Homeowners often feel better about life than renters, but not always – whether you are mortgaged matters

- Replies 5

Homeownership has long been thought of as the great Australian dream. For individuals, it’s seen as the path to adulthood and prosperity. For the nation, it’s seen as a cornerstone of economic and social policy.

Implicit in this is the assumption that owning a home rather than renting one makes people better off.

It’s an assumption we are now able to examine using data from the government-funded Household, Income and Labour Dynamics in Australia (HILDA) survey, which for two decades has asked questions both about homeownership and satisfaction with life.

The overarching question asks

In a study published in the journal Urban Studies, we linked those answers to home ownership and characteristics including age and income.

As expected, we found homeowners were generally more satisfied with their lives than renters. But we also find the extent to which they were more satisfied depended on whether or not they were still paying off a mortgage.

Similarly, outright owners were 2.3 times as likely to report high financial satisfaction as renters – but mortgaged owners were only 1.1 times as likely.

When it comes to satisfaction with their home and neighbourhood, the differences were less extreme.

Outright home owners were 3.1 times as likely to report high satisfaction with their home as renters, while mortgaged owners were 2.8 times as likely.

Outright owners were 1.6 times as likely to report high satisfaction with their neighbourhood as renters, and mortgaged owners 1.4 times as likely.

The results also varied with age and income.

As shown in the graph above, outright owners were more likely to report high financial satisfaction than renters across almost the entire age range.

But mortgaged owners only showed a demonstrably greater financial satisfaction than renters between the ages of 25 and 50.

Beyond age 50, the existence of a mortgage debt burden appeared to cancel out any boost to financial satisfaction from homeownership. This potentially reflects the growing financial stress of making mortgage payments as retirement approaches.

By income, mortgaged owners reported experiencing more financial satisfaction compared to renters the more they earned between A$80,000 and A$240,000. Outright owners experienced more financial satisfaction than renters up to A$320,000.

Beyond these income levels, owners did not have greater financial satisfaction than renters, perhaps because high-earning renters have other sources of financial satisfaction.

This decline might reflect the growing physical burden of maintaining an owned home as people age.

Our study has important implications. One is that age matters.

Although older people consistently express a desire to age in place, we found satisfaction among those who owned vs rented their home declined beyond age 60. This suggests better integration between housing and care is critical to support people ageing in place.

Another implication is that as low-income owners are more reliant on their homes as a source of relative financial satisfaction than high earners, they are more exposed in times of crisis. They may face the risk of being forced to sell suddenly with little time to consider the consequences.

And another implication is as the relative financial satisfaction of mortgage holders disappears after the age of 50, and as more of us approach retirement with mortgages intact, more of us will either postpone retirement or become dissatisfied.

Our findings suggest the extension of mortgage debt into later life should be discouraged if the benefits of the Australian dream are to be preserved.

This article was first published on The Conversation, and was written by, Rachel Ong ViforJ, ARC Future Fellow & Professor of Economics, Curtin University, Hiroaki Suenaga, Senior Lecturer School of Accounting, Economics and Finance, Curtin University, Ryan Brierty, PhD candidate, School of Accounting, Economics and Finance, Curtin University

Implicit in this is the assumption that owning a home rather than renting one makes people better off.

It’s an assumption we are now able to examine using data from the government-funded Household, Income and Labour Dynamics in Australia (HILDA) survey, which for two decades has asked questions both about homeownership and satisfaction with life.

The overarching question asks

We also looked at people’s satisfaction with their financial situation, their home and the neighbourhood in which they live.all things considered, how satisfied are you with your life? Pick a number between 0 and 10 to indicate how satisfied you are

In a study published in the journal Urban Studies, we linked those answers to home ownership and characteristics including age and income.

As expected, we found homeowners were generally more satisfied with their lives than renters. But we also find the extent to which they were more satisfied depended on whether or not they were still paying off a mortgage.

Mortgaged homeowners about as satisfied as renters

Outright home owners were 1.5 times as likely to report high overall satisfaction as renters. But home owners still paying off a mortgage were only a little more likely to feel high overall satisfaction.Similarly, outright owners were 2.3 times as likely to report high financial satisfaction as renters – but mortgaged owners were only 1.1 times as likely.

