Over 4.7 million Australians to get a Centrelink payment boost - Here’s how much more money you could be receiving!

By

- Replies 71

As the cost of living continues to rise, many people are feeling the pinch. However, those living on fixed incomes, such as pensioners, are often hit the hardest.

With limited funds available, many struggle to make ends meet and afford necessities like food, housing, and healthcare.

For these individuals, any increase in their pension payments can be a welcome relief, providing them with some much-needed financial support.

If you’re one of those people who are looking forward to payment boosts, then we’ve got news for you!

More than 4.7 million Australians are set to receive a boost in their fortnightly payments, starting March 20, to keep up with the increasing cost of living.

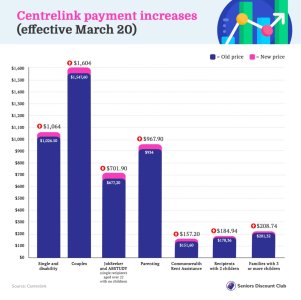

Single pensioners, disability pensioners and carers will receive an extra $37.50 each fortnight and couples will now enjoy an extra $56.40 per fortnight. This boost brings their payments to $1,064 and $1,604 respectively.

Non-pensioners who rely on Centrelink payments will also get some relief. Here’s a breakdown:

• JobSeeker and ABSTUDY payments will increase by $24.70 bringing the fortnight payment to $701.90 for single recipients aged over 22 with no children.

• Parenting Payments will rise by $33.90 to $967.90 a fortnight for single parents.

• Commonwealth Rent Assistance will increase by $5.60 for singles, $6.58 for recipients with two children, and another $7.42 for families with three or more kids.

The increase comes as part of the twice-yearly indexation, ensuring that pensions and allowance payments remain aligned with inflation

Surprisingly, the increase in pension payments has outpaced that of wages, with pensions rising at twice the rate of wages in recent months.

In September, pensions saw a significant increase of 4%, followed by another substantial hike of 3.7% in March.

In contrast, Australian wages rose by 3.3 per cent last year, which was the quickest pace in ten years. However, this increase was far below the inflation rate, which stood at 7.8 per cent - the highest since 1990.

Social Services Minister Amanda Rishworth said the good news will be a real ‘lift’ for those relying on welfare payments, who have felt the pinch of increasing prices on commodities.

She remarked: ‘Indexation is a pillar of our social security system and we want more money in the pockets of everyday Australians so they can better afford essentials.’

'Australia's social security system exists to support our most vulnerable citizens, and we know they are feeling the pinch.'

As exciting as this news is, we must accept that it’s not truly ‘rainbows and unicorns’. We still have to brace ourselves with the likelihood of double-digit mortgage hikes, with the RBA tipping a 10th consecutive rate rise on Tuesday.

The cash rate is expected to increase to 3.6 per cent from 3.35 per cent after the RBA’s comments last month suggested it was growing impatient with high inflation.

This increase represents a 63.8 per cent rise in repayments. At that time, the major banks were providing an average fixed rate of 1.92 per cent.

It should be noted that Australia’s biggest lender, Commonwealth Bank, is currently offering a one-year fixed rate of 5.99%.

Meanwhile, NAB has raised its variable rate for borrowers with a mortgage of less than 20% deposit by 0.2 percentage points to 6.44%.

So, there you have it, folks! While many pensioners welcome this boost, we must be realistic and recognise that it's not a quick fix. As pensions grow, so does inflation and the cost of living.

This creates a vicious cycle where pensioners are forced to tighten their budgets even further just to keep up or find themselves falling behind.

What are your thoughts on these changes? Do you think the payment boosts offer enough relief for those who live on fixed incomes? Share your thoughts with us in the comments below.

With limited funds available, many struggle to make ends meet and afford necessities like food, housing, and healthcare.

For these individuals, any increase in their pension payments can be a welcome relief, providing them with some much-needed financial support.

If you’re one of those people who are looking forward to payment boosts, then we’ve got news for you!

More than 4.7 million Australians are set to receive a boost in their fortnightly payments, starting March 20, to keep up with the increasing cost of living.

A significant increase in the pension and allowance payments for more than 4.7 million Australians is expected to come into effect this month. Credit: Shutterstock.

Single pensioners, disability pensioners and carers will receive an extra $37.50 each fortnight and couples will now enjoy an extra $56.40 per fortnight. This boost brings their payments to $1,064 and $1,604 respectively.

Non-pensioners who rely on Centrelink payments will also get some relief. Here’s a breakdown:

• JobSeeker and ABSTUDY payments will increase by $24.70 bringing the fortnight payment to $701.90 for single recipients aged over 22 with no children.

• Parenting Payments will rise by $33.90 to $967.90 a fortnight for single parents.

• Commonwealth Rent Assistance will increase by $5.60 for singles, $6.58 for recipients with two children, and another $7.42 for families with three or more kids.

The increase comes as part of the twice-yearly indexation, ensuring that pensions and allowance payments remain aligned with inflation

Surprisingly, the increase in pension payments has outpaced that of wages, with pensions rising at twice the rate of wages in recent months.

In September, pensions saw a significant increase of 4%, followed by another substantial hike of 3.7% in March.

In contrast, Australian wages rose by 3.3 per cent last year, which was the quickest pace in ten years. However, this increase was far below the inflation rate, which stood at 7.8 per cent - the highest since 1990.

Social Services Minister Amanda Rishworth said the good news will be a real ‘lift’ for those relying on welfare payments, who have felt the pinch of increasing prices on commodities.

She remarked: ‘Indexation is a pillar of our social security system and we want more money in the pockets of everyday Australians so they can better afford essentials.’

'Australia's social security system exists to support our most vulnerable citizens, and we know they are feeling the pinch.'

As exciting as this news is, we must accept that it’s not truly ‘rainbows and unicorns’. We still have to brace ourselves with the likelihood of double-digit mortgage hikes, with the RBA tipping a 10th consecutive rate rise on Tuesday.

The cash rate is expected to increase to 3.6 per cent from 3.35 per cent after the RBA’s comments last month suggested it was growing impatient with high inflation.

This increase represents a 63.8 per cent rise in repayments. At that time, the major banks were providing an average fixed rate of 1.92 per cent.

It should be noted that Australia’s biggest lender, Commonwealth Bank, is currently offering a one-year fixed rate of 5.99%.

Meanwhile, NAB has raised its variable rate for borrowers with a mortgage of less than 20% deposit by 0.2 percentage points to 6.44%.

Key Takeaways

- More than 4.7 million Australians are set to receive a boost in their fortnightly payments, starting March 20.

- Single pensioners, disability pensioners and carers will receive an extra $37.50 each fortnight, couples will enjoy an extra $56.40 and other welfare recipients will receive increases.

- The increase comes as part of twice-yearly indexation, to ensure that pensions and allowance payments remain aligned with inflation.

- The RBA is tipping a 10th consecutive rate rise. Major banks are offering fixed rates of up to 5.99%.

So, there you have it, folks! While many pensioners welcome this boost, we must be realistic and recognise that it's not a quick fix. As pensions grow, so does inflation and the cost of living.

This creates a vicious cycle where pensioners are forced to tighten their budgets even further just to keep up or find themselves falling behind.

What are your thoughts on these changes? Do you think the payment boosts offer enough relief for those who live on fixed incomes? Share your thoughts with us in the comments below.

Last edited by a moderator: