properties, including those in flood-prone areas, the premiums have shot up by a whopping 50%. This is the most significant rise in two decades, leading to concerns that households may abandon insurance altogether due to the skyrocketing costs.

As a result, nearly one in eight Australian households (1.24m) are now considered “affordability stressed”, spending more than four weeks of their annual income on home insurance.

But there's a silver lining amidst this gloomy scenario. Compare the Market*, a leading comparison business, is helping Australians fight back against these rising costs.

Adrian Taylor, Executive General Manager of General Insurance at Compare the Market*, offers some valuable advice. "When comparing policies to your current insurance, ensure you're comparing the same sum insured, same excesses, and same optional cover. This way, you can be sure your results are comparable," he advises.

Mr Taylor also suggests playing around with the excess amount to see if it lowers the cost of the insurance premium. He reminds us that while choosing a higher excess for a lower premium means you'll have to pay more in the event of a claim, the savings from switching may well outweigh the cost to cancel.

He also recommends considering a home security system, and notifying your insurer of your retirement status, all of which could potentially lower your premium.

With Compare the Market*, you can compare up to 7 different home insurers*, helping you to look for a better deal. So, don't wait for your renewal notice to arrive. Take control of your home insurance costs today with Compare the Market*.

Remember, it's not just about finding the cheapest insurance, but the right insurance for you. And with Compare The Market, you're in safe hands.

*Please note, members, this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission to write an article or post a deal. We simply do this to assist with the costs of running the SDC. Thank you!

For high-risk properties, including those in flood-prone areas, the premiums have shot up by a whopping 50%. This is the most significant rise in two decades, leading to concerns that households may abandon insurance altogether due to the skyrocketing costs.

As a result, nearly one in eight Australian households (1.24m) are now considered “affordability stressed”, spending more than four weeks of their annual income on home insurance.

But there's a silver lining amidst this gloomy scenario. Compare the Market*, a leading comparison business, is helping Australians fight back against these rising costs.

Adrian Taylor, Executive General Manager of General Insurance at Compare the Market*, offers some valuable advice. "When comparing policies to your current insurance, ensure you're comparing the same sum insured, same excesses, and same optional cover. This way, you can be sure your results are comparable," he advises.

Mr Taylor also suggests playing around with the excess amount to see if it lowers the cost of the insurance premium. He reminds us that while choosing a higher excess for a lower premium means you'll have to pay more in the event of a claim, the savings from switching may well outweigh the cost to cancel.

He also recommends considering a home security system, and notifying your insurer of your retirement status, all of which could potentially lower your premium.

With Compare the Market*, you can compare up to 7 different home insurers*, helping you to look for a better deal. So, don't wait for your renewal notice to arrive. Take control of your home insurance costs today with Compare the Market*.

Remember, it's not just about finding the cheapest insurance, but the right insurance for you. And with Compare The Market, you're in safe hands.

*Please note, members, this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission to write an article or post a deal. We simply do this to assist with the costs of running the SDC. Thank you!

Last edited: