Horror stories from AustralianSuper customers – Accounts locked and no warning given!

- Replies 6

Many Aussies, especially those much closer to retirement age, use their superannuation funds to grow their savings and create a secure financial future.

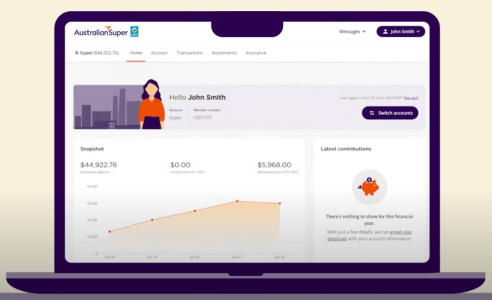

That's why when the largest superannuation fund in the country launched a new digital platform in mid-November 2022 that was supposed to make things easier, many were thrilled.

Unfortunately, we all know too well that something can go wrong during major system upgrade, but this horror story is one for the ages, and we can only hope you're not impacted.

Australia's largest superannuation fund, AustralianSuper, boasts close to 3 million members and holds around $258 billion in members' money.

However, two months after initiating system upgrades, customers are still unable to access their accounts, and the superfund has been slammed on social media.

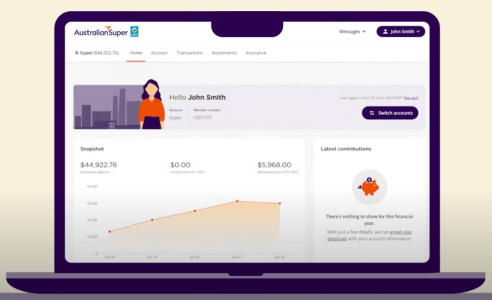

In mid-November, the fund released a new digital platform, including changes to its online member portal and phone app.

But the lack of planning and foresight has left customers high and dry, with many experiencing technical issues, at least four or five unplanned outages, and some being unable to log into their accounts at all.

'I can't understand how the new portal is still not fully working, and members are still unable to access their accounts. How has the CEO still got his job? Absolute debacle,' wrote one angry customer on social media.

People have also complained about long wait times to access any help from the phone lines or web chat.

'We are still unable to access our accounts despite numerous phone calls to Australian Super over the past two months,' another woman shared. 'My son has been trying to register for days now and still cannot do it. He is starting to wonder if he needs to go to someone else for his super as this is way too hard.'

To make matters worse, the 'choice' accounts and the member direct option, which is a self-managed system that allows members to control their own money, appear to have been affected, with many customers being locked out of their accounts without warning.

AustralianSuper later announced that issues impacting some members' ability to log in have been resolved, and they're 'working to resolve the remaining issues as quickly as possible', but revelations of substandard customer service sure put a cloud on things.

A review of superannuation funds released by the Australian Securities and Investments Commission in December also revealed some funds did not have adequate systems in place to manage and resolve disputes, adding fuel to the fire for disgruntled customers.

The importance of data security and privacy for superannuation funds cannot be overstated, especially when substantial amounts of members' money are involved.

Trustees of the funds are legally liable to protect the data of their members from any malicious attacks and security breaches, both on digital and physical platforms.

Technology has revolutionised the way members interact with superannuation funds, allowing for unprecedented access to accounts and transactions at the click of a button.

However, this also leaves members vulnerable to data theft and fraud. Such incidents can cost not only members their hard-earned money but also their trust and faith in the superannuation funds.

Through rigorous systems, policies and processes, superannuation funds should be able to guard against external threats, thereby keeping their members' data safe and secure.

If a superannuation fund encounters a major breach of data security, they are obligated to inform its members while also taking all necessary steps to protect their assets and investments.

Members, please stay vigilant! If you've noticed any issues with your AustralianSuper accounts, then you should call the fund's customer service hotline (1300 300 273) or reach out on web chat to get your accounts unlocked.

And if you're looking for a reliable super fund, then it pays to do your research and shop around for one that has all the features you're looking for and supports you in managing your superannuation.

Ask around to make sure your super fund is the right choice for you. Check the company's fee structures, investment strategies, banking and payment processes, as well as its customer service track record.

