Is a cashless society in Australia closer than we think?

- Replies 41

For many Australians, the days of fumbling with loose change or withdrawing cash seem to be fading fast.

Over the past few decades, digital payments have been steadily gaining traction. But the COVID-19 pandemic appears to have supercharged Australia's transition towards a cashless society.

In the 1970s, Australia entered the modern payments era with the advent of the Bankcard. But the pieces were already in place with credit cards and internet banking in the 80s and 90s.

Then, the boom of smartphones and apps brought game-changers like PayPal, Apple Pay and tap-and-go.

Dr Angel Zhong, an associate professor in finance at RMIT, pointed out that the transition to digital wallets and buy-now-pay-later (BNPL) systems is not only happening in major cities but is also gaining traction in remote parts of Australia.

'The shift towards a cashless society in Australia isn't just a possibility, it's already well underway,' she said.

According to Zhong, the appeal of digital transactions has become too compelling for consumers and businesses to resist. As a result, this shift has caused the digital payment sector to outshine traditional payment methods.

According to a report from the Australian Banking Association, the use of digital wallet payments has seen an astonishing surge, increasing from just $746 million in 2018 to a whopping $93 billion in 2022.

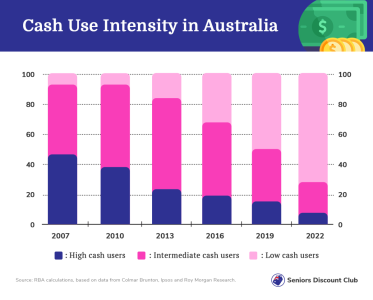

This rise in digital payments has dramatically reduced the use of cash, which now only accounts for 13 per cent of consumer transactions in Australia as of the end of 2022—a stark contrast to the 70 per cent of transactions in cash back in 2007.

Digital wallets have also gained widespread popularity across various age groups. Young Aussies between 18 and 29 are at the forefront, with two-thirds using digital wallets to make payments.

The report also showed that almost 40 per cent of Australians have grown so comfortable with digital wallets that they are willing to leave their physical wallets, credit or debit cards at home, as long as they have their mobile devices equipped with digital wallet capabilities.

Australia has become a global leader in adopting digital payments, outpacing the United States and European countries.

This surge is not limited to digital wallets; Buy Now Pay Later (BNPL) services are also gaining traction in Australia, where many prominent products in this category originated.

According to the Australian Securities and Investment Commission (ASIC), the total value of all BNPL transactions saw a substantial 79 per cent increase during the 2018-19 financial year.

This growth trend has persisted into 2022, with the Reserve Bank of Australia (RBA) reporting an annual expansion of over 30 per cent.

In addition to BNPL, other payment methods like PayID and PayPal are also making their presence felt in the Australian market.

Last week, we reported about the government's plans to regulate the payment system, as outlined in proposed amendments to the Reforms to the Payment Systems (Regulation) Act of 1998.

Under these new regulations, Buy Now, Pay Later (BNPL) services and digital wallet providers such as Apple Pay and Google Pay will be subjected to the same oversight by the Reserve Bank of Australia (RBA) as traditional credit and debit card issuers.

These regulations are designed to ensure that these providers adhere to clear security measures, data protection, and dispute resolution standards.

This, in turn, will instil confidence in Australians that their funds and personal information are adequately safeguarded.

Given the rising concerns regarding cyber-attacks, these regulations will be crucial in reducing the risk of fraudulent activities and money laundering. They will also enhance the detection of suspicious transactions.

The new regulations will also promote fair competition and market stability by levelling the playing field and preventing monopolistic practices.

'As payments increasingly become digital, our payments system needs to remain fit for purpose so that it delivers for consumers and small businesses,' said Treasurer Jim Chalmers.

'We want to make sure the shift to digital payments occurs in a way that promotes greater competition, innovation and productivity across our entire economy.'

During a government inquiry last September, the CEO of Commonwealth Bank, Matt Comyn, revealed that maintaining physical cash availability in Australia costs his bank $400 million annually.

He explained that this expense is due to the logistics and security required to transport and manage cash across the country.

It comes in the wake of several major banks, including CommBank, NAB, and ANZ, transitioning some of their branches to cashless operations—with Macquarie Bank even announcing its plan to completely phase out cash services by 2025.

Zhong's prediction suggests that Australia will become a cashless society by 2030, but the Commonwealth Bank's forecast indicates that this transition could occur even sooner, possibly by 2026.

However, it's important to clarify that the move towards a cashless society doesn't imply the complete disappearance of physical banknotes. There's no need to worry that your cash will lose its value.

'The meaning of cashless society is more about the way that we transact… It adds to the convenience of our day-to-day lives,' added Zhong.

'There is always a place for cash, but the majority will be making payments with digital wallets.'

A world without cash may still be some way off, but innovations and changes like major banks' cashless branches have certainly brought Australia closer. Only time will tell how much further this cashless revolution will go.

Members, what does the future of money look like to you? Share your predictions and thoughts in the comments section below!

Over the past few decades, digital payments have been steadily gaining traction. But the COVID-19 pandemic appears to have supercharged Australia's transition towards a cashless society.

In the 1970s, Australia entered the modern payments era with the advent of the Bankcard. But the pieces were already in place with credit cards and internet banking in the 80s and 90s.

Then, the boom of smartphones and apps brought game-changers like PayPal, Apple Pay and tap-and-go.

The convenience of digital transactions has become irresistible for consumers and businesses. Credit: Shutterstock.

Dr Angel Zhong, an associate professor in finance at RMIT, pointed out that the transition to digital wallets and buy-now-pay-later (BNPL) systems is not only happening in major cities but is also gaining traction in remote parts of Australia.

