Pro-cash advocate exposes Australia's 'cashless society': ‘Our economy isn't inclusive anymore’

By

Seia Ibanez

- Replies 31

As digital payments become increasingly popular in Australia, many have experienced the convenience of skipping cash transactions and tapping their cards into machines or using their phones to make payments instead.

But according to a pro-cash advocate, this 'cashless society' that we've all jumped into in recent years is costing businesses and customers thousands of dollars a year.

Jason Bryce—the coordinator of the Cash Welcome campaign—said that the average fee for an EFTPOS machine is around $200 a month, and for some businesses that use multiple machines, those fees quickly add up.

'It costs thousands of dollars a month for a standard, average business like this one, a coffee shop behind me, to accept card payments,' Bryce said as he was speaking outside of Footscray Doughnuts and Coffee in Melbourne’s west.

'And if your volume goes down, your fees go up. So whatever happens, the bank or the phone company, the telco, is clipping the ticket on the way through.'

'Sure, lots of people like to tap and go, but there's some times when we all need to use cash, and some people use cash every single day.'

It’s not just businesses that are losing out either; customers are also paying a higher price for purchases due to the surcharge fees that some businesses pass on to them.

Bryce has been campaigning on behalf of cash movement since both his bank and local supermarket discontinued cash payments throughout the COVID-19 pandemic.

Cash transactions have declined since the pandemic, while some businesses and bank branches refuse to accept physical currency transactions.

Bryce said that businesses ‘need to be able to accept cash’ as they would save ‘thousands’ of costs on monthly fees and transactions.

He added that people use cash to budget and save money when they are tightening their spending due to the rising interest rates.

‘(Cash) is just getting too hard to get, bank branches are closing, ATMs are closing and as soon as there is an outage, we are stuck,’ Bryce said.

'Our economy isn't inclusive anymore.’

'Without cash, our economy is weaker because retailers and consumers are more vulnerable to computer failures, bank system outages and even online criminals.'

According to Bryce, the Optus outage was a ‘big wake-up call’ for Australian businesses and customers.

Business owners were stranded in their operations due to no mobile reception or broadband last 8 November when the telecommunication giant had an outage.

Some businesses reported issues communicating with customers and accepting digital payments, while others were forced to close that day. The outage affected at least 10 million customers.

Mt Druitt service centre ANZCO Automotive informed its customers that they had to close their shop that day.

‘For the time being, we will not be operating. Due to this outage, our entire system is not operating,’ its business owners announced.

Another business, Stewy the Snake Catcher on the Gold Coast, said to his followers that he was not spared by the outage.

'We are aware of a major outage across the Optus network, and I myself am with Optus' he said.

'We apologise in advance if you try to get through to us this morning and are having trouble. Hopefully, they rectify the issue ASAP.'

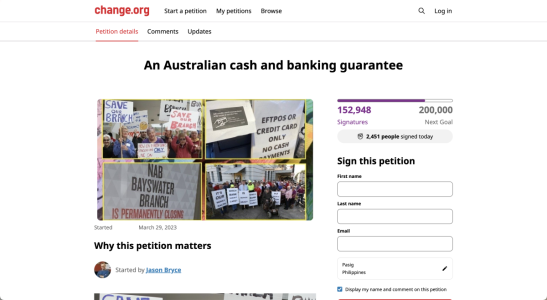

Bryce has a petition that currently has over 150,000 signatures on it since March. It calls for Australians to ‘have reasonable local access to cash and full banking services’ and to ‘choose cash when paying for food and essentials at physical retailers'.

The petition reads, ‘We will win this war on cash if we can keep going, pushing governments to protect our rights.’

'Other countries are protecting cash, and Australia must follow.'

Australia already lags behind the United Kingdom, the European Union, and the United States, who have all recently backed legislation that protects the people’s right to use cash.

'We need to be able to choose how we pay for stuff, whether it be tapping or whether it be cash,' Bryce said.

