See the ridiculous exchange between a woman and her Medibank agent: 'The service is atrocious'

By

Seia Ibanez

- Replies 17

Disclaimer: Names with an asterisk (*) beside them have been changed to protect the person's identity.

Navigating the labyrinth of health insurance policies can be a daunting task, especially when you decide to cancel your policy.

This is the case of one Medibank customer who revealed a frustrating exchange that has left many Australians questioning the ease of cancelling their health insurance policies.

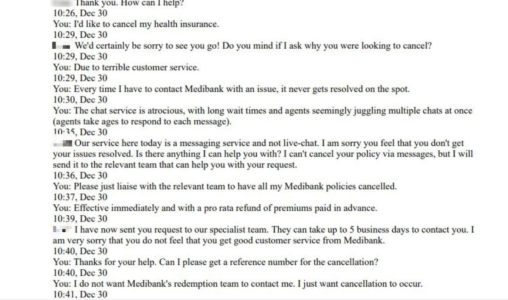

Annie*'s ordeal began on 30 December when she contacted Medibank via its chat function to cancel her private health insurance.

Her reason? A series of disappointing customer service experiences.

Annie* expressed her frustration, stating, 'Every time I have to contact Medibank with an issue, it never gets resolved on the spot.’

‘The chat service is atrocious, with long wait times and agents seemingly juggling multiple chats at once.'

The Medibank agent responded, explaining: ‘Our service here today is a messaging service and not live chat.’

The agent assured Annie* that her cancellation request would be forwarded to the relevant team for processing.

However, the agent also mentioned that Annie* would be contacted within five business days, a response that left Annie* requesting a reference number and explicitly stating her wish not to be contacted by Medibank's customer retention team.

The agent replied, ‘I have put a copy of your request not to be contacted and for the policy to be closed.’

Fast forward to 10 January, Annie* found herself back on Medibank's live chat, seeking confirmation of her policy cancellation ahead of her monthly direct debit due the following day.

This time, the agent asked her to explain her reasons for cancellation, which she repeatedly said that it was due to the company’s bad customer service, and informed her that she would need to receive a call from an agent within the next two to three business days to finalise the cancellation.

‘This is ridiculous,’ Annie* wrote.

‘I specifically asked that your retention team NOT call me.’

Annie's* frustration was palpable as she reiterated her request for cancellation and her desire not to be contacted by the retention team.

When she threatened to take her complaint to the ombudsman, the agent replied: ‘Sorry, but in this case, while Medibank does encourage our members to refer their complaints to the ombudsman if they are unsatisfied with the outcome, we would like the opportunity to deal with this as a formal complaint on an internal basis first.’

'Just CANCEL my policies! Why is that hard for you to understand?' she responded.

The conversation ended with Annie* pointing out the inconsistencies between the information provided by the two agents and expressing her frustration at Medibank's internal processes.

The Medibank agent wrote, ‘In order for us to cancel your policy, we need to endorse this to our consultant’s team to assess this first, and this is our normal process of cancellation [SIC],’ and insisted that a phone call was required.

Annie's* experience highlighted the potential difficulties customers may face when cancelling their health insurance policies.

She pointed out that Medibank’s ‘internal processes and systems are for you to manage’.

‘You can’t use that as an excuse to deny your customer’s request to cancel,’ she said.

'They make it very easy to sign up but hard to cancel,’ labelling the interactions 'ridiculous stonewalling'.

Following this conversation, Annie* said that she has since called Medibank and believes that her policy has been cancelled. She has now joined a different health insurer.

In response to the incident, a Medibank spokesperson apologised for the delay in cancelling Annie's* policy.

‘We’re sorry for the delay in cancelling the customer’s policy,’ the spokesperson said.

‘This was a case of human error which can happen from time to time.’

‘This is not the experience we want for our customers.’

‘When a customer contacts us to cancel their policy, we have processes in place to ensure it is done in a timely manner.’

The spokesperson added, ‘When the customer contacted us last week about the delay, we cancelled the policy and backdated it to the original date that was requested.’

‘We also reimbursed the January premium so that the customer was not out of pocket.’

The Australian Competition and Consumer Commission (ACCC) states that unreasonable barriers to cancelling contracts or subscriptions can raise concerns under Australian Consumer Law.

Businesses must clearly disclose any key terms within their contracts to consumers upfront, such as those relating to cancellation.

Medibank also received backlash a few months ago when the insurance company suffered from a data breach.

Millions of Australians had their personal data exposed, including a Byron Bay resident. She mentioned that after Medibank’s data breach, her PayPal account was hacked, making her feel ‘extremely vulnerable and violated’. You can read more about the story here.