'The shift towards a cashless society in Australia isn't just a possibility, it's already well underway,' she said.

According to Zhong, the appeal of digital transactions has become too compelling for consumers and businesses to resist. As a result, this shift has caused the digital payment sector to outshine traditional payment methods.

According to a report from the Australian Banking Association, the use of digital wallet payments has seen an astonishing surge, increasing from just $746 million in 2018 to a whopping $93 billion in 2022.

This rise in digital payments has dramatically reduced the use of cash, which now only accounts for 13 per cent of consumer transactions in Australia as of the end of 2022—a stark contrast to the 70 per cent of transactions in cash back in 2007.

Digital wallets have also gained widespread popularity across various age groups. Young Aussies between 18 and 29 are at the forefront, with two-thirds using digital wallets to make payments.

The report also showed that almost 40 per cent of Australians have grown so comfortable with digital wallets that they are willing to leave their physical wallets, credit or debit cards at home, as long as they have their mobile devices equipped with digital wallet capabilities.

Australia has become a global leader in adopting digital payments, outpacing the United States and European countries.

This surge is not limited to digital wallets; Buy Now Pay Later (BNPL) services are also gaining traction in Australia, where many prominent products in this category originated.

According to the Australian Securities and Investment Commission (ASIC), the total value of all BNPL transactions saw a substantial 79 per cent increase during the 2018-19 financial year.

This growth trend has persisted into 2022, with the Reserve Bank of Australia (RBA) reporting an annual expansion of over 30 per cent.

In addition to BNPL, other payment methods like PayID and PayPal are also making their presence felt in the Australian market.

Last week, we reported about the government's plans to regulate the payment system, as outlined in proposed amendments to the Reforms to the Payment Systems (Regulation) Act of 1998.

Under these new regulations, Buy Now, Pay Later (BNPL) services and digital wallet providers such as Apple Pay and Google Pay will be subjected to the same oversight by the Reserve Bank of Australia (RBA) as traditional credit and debit card issuers.

These regulations are designed to ensure that these providers adhere to clear security measures, data protection, and dispute resolution standards.

This, in turn, will instil confidence in Australians that their funds and personal information are adequately safeguarded.

Given the rising concerns regarding cyber-attacks, these regulations will be crucial in reducing the risk of fraudulent activities and money laundering. They will also enhance the detection of suspicious transactions.

The new regulations will also promote fair competition and market stability by levelling the playing field and preventing monopolistic practices.

'As payments increasingly become digital, our payments system needs to remain fit for purpose so that it delivers for consumers and small businesses,' said Treasurer Jim Chalmers.

'We want to make sure the shift to digital payments occurs in a way that promotes greater competition, innovation and productivity across our entire economy.'

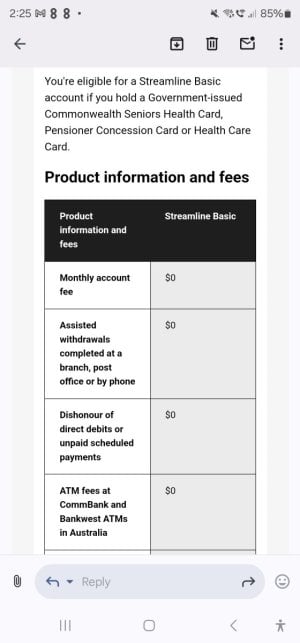

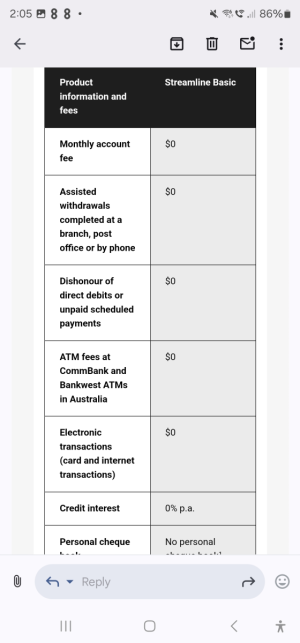

During a government inquiry last September, the CEO of Commonwealth Bank, Matt Comyn, revealed that maintaining physical cash availability in Australia costs his bank $400 million annually.

He explained that this expense is due to the logistics and security required to transport and manage cash across the country.

It comes in the wake of several major banks, including CommBank, NAB, and ANZ, transitioning some of their branches to cashless operations—with Macquarie Bank even announcing its plan to completely phase out cash services by 2025.

Zhong's prediction suggests that Australia will become a cashless society by 2030, but the Commonwealth Bank's forecast indicates that this transition could occur even sooner, possibly by 2026.

However, it's important to clarify that the move towards a cashless society doesn't imply the complete disappearance of physical banknotes. There's no need to worry that your cash will lose its value.

'The meaning of cashless society is more about the way that we transact… It adds to the convenience of our day-to-day lives,' added Zhong.

'There is always a place for cash, but the majority will be making payments with digital wallets.'

Key Takeaways

- The shift towards a cashless society in Australia is ‘well underway’ according to an expert, with digital wallet payments surging from $746 million in 2018 to over $93 billion in 2022.

- Cash only accounts for 13 per cent of consumer payments in Australia as of the end of 2022, contrasting with 70 per cent in 2007.

- The government recognises this trend and has unveiled reforms to regulate digital payment providers, ensuring they meet clear security measures, data protection and dispute resolution standards.

A world without cash may still be some way off, but innovations and changes like major banks' cashless branches have certainly brought Australia closer. Only time will tell how much further this cashless revolution will go.

Members, what does the future of money look like to you? Share your predictions and thoughts in the comments section below!