New government program aims to make home-buying easier for Aussies

- Replies 23

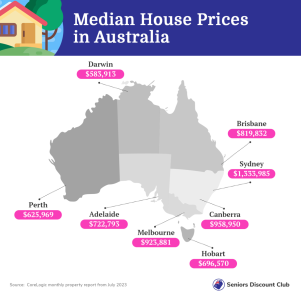

Purchasing a home is costly, and for many Aussies, it remains financially challenging. The considerable deposits required, escalating prices, and complex loan regulations create a financial obstacle course.

This situation not only carries financial risks but tends to demotivate, especially when progress towards homeownership feels slow or unattainable.

Fortunately, there's a potential solution on the horizon. Prime Minister Anthony Albanese and the National Cabinet have taken steps to alleviate some of the challenges of buying a home.

During a recent Labor Party National Conference, they introduced the Help to Buy Scheme. Initially introduced in last year's federal election campaign, the policy was scheduled to take effect this year but was pushed out to next year.

How does it work?

The proposed legislation aims to assist individuals with low and middle incomes in entering a previously difficult-to-access market. It's designed to aid up to 10,000 buyers each year. This initiative, supported by $329 million in funding, is commonly referred to as a 'shared equity scheme'.

Essentially, the shared equity scheme enables you to co-purchase a home you're already living in (known as 'rent to buy'), with the government providing assistance. Through this program, eligible individuals can receive an 'equity contribution'. This contribution can cover as much as 40 per cent of the cost of a new home or 30 per cent for an existing one, whether it's a house, unit, or townhouse.

An important perk of the scheme is that the buyer won't be required to pay 'rent' for the portion of the property owned by the government. This means those participating in the scheme can benefit from reduced upfront costs and potentially access more affordable homeownership opportunities.

Who is eligible for the scheme?

To qualify for the scheme, you need to meet certain criteria:

'So often, these Australians have done all the right things—worked hard, saved up, made sacrifices, but a deposit for a home is still out of reach,' Albanese told the ALP National Conference.

'Our government will step up and put in our share, opening the door of home ownership to tens of thousands of hard-working people.'

This news follows the PM's recent confirmation that the government is on track to build 1.2 million new homes within the next five years, a potential of 200,000 more homes than had previously been in the government's plan.

Members, if you or someone you know is considering buying a home, investigate if you're eligible for this government scheme—it could be an invaluable boost for getting closer to the house of your dreams!

What do you think about this program? Do you view it as a valuable form of government assistance? Feel free to share your opinions in the comments section!

This situation not only carries financial risks but tends to demotivate, especially when progress towards homeownership feels slow or unattainable.

Fortunately, there's a potential solution on the horizon. Prime Minister Anthony Albanese and the National Cabinet have taken steps to alleviate some of the challenges of buying a home.

During a recent Labor Party National Conference, they introduced the Help to Buy Scheme. Initially introduced in last year's federal election campaign, the policy was scheduled to take effect this year but was pushed out to next year.

The scheme will give people an 'equity contribution' of up to 40 per cent of the cost of a new home, or 30 per cent for existing homes. Credit: Shutterstock.

How does it work?

The proposed legislation aims to assist individuals with low and middle incomes in entering a previously difficult-to-access market. It's designed to aid up to 10,000 buyers each year. This initiative, supported by $329 million in funding, is commonly referred to as a 'shared equity scheme'.

Essentially, the shared equity scheme enables you to co-purchase a home you're already living in (known as 'rent to buy'), with the government providing assistance. Through this program, eligible individuals can receive an 'equity contribution'. This contribution can cover as much as 40 per cent of the cost of a new home or 30 per cent for an existing one, whether it's a house, unit, or townhouse.

An important perk of the scheme is that the buyer won't be required to pay 'rent' for the portion of the property owned by the government. This means those participating in the scheme can benefit from reduced upfront costs and potentially access more affordable homeownership opportunities.

Who is eligible for the scheme?

To qualify for the scheme, you need to meet certain criteria:

- You must be an Australian citizen and be at least 18 years old.

- Your yearly income should be $90,000 or less if you're an individual or $120,000 or less if you're a couple.

- You must live in the home that you're purchasing.

- You shouldn't currently own any other land or property in Australia or anywhere else, but this doesn't necessarily have to be your first home.

- You must provide a minimum 2 per cent deposit of the home's price. You'll also need to demonstrate that you can secure financing for the remaining loan amount.

- Additionally, you must show that you can cover all initial expenses associated with the property purchase, including stamp duty, legal fees, and bank fees.

- Keep in mind that ongoing costs related to the property, such as rates, strata fees, and electricity bills, will be your responsibility.

'So often, these Australians have done all the right things—worked hard, saved up, made sacrifices, but a deposit for a home is still out of reach,' Albanese told the ALP National Conference.

'Our government will step up and put in our share, opening the door of home ownership to tens of thousands of hard-working people.'

This news follows the PM's recent confirmation that the government is on track to build 1.2 million new homes within the next five years, a potential of 200,000 more homes than had previously been in the government's plan.

Key Takeaways

- The Help to Buy Scheme, which would have the federal government contributing up to 40 per cent of the cost of a new home for eligible buyers, has been agreed upon by the states and territories.

- Prime Minister Anthony Albanese confirmed the scheme would assist tens of thousands of Australian low to middle-income earners from next year.

- To be eligible for the scheme, single individuals must have an income of no more than $90,000 and couples a combined income under $120,000.

- The scheme's support announcement follows Albanese's commitment to build 1.2 million new homes over the next five years.

Members, if you or someone you know is considering buying a home, investigate if you're eligible for this government scheme—it could be an invaluable boost for getting closer to the house of your dreams!

What do you think about this program? Do you view it as a valuable form of government assistance? Feel free to share your opinions in the comments section!