What do you think of this story? Do you agree with Bryce to have cash payments for in-person transactions, or do you prefer a ‘cashless society’? Share your thoughts in the comments below!

But according to a pro-cash advocate, this 'cashless society' that we've all jumped into in recent years is costing businesses and customers thousands of dollars a year.

Jason Bryce—the coordinator of the Cash Welcome campaign—said that the average fee for an EFTPOS machine is around $200 a month, and for some businesses that use multiple machines, those fees quickly add up.

'It costs thousands of dollars a month for a standard, average business like this one, a coffee shop behind me, to accept card payments,' Bryce said as he was speaking outside of Footscray Doughnuts and Coffee in Melbourne’s west.

Pro-cash advocate Jason Bryce said that banks and businesses should offer cash payments. Credit: Unsplash

'And if your volume goes down, your fees go up. So whatever happens, the bank or the phone company, the telco, is clipping the ticket on the way through.'

'Sure, lots of people like to tap and go, but there's some times when we all need to use cash, and some people use cash every single day.'

It’s not just businesses that are losing out either; customers are also paying a higher price for purchases due to the surcharge fees that some businesses pass on to them.

Bryce has been campaigning on behalf of cash movement since both his bank and local supermarket discontinued cash payments throughout the COVID-19 pandemic.

Cash transactions have declined since the pandemic, while some businesses and bank branches refuse to accept physical currency transactions.

Bryce said that businesses ‘need to be able to accept cash’ as they would save ‘thousands’ of costs on monthly fees and transactions.

He added that people use cash to budget and save money when they are tightening their spending due to the rising interest rates.

‘(Cash) is just getting too hard to get, bank branches are closing, ATMs are closing and as soon as there is an outage, we are stuck,’ Bryce said.

'Our economy isn't inclusive anymore.’

'Without cash, our economy is weaker because retailers and consumers are more vulnerable to computer failures, bank system outages and even online criminals.'

According to Bryce, the Optus outage was a ‘big wake-up call’ for Australian businesses and customers.

Business owners were stranded in their operations due to no mobile reception or broadband last 8 November when the telecommunication giant had an outage.

Some businesses reported issues communicating with customers and accepting digital payments, while others were forced to close that day. The outage affected at least 10 million customers.

Mt Druitt service centre ANZCO Automotive informed its customers that they had to close their shop that day.

‘For the time being, we will not be operating. Due to this outage, our entire system is not operating,’ its business owners announced.

Another business, Stewy the Snake Catcher on the Gold Coast, said to his followers that he was not spared by the outage.

'We are aware of a major outage across the Optus network, and I myself am with Optus' he said.

'We apologise in advance if you try to get through to us this morning and are having trouble. Hopefully, they rectify the issue ASAP.'

Bryce has a petition that currently has over 150,000 signatures on it since March. It calls for Australians to ‘have reasonable local access to cash and full banking services’ and to ‘choose cash when paying for food and essentials at physical retailers'.

The petition reads, ‘We will win this war on cash if we can keep going, pushing governments to protect our rights.’

'Other countries are protecting cash, and Australia must follow.'

Australia already lags behind the United Kingdom, the European Union, and the United States, who have all recently backed legislation that protects the people’s right to use cash.

'We need to be able to choose how we pay for stuff, whether it be tapping or whether it be cash,' Bryce said.

Key Takeaways

- Pro-cash advocate Jason Bryce has warned against Australia becoming a cashless society, arguing it's costing businesses and customers money through card payment fees.

- According to Bryce, EFTPOS machines could be costing businesses around $200 a month due to monthly fees and surcharges, significantly impacting small businesses.

- Bryce argues that cash is vital for consumers to effectively budget and save money and highlights the vulnerability to technological failures and online criminal activity in a cashless society.

- A petition started by Bryce calling for the right to use cash and for businesses and banks to support cash payments has garnered 150,000 signatures since March.

What do you think of this story? Do you agree with Bryce to have cash payments for in-person transactions, or do you prefer a ‘cashless society’? Share your thoughts in the comments below!