Pension age increase draws ire from unions and older Aussies: ‘Should not be a one size fits all’

- Replies 59

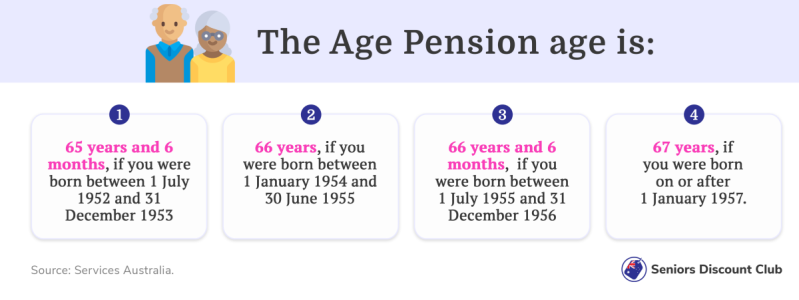

The good old days when you could retire with a pension at age 65 are a thing of the past.

After the Federal Government changed the law and raised the age threshold at which Australians can access the pension, Aussies now have to wait two more years till the age of 67.

Given the circumstances, it's unsurprising that this news was met with intense backlash—union bosses and Australians nearing retirement age were both very vocal in their criticism of the new regulations.

For instance, the Construction Forestry Maritime Mining Energy Union (CFMEU) NSW secretary Darren Greenfield highlighted the effect the law change would have on hardworking labourers.

In his words, 'In construction, they do a lot of the heavy lifting of the structure, concreters, steel fixers, scaffolders, it is very labour intensive work. A lot of their bodies burn out by 50 to 55.'

'By the time they get to 60, it is a nightmare for them not to be able to retire.'

Daniel Walton, the National Secretary of the Australian Workers Union, was also worried about blue-collar workers who may have difficulty working until they retire because of physical limitations.

He wanted to draw attention to the fact that their work can be tough on their bodies, which makes it difficult for them to keep working as they get older.

This news affected more than just the typical tradesperson's retirement age—it obviously affected the whole country. So it's not shocking to see seniors from various backgrounds outraged over the issue.

The comments left on the news story are undoubtedly poignant. They brought forth some pertinent points about our outdated retirement policies and how things could be done better.

For example, it was argued that it simply isn't right for everyone to have to wait until they're 67, regardless of their personal circumstances and the type of work they do.

'The retirement age should not be a one size fits all; it should be a reflection of your work life,' commented one pensioner.

'Years of doing hard physical work and hard emotional work should be taken into account and used to reduce your retirement age. This is what they do in France, and they even take into consideration how many children you have brought up.'

Moreover, another brought up a controversial side to the issue—the glaring discrepancies between the retirement age of politicians and the average Aussie worker.

'The politicians don't care. They do two terms & they are on a lifelong pension, plus they are able to access their superannuation. They are hoping the average worker drops in their tracks so they don't have to pay out any pensions. We know what's going on. They just think we don't & they couldn't care less,' they said.

We have discussed the highly debated issue of the increased Age Pension here in the SDC forum, and many of our members have shared their perspectives on the matter.

Member Rhondda@Benjji commented: 'Why did we pay taxes all those years? It was for the pension. They keep raising the age every few years, and it's not fair to the people who reach the age only to have it change.'

Meanwhile, member @DanB said, 'I quite like the idea of giving the incentive of Pension Age people to stay longer in employment by way of tax concessions rather than increasing the pension age.'

Member @elaine41 shared a personal anecdote: 'As a retired psychiatric nurse, there is no way it is safe to ask people over 60 to work in that profession. We can no longer move fast enough to avoid injury when a patient is aggressive…'

It’s important that the government reforms the existing pension system so it takes into account the individual needs of seniors—particularly those who have worked hard and long in physically demanding or emotionally draining jobs.

