Shopper shares brilliant money-saving tip for when you need emergency cash

- Replies 20

As the cost of living rises, many Australians worry about affording their weekly grocery bill. Many often live on a fixed income, so every little bit can help stretch their budgets.

Well, worry no more, dear members! A fellow ALDI shopper has shared a simple and easy money-saving tip to help ease ongoing cost-of-living pressures.

In a popular Facebook group, an Aussie mum asked about the possibility of purchasing Afterpay gift cards for ALDI, as she was struggling to afford groceries for her family.

For those who may not be familiar, Afterpay is a Buy Now, Pay Later (BNPL) service that allows shoppers to purchase gift cards and split the cost into four separate payments. This feature is currently available at supermarkets such as Woolworths and Coles and other retailers like Kmart, Bunnings Warehouse, Harvey Norman, and JB Hi-Fi.

Unfortunately, it seems that ALDI does not currently offer this service – a fact that disappointed many on social media, as it could have been a convenient way to manage grocery costs. However, this hiccup didn't stop some shoppers from offering an alternative solution!

One supportive mum shared her homemade trick for setting aside emergency grocery money: 'Afterpay don't have ALDI (capability), I've looked before,' she wrote in response to the original post.

'But each week I go shopping, I get a $10 or $20 gift card for ALDI and put it away, so if something like this happens, you don't have to worry. It comes in handy, even (to) use at Christmas.'

This simple practice of purchasing an extra $10 or $20 ALDI gift card during your weekly shopping can help you slowly accumulate substantial savings.

Over a year, you could amass over $500 in emergency funds – ready to be used for groceries, essential items or even holiday shopping!

Considering that recent financial hardship surveys revealed that four in 10 Australians are experiencing financial strain, this strategy for setting aside extra funds could make an enormous difference.

Individuals facing hardship may have difficulties paying bills or rent, affording food and necessities, covering mortgage or loan repayments, or preparing for an emergency.

With almost 16% of survey respondents admitting insufficient funds for food and basics, adopting an innovative savings plan like the ALDI gift card tip could help alleviate these looming pressures.

If you're not shopping at ALDI but still want to find ways to save money, Afterpay gift cards can be a great option.

Here's how it works: First, select the desired amount and the recipient for your e-Gift Card, then complete the purchase using Afterpay. Once you've made your purchase, Afterpay will send you an order confirmation email.

Shortly after that, Prezzee, Afterpay's chosen gift card supplier, will send a second email containing the e-Gift Card to the recipient's email address.

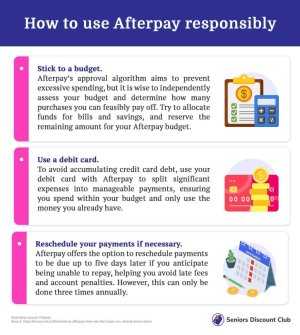

However, it's important to note that while Buy Now, Pay Later (BNPL) schemes offer convenience, consumer advocacy groups have raised concerns regarding potential drawbacks.

These concerns include the risk of accumulating excessive debt, difficulties managing repayments, and a need for more transparency regarding terms and conditions.

Many individuals are already facing financial challenges, so these schemes may pose additional risks for vulnerable consumers. Therefore, before using these gift cards, familiarising yourself with the terms and conditions is crucial to avoid getting into debt.

We hope you find these tips helpful, members! If you have any other advice on saving money from time to time, please share them with us in the comments below. We would love to hear from you!

Well, worry no more, dear members! A fellow ALDI shopper has shared a simple and easy money-saving tip to help ease ongoing cost-of-living pressures.

In a popular Facebook group, an Aussie mum asked about the possibility of purchasing Afterpay gift cards for ALDI, as she was struggling to afford groceries for her family.

For those who may not be familiar, Afterpay is a Buy Now, Pay Later (BNPL) service that allows shoppers to purchase gift cards and split the cost into four separate payments. This feature is currently available at supermarkets such as Woolworths and Coles and other retailers like Kmart, Bunnings Warehouse, Harvey Norman, and JB Hi-Fi.

An ALDI shopper shared her simple tip to save money for groceries, aiming to help fellow customers with cost-of-living pressures. Credit: Unsplash/Melissa Walker Horn.

Unfortunately, it seems that ALDI does not currently offer this service – a fact that disappointed many on social media, as it could have been a convenient way to manage grocery costs. However, this hiccup didn't stop some shoppers from offering an alternative solution!

One supportive mum shared her homemade trick for setting aside emergency grocery money: 'Afterpay don't have ALDI (capability), I've looked before,' she wrote in response to the original post.

'But each week I go shopping, I get a $10 or $20 gift card for ALDI and put it away, so if something like this happens, you don't have to worry. It comes in handy, even (to) use at Christmas.'

This simple practice of purchasing an extra $10 or $20 ALDI gift card during your weekly shopping can help you slowly accumulate substantial savings.

Over a year, you could amass over $500 in emergency funds – ready to be used for groceries, essential items or even holiday shopping!

Considering that recent financial hardship surveys revealed that four in 10 Australians are experiencing financial strain, this strategy for setting aside extra funds could make an enormous difference.

Individuals facing hardship may have difficulties paying bills or rent, affording food and necessities, covering mortgage or loan repayments, or preparing for an emergency.

With almost 16% of survey respondents admitting insufficient funds for food and basics, adopting an innovative savings plan like the ALDI gift card tip could help alleviate these looming pressures.

Key Takeaways

- An ALDI shopper has shared her simple tip to save money for groceries, helping fellow customers ease ongoing cost-of-living pressures.

- Shoppers can buy gift cards through Buy Now, Pay Later (BNPL) service Afterpay, which can be used at Woolworths and Coles but not at ALDI.

- One mum suggested purchasing a $10 or $20 ALDI gift card each week, creating emergency savings.

- In March, a NAB hardship survey found four in 10 Australians are experiencing financial hardship, the highest number recorded since the early days of the COVID outbreak.

If you're not shopping at ALDI but still want to find ways to save money, Afterpay gift cards can be a great option.

Here's how it works: First, select the desired amount and the recipient for your e-Gift Card, then complete the purchase using Afterpay. Once you've made your purchase, Afterpay will send you an order confirmation email.

Shortly after that, Prezzee, Afterpay's chosen gift card supplier, will send a second email containing the e-Gift Card to the recipient's email address.

However, it's important to note that while Buy Now, Pay Later (BNPL) schemes offer convenience, consumer advocacy groups have raised concerns regarding potential drawbacks.

These concerns include the risk of accumulating excessive debt, difficulties managing repayments, and a need for more transparency regarding terms and conditions.

Many individuals are already facing financial challenges, so these schemes may pose additional risks for vulnerable consumers. Therefore, before using these gift cards, familiarising yourself with the terms and conditions is crucial to avoid getting into debt.

We hope you find these tips helpful, members! If you have any other advice on saving money from time to time, please share them with us in the comments below. We would love to hear from you!