Quick-thinking bank staff saves senior couple from losing $10,000

- Replies 6

Scams aimed at older Australians are on the rise, with criminals finding more sophisticated ways to target vulnerable seniors.

Romance scams, inheritance scams, investment scams… The list goes on. Just last year, over $3 billion was lost to scammers nationwide.

Fortunately, more and more people are becoming aware of these schemes. Just recently, the quick thinking of staff at a small town bank recently saved a local elderly couple from losing thousands.

So, what happened, and how did the bank staff know that the couple, who prefers to remain anonymous in this story, needed help?

The scam started when the couple received a phone call from someone claiming to work for their bank, National Australia Bank (NAB)—a tactic that aims to build trust by impersonating a known, trusted business.

The scammer spun an elaborate lie about uncovering 'internal fraud' at the Renmark branch and needing the couple's help to catch a 'corrupt' staff member.

Then, they instructed the couple to physically withdraw cash—which was around $10,000—to aid the 'investigation', prepping them to answer questions bank staff might ask.

'The actual scammer had made up a complex list of lies and said the couple was helping to uncover fraud at our branch and that one of our staff members could potentially be corrupt,' recalled Tammy McBride, the Branch Manager at NAB Renmark.

She added that the scammers even made up stories of how customers of the local branch had 'lost their money' from the bank.

When the visibly nervous senior woman came in alone to make a large withdrawal—which was highly unusual for her—Ms McBride said she immediately sensed something was wrong.

'It all looked unnatural, and she looked quite nervous. [The couple] are regular customers, and the husband would normally come in by himself and request a smaller amount,' she said.

Thankfully, the staff at the bank came to the wife's aid and inquired about the issue. During this interaction, they discovered the scammer had been eavesdropping on their conversations via a telephone hidden in the wife's handbag.

According to Ms McBride, scams were not uncommon at their branch, occurring a few times a week.

However, this incident stood out as an exceptionally sophisticated and perilous example.

'I think this one just showed how sophisticated and dangerous a scam can be,' she said.

Heidi Snell, the Executive General Manager of the National Anti-Scam Centre at the Australian Competition and Consumer Commission, said scams are becoming more sophisticated and cunning in Australia.

Scammers now use everyday situations to deceive people, making it difficult for potential victims to recognise the scams.

It's crucial to be aware of the warning signs to safeguard yourself. These scammers often build trust by pretending to know various details about you. They may even develop a relationship with you over time!

While there is a rising trend in the amount of money lost to scams, the National Anti-Scam Centre is collaborating with industries like banks and telecommunications to combat this issue.

'In the long term, we hope to see the number go down again,' added Ms Snell. 'But it is really important for consumers to take an active role in protecting themselves.'

With scams becoming incredibly sophisticated nowadays, we all must stay alert. But this story shows that awareness and community lookout can successfully stop these criminal schemes.

Kudos to the Renmark NAB staff for their brilliant intervention! It's a great reminder to remain vigilant and know that with quick thinking, scams can be prevented.

What are your thoughts on this story, members? Have you ever been in a similar situation? Share your experiences with us; leave a comment below!

Romance scams, inheritance scams, investment scams… The list goes on. Just last year, over $3 billion was lost to scammers nationwide.

Fortunately, more and more people are becoming aware of these schemes. Just recently, the quick thinking of staff at a small town bank recently saved a local elderly couple from losing thousands.

So, what happened, and how did the bank staff know that the couple, who prefers to remain anonymous in this story, needed help?

The scam started when the couple received a phone call from someone claiming to work for their bank, National Australia Bank (NAB)—a tactic that aims to build trust by impersonating a known, trusted business.

The scammer spun an elaborate lie about uncovering 'internal fraud' at the Renmark branch and needing the couple's help to catch a 'corrupt' staff member.

Then, they instructed the couple to physically withdraw cash—which was around $10,000—to aid the 'investigation', prepping them to answer questions bank staff might ask.

'The actual scammer had made up a complex list of lies and said the couple was helping to uncover fraud at our branch and that one of our staff members could potentially be corrupt,' recalled Tammy McBride, the Branch Manager at NAB Renmark.

She added that the scammers even made up stories of how customers of the local branch had 'lost their money' from the bank.

When the visibly nervous senior woman came in alone to make a large withdrawal—which was highly unusual for her—Ms McBride said she immediately sensed something was wrong.

'It all looked unnatural, and she looked quite nervous. [The couple] are regular customers, and the husband would normally come in by himself and request a smaller amount,' she said.

Thankfully, the staff at the bank came to the wife's aid and inquired about the issue. During this interaction, they discovered the scammer had been eavesdropping on their conversations via a telephone hidden in the wife's handbag.

According to Ms McBride, scams were not uncommon at their branch, occurring a few times a week.

However, this incident stood out as an exceptionally sophisticated and perilous example.

'I think this one just showed how sophisticated and dangerous a scam can be,' she said.

Heidi Snell, the Executive General Manager of the National Anti-Scam Centre at the Australian Competition and Consumer Commission, said scams are becoming more sophisticated and cunning in Australia.

Scammers now use everyday situations to deceive people, making it difficult for potential victims to recognise the scams.

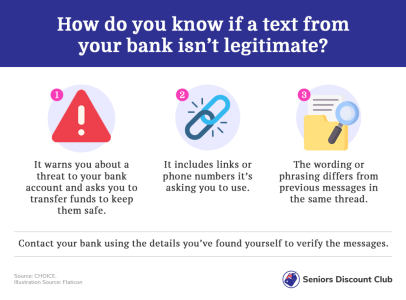

It's crucial to be aware of the warning signs to safeguard yourself. These scammers often build trust by pretending to know various details about you. They may even develop a relationship with you over time!

While there is a rising trend in the amount of money lost to scams, the National Anti-Scam Centre is collaborating with industries like banks and telecommunications to combat this issue.

'In the long term, we hope to see the number go down again,' added Ms Snell. 'But it is really important for consumers to take an active role in protecting themselves.'

Key Takeaways

- A small-town bank in South Australia saved a local elderly couple from losing thousands of dollars to a sophisticated scam.

- The scammer, posing as a worker from the National Australia Bank (NAB), tried to convince the couple to physically withdraw their cash from the bank, claiming that they were helping to uncover fraud in the bank.

- The NAB staff at the Renmark branch became suspicious when the woman, who appeared nervous, requested a large amount of money. It was revealed that the scammer was listening to the entire interaction through the phone in the woman's handbag.

- The Australian Competition and Consumer Commission (ACCC) reported a record $3.1 billion in losses to scams in 2022. Heidi Snell from ACCC's National Anti-Scam Centre said this fraud is becoming increasingly sophisticated and urged consumers to protect themselves.

With scams becoming incredibly sophisticated nowadays, we all must stay alert. But this story shows that awareness and community lookout can successfully stop these criminal schemes.

Kudos to the Renmark NAB staff for their brilliant intervention! It's a great reminder to remain vigilant and know that with quick thinking, scams can be prevented.

What are your thoughts on this story, members? Have you ever been in a similar situation? Share your experiences with us; leave a comment below!