When it comes to satisfaction with their home and neighbourhood, the differences were less extreme.

Outright home owners were 3.1 times as likely to report high satisfaction with their home as renters, while mortgaged owners were 2.8 times as likely.

Outright owners were 1.6 times as likely to report high satisfaction with their neighbourhood as renters, and mortgaged owners 1.4 times as likely.

The results also varied with age and income.

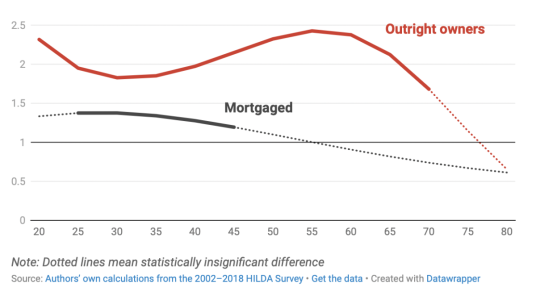

Financial satisfaction relative to renters by age

As shown in the graph above, outright owners were more likely to report high financial satisfaction than renters across almost the entire age range.

But mortgaged owners only showed a demonstrably greater financial satisfaction than renters between the ages of 25 and 50.

Beyond age 50, the existence of a mortgage debt burden appeared to cancel out any boost to financial satisfaction from homeownership. This potentially reflects the growing financial stress of making mortgage payments as retirement approaches.

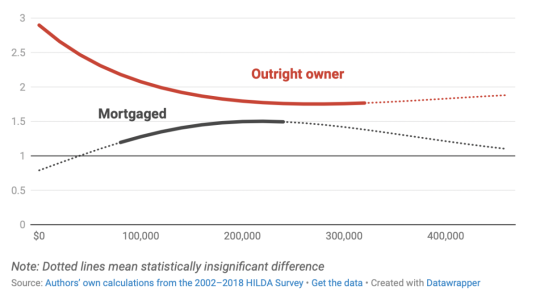

Financial satisfaction relative to renters by income

By income, mortgaged owners reported experiencing more financial satisfaction compared to renters the more they earned between A$80,000 and A$240,000. Outright owners experienced more financial satisfaction than renters up to A$320,000.

Beyond these income levels, owners did not have greater financial satisfaction than renters, perhaps because high-earning renters have other sources of financial satisfaction.

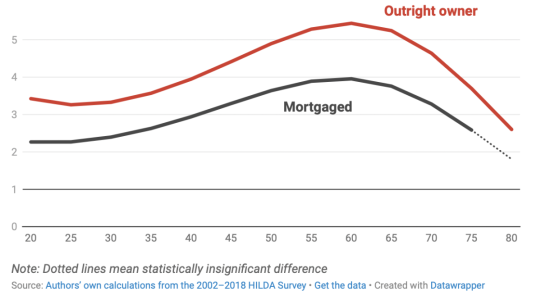

How satisfied people feel beyond 60

In other respects, outright owners and mortgaged homeowners showed similar patterns, becoming more satisfied with their homes relative to renters the more they age up – until the age of 60. That’s when their satisfaction relative to renters declined, as illustrated below.This decline might reflect the growing physical burden of maintaining an owned home as people age.

Satisfaction with home relative to renters by age

Our study has important implications. One is that age matters.

Although older people consistently express a desire to age in place, we found satisfaction among those who owned vs rented their home declined beyond age 60. This suggests better integration between housing and care is critical to support people ageing in place.

Another implication is that as low-income owners are more reliant on their homes as a source of relative financial satisfaction than high earners, they are more exposed in times of crisis. They may face the risk of being forced to sell suddenly with little time to consider the consequences.

And another implication is as the relative financial satisfaction of mortgage holders disappears after the age of 50, and as more of us approach retirement with mortgages intact, more of us will either postpone retirement or become dissatisfied.

Our findings suggest the extension of mortgage debt into later life should be discouraged if the benefits of the Australian dream are to be preserved.

This article was first published on The Conversation, and was written by, Rachel Ong ViforJ, ARC Future Fellow & Professor of Economics, Curtin University, Hiroaki Suenaga, Senior Lecturer School of Accounting, Economics and Finance, Curtin University, Ryan Brierty, PhD candidate, School of Accounting, Economics and Finance, Curtin University