Have you experienced the same situation in Medibank or any other companies? Share your experiences with us in the comments below!

Have you experienced the same situation in Medibank or any other companies? Share your experiences with us in the comments below!

Navigating the labyrinth of health insurance policies can be a daunting task, especially when you decide to cancel your policy.

This is the case of one Medibank customer who revealed a frustrating exchange that has left many Australians questioning the ease of cancelling their health insurance policies.

Annie*'s ordeal began on 30 December when she contacted Medibank via its chat function to cancel her private health insurance.

Her reason? A series of disappointing customer service experiences.

Annie* expressed her frustration, stating, 'Every time I have to contact Medibank with an issue, it never gets resolved on the spot.’

‘The chat service is atrocious, with long wait times and agents seemingly juggling multiple chats at once.'

The Medibank agent responded, explaining: ‘Our service here today is a messaging service and not live chat.’

The agent assured Annie* that her cancellation request would be forwarded to the relevant team for processing.

However, the agent also mentioned that Annie* would be contacted within five business days, a response that left Annie* requesting a reference number and explicitly stating her wish not to be contacted by Medibank's customer retention team.

The agent replied, ‘I have put a copy of your request not to be contacted and for the policy to be closed.’

Fast forward to 10 January, Annie* found herself back on Medibank's live chat, seeking confirmation of her policy cancellation ahead of her monthly direct debit due the following day.

This time, the agent asked her to explain her reasons for cancellation, which she repeatedly said that it was due to the company’s bad customer service, and informed her that she would need to receive a call from an agent within the next two to three business days to finalise the cancellation.

‘This is ridiculous,’ Annie* wrote.

‘I specifically asked that your retention team NOT call me.’

Annie's* frustration was palpable as she reiterated her request for cancellation and her desire not to be contacted by the retention team.

When she threatened to take her complaint to the ombudsman, the agent replied: ‘Sorry, but in this case, while Medibank does encourage our members to refer their complaints to the ombudsman if they are unsatisfied with the outcome, we would like the opportunity to deal with this as a formal complaint on an internal basis first.’

'Just CANCEL my policies! Why is that hard for you to understand?' she responded.

The conversation ended with Annie* pointing out the inconsistencies between the information provided by the two agents and expressing her frustration at Medibank's internal processes.

The Medibank agent wrote, ‘In order for us to cancel your policy, we need to endorse this to our consultant’s team to assess this first, and this is our normal process of cancellation [SIC],’ and insisted that a phone call was required.

Annie's* experience highlighted the potential difficulties customers may face when cancelling their health insurance policies.

She pointed out that Medibank’s ‘internal processes and systems are for you to manage’.

‘You can’t use that as an excuse to deny your customer’s request to cancel,’ she said.

'They make it very easy to sign up but hard to cancel,’ labelling the interactions 'ridiculous stonewalling'.

Following this conversation, Annie* said that she has since called Medibank and believes that her policy has been cancelled. She has now joined a different health insurer.

In response to the incident, a Medibank spokesperson apologised for the delay in cancelling Annie's* policy.

‘We’re sorry for the delay in cancelling the customer’s policy,’ the spokesperson said.

‘This was a case of human error which can happen from time to time.’

‘This is not the experience we want for our customers.’

‘When a customer contacts us to cancel their policy, we have processes in place to ensure it is done in a timely manner.’

The spokesperson added, ‘When the customer contacted us last week about the delay, we cancelled the policy and backdated it to the original date that was requested.’

‘We also reimbursed the January premium so that the customer was not out of pocket.’

The Australian Competition and Consumer Commission (ACCC) states that unreasonable barriers to cancelling contracts or subscriptions can raise concerns under Australian Consumer Law.

Businesses must clearly disclose any key terms within their contracts to consumers upfront, such as those relating to cancellation.

Medibank also received backlash a few months ago when the insurance company suffered from a data breach.

Millions of Australians had their personal data exposed, including a Byron Bay resident. She mentioned that after Medibank’s data breach, her PayPal account was hacked, making her feel ‘extremely vulnerable and violated’. You can read more about the story here.

Key Takeaways

- An irate Medibank customer encountered 'ridiculous stonewalling' while trying to cancel her policy, leading to frustration over the lengthy process.

- The customer's cancellation request through chat services was met with delays and a requirement for a call from Medibank's consultant team despite requests not to be contacted by the retention team.

- After persistence and the threat of taking the complaint to the ombudsman, the customer believes her policy was finally cancelled, and she has since joined a rival insurer.

- Medibank apologised for the delay, attributing it to human error, and assured that they have processes to ensure timely cancellations, adding that the customer's January premium was also reimbursed.