Shocking Hack Story: Aged Care Worker Loses $40K - Here's how you can protect your money

By

- Replies 19

Whether you’re trying to build a retirement nest egg, provide for your family, or just cover your bills each month, we understand the importance of saving your hard-earned money.

That's why it's so concerning to hear stories like Marylynne Desveaux. Marylynne is an aged care worker in her sixties who recently lost nearly $40,000 of her retirement savings to a 'sophisticated' impersonation hack.

For Marylynne, the hack was painful. Not only was she losing her hard-earned savings, but it had taken her a long time to build them back up after losing her job during the pandemic.

The details of the hack are harrowing. Cyber criminals had hacked into Marylynne's ING account's payee contact list and changed the bank details of one of her contacts (a man named Graham, who had not received a transaction from Marylynne since 2018) to a different account.

This allowed hackers to make multiple transfers under Graham's name – and while Marylynne noticed the transactions and called Graham to see why the money was being sent to him, it was too late: the funds had already been sent away.

Marylynne said that a woman from ING told her the bank couldn't explain how the hackers got in as it was 'very sophisticated' and they got in 'a different way than they normally would'. She immediately reported the hack to both the police and Australian Financial Complaints Authority (AFCA), though as of yet there has been no news of the money being recuperated.

It's a hard story to read, and one that reminds all of us of how careful we have to be with our money, no matter where it's being held. So, what steps can you take against scammers and hackers? The first thing you should do is be aware of different types of scams. That means familiarising yourself with the types of schemes being used by hackers – and remember, they're always evolving.

At the Seniors Discount Club, we like to frequently cover the subject of online safety. If you ever want to learn about current scams, we encourage you to check out our Scam Watch forum here. It also never hurts to double-check with friends or family members regarding anything that seems suspicious. You should also make sure you're using secure software on your devices, as this will help protect against malicious software and activity.

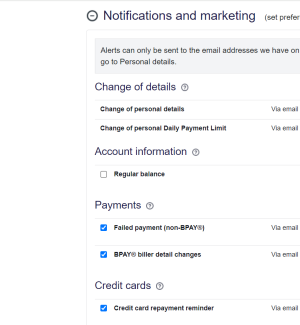

When it comes to your online banking, be sure to set up notifications and security alerts. That way, you'll immediately know if there has been any suspicious activity on your accounts and can take appropriate steps to secure them.

If you ever fall victim to a hack, it's important you report it straight away. You should also contact your financial institution and inform them of what's happened, as well as any other accounts you may have used (credit cards, etc).

Finally, check your accounts regularly. We understand it's not always convenient to check your accounts on a regular basis, but it's crucial if you want to avoid becoming a victim of fraud. Being vigilant and taking preventative steps are crucial when it comes to money and online safety. It's really the only way you can ensure your hard-earned savings are protected.

Types of Online Scams and How to Avoid Them

One common scam is 'phishing' - this is where a hacker will send an email pretending to be from a credible source (like your bank) and ask you to provide sensitive information. It might be an email saying there's been suspicious activity on your account and asking you to 'confirm' your log-in details – but in reality, you're just handing over your information to the scammers.

Next, we have 'impersonation scams'. In these cases, a hacker might pose as a friend or family member in need of immediate financial assistance. They might employ emotional manipulation to convince you to transfer money to them quickly, without properly verifying the sender's identity.

'Investment scams' are another type. They lure you with seemingly impossible high-return schemes, fooling you into transferring money or investments into these bogus portfolios, resulting in tragic financial losses.

To prevent falling for any of these fraudulent activities, a few key points can be remembered. Always verify contact requests or transactional information independently, directly with your bank or the person supposedly in need of help. It might take a little extra time to confirm, but it's better than losing your precious savings. Never give away your bank details over email, or to someone you cannot verify beyond doubt.

We wish Marylynne all the best with her investigations – we hope she gets her money back! What are your thoughts on this story, members? Share your comments below!

That's why it's so concerning to hear stories like Marylynne Desveaux. Marylynne is an aged care worker in her sixties who recently lost nearly $40,000 of her retirement savings to a 'sophisticated' impersonation hack.

For Marylynne, the hack was painful. Not only was she losing her hard-earned savings, but it had taken her a long time to build them back up after losing her job during the pandemic.

The details of the hack are harrowing. Cyber criminals had hacked into Marylynne's ING account's payee contact list and changed the bank details of one of her contacts (a man named Graham, who had not received a transaction from Marylynne since 2018) to a different account.

This allowed hackers to make multiple transfers under Graham's name – and while Marylynne noticed the transactions and called Graham to see why the money was being sent to him, it was too late: the funds had already been sent away.

Marylynne said that a woman from ING told her the bank couldn't explain how the hackers got in as it was 'very sophisticated' and they got in 'a different way than they normally would'. She immediately reported the hack to both the police and Australian Financial Complaints Authority (AFCA), though as of yet there has been no news of the money being recuperated.

It's a hard story to read, and one that reminds all of us of how careful we have to be with our money, no matter where it's being held. So, what steps can you take against scammers and hackers? The first thing you should do is be aware of different types of scams. That means familiarising yourself with the types of schemes being used by hackers – and remember, they're always evolving.

At the Seniors Discount Club, we like to frequently cover the subject of online safety. If you ever want to learn about current scams, we encourage you to check out our Scam Watch forum here. It also never hurts to double-check with friends or family members regarding anything that seems suspicious. You should also make sure you're using secure software on your devices, as this will help protect against malicious software and activity.

When it comes to your online banking, be sure to set up notifications and security alerts. That way, you'll immediately know if there has been any suspicious activity on your accounts and can take appropriate steps to secure them.

If you ever fall victim to a hack, it's important you report it straight away. You should also contact your financial institution and inform them of what's happened, as well as any other accounts you may have used (credit cards, etc).

Finally, check your accounts regularly. We understand it's not always convenient to check your accounts on a regular basis, but it's crucial if you want to avoid becoming a victim of fraud. Being vigilant and taking preventative steps are crucial when it comes to money and online safety. It's really the only way you can ensure your hard-earned savings are protected.

Types of Online Scams and How to Avoid Them

One common scam is 'phishing' - this is where a hacker will send an email pretending to be from a credible source (like your bank) and ask you to provide sensitive information. It might be an email saying there's been suspicious activity on your account and asking you to 'confirm' your log-in details – but in reality, you're just handing over your information to the scammers.

Next, we have 'impersonation scams'. In these cases, a hacker might pose as a friend or family member in need of immediate financial assistance. They might employ emotional manipulation to convince you to transfer money to them quickly, without properly verifying the sender's identity.

'Investment scams' are another type. They lure you with seemingly impossible high-return schemes, fooling you into transferring money or investments into these bogus portfolios, resulting in tragic financial losses.

To prevent falling for any of these fraudulent activities, a few key points can be remembered. Always verify contact requests or transactional information independently, directly with your bank or the person supposedly in need of help. It might take a little extra time to confirm, but it's better than losing your precious savings. Never give away your bank details over email, or to someone you cannot verify beyond doubt.

Key Takeaways

- Aged care worker Marylynne Desveaux lost nearly $40,000 due to a sophisticated impersonation hack into her ING account's payee contact list.

- Hackers changed the bank details of her contact, which allowed them to make multiple transfers to a scammer's account.

- Desveaux has been in limbo with the bank's feedback, who only confirmed that they couldn't recover her funds and are currently investigating the situation.

- A similar ING account hack also happened last year, where $10,000 was taken from a mother on maternity leave's account.

We wish Marylynne all the best with her investigations – we hope she gets her money back! What are your thoughts on this story, members? Share your comments below!