In this case, we hope the government will listen to the voices of many older Aussies and introduce a new system built on fairness. Rest assured, we will keep you informed of any updates regarding this matter.

Members, do you have more to add to this conversation? Share your opinions with us in the comments below!

After the Federal Government changed the law and raised the age threshold at which Australians can access the pension, Aussies now have to wait two more years till the age of 67.

Given the circumstances, it's unsurprising that this news was met with intense backlash—union bosses and Australians nearing retirement age were both very vocal in their criticism of the new regulations.

The topic of retirement age and eligibility for the age pension requires thoughtful consideration, taking into account the diverse needs of Australian workers and their retirement plans. Credit: Shutterstock.

For instance, the Construction Forestry Maritime Mining Energy Union (CFMEU) NSW secretary Darren Greenfield highlighted the effect the law change would have on hardworking labourers.

In his words, 'In construction, they do a lot of the heavy lifting of the structure, concreters, steel fixers, scaffolders, it is very labour intensive work. A lot of their bodies burn out by 50 to 55.'

'By the time they get to 60, it is a nightmare for them not to be able to retire.'

Daniel Walton, the National Secretary of the Australian Workers Union, was also worried about blue-collar workers who may have difficulty working until they retire because of physical limitations.

He wanted to draw attention to the fact that their work can be tough on their bodies, which makes it difficult for them to keep working as they get older.

This news affected more than just the typical tradesperson's retirement age—it obviously affected the whole country. So it's not shocking to see seniors from various backgrounds outraged over the issue.

The comments left on the news story are undoubtedly poignant. They brought forth some pertinent points about our outdated retirement policies and how things could be done better.

For example, it was argued that it simply isn't right for everyone to have to wait until they're 67, regardless of their personal circumstances and the type of work they do.

'The retirement age should not be a one size fits all; it should be a reflection of your work life,' commented one pensioner.

'Years of doing hard physical work and hard emotional work should be taken into account and used to reduce your retirement age. This is what they do in France, and they even take into consideration how many children you have brought up.'

Moreover, another brought up a controversial side to the issue—the glaring discrepancies between the retirement age of politicians and the average Aussie worker.

'The politicians don't care. They do two terms & they are on a lifelong pension, plus they are able to access their superannuation. They are hoping the average worker drops in their tracks so they don't have to pay out any pensions. We know what's going on. They just think we don't & they couldn't care less,' they said.

We have discussed the highly debated issue of the increased Age Pension here in the SDC forum, and many of our members have shared their perspectives on the matter.

Member Rhondda@Benjji commented: 'Why did we pay taxes all those years? It was for the pension. They keep raising the age every few years, and it's not fair to the people who reach the age only to have it change.'

Meanwhile, member @DanB said, 'I quite like the idea of giving the incentive of Pension Age people to stay longer in employment by way of tax concessions rather than increasing the pension age.'

Member @elaine41 shared a personal anecdote: 'As a retired psychiatric nurse, there is no way it is safe to ask people over 60 to work in that profession. We can no longer move fast enough to avoid injury when a patient is aggressive…'

Key Takeaways

- The Federal Government has raised the pension age to 67, triggering a backlash from unions and older Australians.

- Union bosses like Darren Greenfield of CFMEU and Daniel Walton of the Australian Workers Union have voiced concerns about the potential repercussions of the change, especially for blue-collar workers.

- Older Australians nearing retirement have expressed dissatisfaction.

- Some aged Australians and union representatives are arguing for a more nuanced approach to determining retirement age, taking into consideration the physical and emotional demands of one's career.

It’s important that the government reforms the existing pension system so it takes into account the individual needs of seniors—particularly those who have worked hard and long in physically demanding or emotionally draining jobs.

In this case, we hope the government will listen to the voices of many older Aussies and introduce a new system built on fairness. Rest assured, we will keep you informed of any updates regarding this matter.

Members, do you have more to add to this conversation? Share your opinions with us in the comments below!