Check out the video below for a better understanding of the concept of superannuation and the factors to think about when deciding which one is right for you.

Credit: 11MinuteClass : Money.

Please be aware, though, that the information in this video is just meant to serve as general information. You shouldn't take anything here as professional advice on your legal, financial, or investing matters.

For more information that applies to your specific situation, you may want to consult with an attorney, financial advisor, accountant, or other qualified professionals.

That's why when the largest superannuation fund in the country launched a new digital platform in mid-November 2022 that was supposed to make things easier, many were thrilled.

Unfortunately, we all know too well that something can go wrong during major system upgrade, but this horror story is one for the ages, and we can only hope you're not impacted.

Australia's largest superannuation fund, AustralianSuper, boasts close to 3 million members and holds around $258 billion in members' money.

However, two months after initiating system upgrades, customers are still unable to access their accounts, and the superfund has been slammed on social media.

AustralianSuper launched a new digital platform in mid-November that was supposed to make things easier for users. Credit: YouTube/AustralianSuper.

In mid-November, the fund released a new digital platform, including changes to its online member portal and phone app.

But the lack of planning and foresight has left customers high and dry, with many experiencing technical issues, at least four or five unplanned outages, and some being unable to log into their accounts at all.

'I can't understand how the new portal is still not fully working, and members are still unable to access their accounts. How has the CEO still got his job? Absolute debacle,' wrote one angry customer on social media.

People have also complained about long wait times to access any help from the phone lines or web chat.

'We are still unable to access our accounts despite numerous phone calls to Australian Super over the past two months,' another woman shared. 'My son has been trying to register for days now and still cannot do it. He is starting to wonder if he needs to go to someone else for his super as this is way too hard.'

To make matters worse, the 'choice' accounts and the member direct option, which is a self-managed system that allows members to control their own money, appear to have been affected, with many customers being locked out of their accounts without warning.

AustralianSuper later announced that issues impacting some members' ability to log in have been resolved, and they're 'working to resolve the remaining issues as quickly as possible', but revelations of substandard customer service sure put a cloud on things.

A review of superannuation funds released by the Australian Securities and Investments Commission in December also revealed some funds did not have adequate systems in place to manage and resolve disputes, adding fuel to the fire for disgruntled customers.

The importance of data security and privacy for superannuation funds cannot be overstated, especially when substantial amounts of members' money are involved.

Trustees of the funds are legally liable to protect the data of their members from any malicious attacks and security breaches, both on digital and physical platforms.

If you're concerned about your superannuation fund, then maybe it's time to reflect and assess if it's time to make a change. Credit: Pexels/cottonbro studio.

Technology has revolutionised the way members interact with superannuation funds, allowing for unprecedented access to accounts and transactions at the click of a button.

However, this also leaves members vulnerable to data theft and fraud. Such incidents can cost not only members their hard-earned money but also their trust and faith in the superannuation funds.

Through rigorous systems, policies and processes, superannuation funds should be able to guard against external threats, thereby keeping their members' data safe and secure.

If a superannuation fund encounters a major breach of data security, they are obligated to inform its members while also taking all necessary steps to protect their assets and investments.

Key Takeaways

- AustralianSuper, Australia's largest superannuation fund, has been inundated with complaints from customers who are unable to access their online accounts after it was upgraded in mid-November.

- Social media users have expressed frustration with the lack of information from AustralianSuper and long wait times for customer service help.

- AustralianSuper has confirmed that the majority of members are now able to log in and complete transactions, and the company is working fast to remedy the remaining issues.

And if you're looking for a reliable super fund, then it pays to do your research and shop around for one that has all the features you're looking for and supports you in managing your superannuation.

Ask around to make sure your super fund is the right choice for you. Check the company's fee structures, investment strategies, banking and payment processes, as well as its customer service track record.

Check out the video below for a better understanding of the concept of superannuation and the factors to think about when deciding which one is right for you.

Credit: 11MinuteClass : Money.

Please be aware, though, that the information in this video is just meant to serve as general information. You shouldn't take anything here as professional advice on your legal, financial, or investing matters.

For more information that applies to your specific situation, you may want to consult with an attorney, financial advisor, accountant, or other qualified professionals.