Fury ensues as Optus outage shines light on the risks of a cashless society

Australia's rapid transition towards a cashless society has always been met with a wave of criticism. But following the nationwide Optus outage, which left millions of Aussies unable to make digital transactions, this criticism has turned into outrage.

The incident also ignited a heated debate about the country's readiness to abandon cash entirely, with many arguing that the outage underscores the importance of maintaining a dual system of cash and digital payments.

The Optus network failure, which occurred on November 8, left approximately 10 million users unable to make or receive calls, send texts, or access the internet for over nine hours.

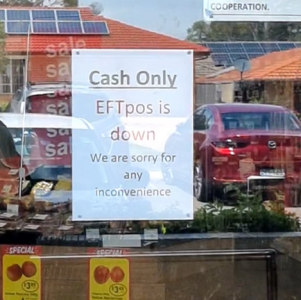

The outage had a domino effect, crippling thousands of businesses across the country that rely on EFTPOS machines for transactions. As a result, customers were forced to revert to cash payments.

The incident has led to criticism of the ongoing reduction of ATMs and bank branches, making it increasingly difficult for consumers to withdraw cash.

A social media user captured the sentiment of many Australians, expressing her frustration outside an IGA store that had put up a 'Cash Only...EFTPOS is down' sign due to the outage.

'The fact this still happens, and yet the Australian government is removing banks and ATMs to make it even harder to get cash out is such a f****d thing to do,' the user said in a video.

'Make society cashless, no, f****ng we need cash,' she added.

The video resonated with thousands of viewers, many of whom agreed that despite the increasing prevalence of electronic transactions, cash remains a necessary fallback option.

'[November 8] proved to everybody that the world is f****d without cash when computer systems have glitches [...] Hackers can fix the problem,' one user commented.

The Optus outage has also drawn attention to the steady decline of ATMs and bank branches in regional parts of Australia.

Data from the Australian Prudential Regulation Authority revealed that 424 bank branches closed in the year to June, and since 2017, 1,600 bank branches have closed across Australia.

Business owners also have the same sentiments towards cashless transactions. Peggy Zaromias, the owner of Nick's Handbags in Bankstown, Sydney, stated that abandoning cash would significantly impact many small and family-run businesses.

'I'm old-school—I still prefer cash, not just business-wise but for everything,' Ms Zaromias shared. 'When they turn around and say, “We're going to go cashless”—well, that's ridiculous. If something like (the Optus crash) happens, then what?'

Despite the backlash, some believe that going cashless is inevitable. Independent Payments Market Expert Lance Blockley estimated that by 2025, traditional cash would make up less than 4 per cent of total retail purchases across the country.

Major banks like the Commonwealth Bank, ANZ, and NAB have already opened cashless branches where customers are directed to ATMs for 'everyday banking'.

While digital transactions offer convenience and efficiency, the reliance on technology exposed consumers and businesses to potential disruptions.

As Australia continues its march towards becoming a cashless society, it's crucial to ensure that adequate safeguards are in place to prevent similar incidents from causing widespread disruption in the future.

What are your thoughts on this issue, members? How were you affected by the Optus outage? Do you believe Australia is ready to go cashless, or do you think cash still has a place in our society? Share your thoughts in the comments below.

The incident also ignited a heated debate about the country's readiness to abandon cash entirely, with many arguing that the outage underscores the importance of maintaining a dual system of cash and digital payments.

The Optus network failure, which occurred on November 8, left approximately 10 million users unable to make or receive calls, send texts, or access the internet for over nine hours.

The outage had a domino effect, crippling thousands of businesses across the country that rely on EFTPOS machines for transactions. As a result, customers were forced to revert to cash payments.

The incident has led to criticism of the ongoing reduction of ATMs and bank branches, making it increasingly difficult for consumers to withdraw cash.

A social media user captured the sentiment of many Australians, expressing her frustration outside an IGA store that had put up a 'Cash Only...EFTPOS is down' sign due to the outage.

'The fact this still happens, and yet the Australian government is removing banks and ATMs to make it even harder to get cash out is such a f****d thing to do,' the user said in a video.

'Make society cashless, no, f****ng we need cash,' she added.

The video resonated with thousands of viewers, many of whom agreed that despite the increasing prevalence of electronic transactions, cash remains a necessary fallback option.

'[November 8] proved to everybody that the world is f****d without cash when computer systems have glitches [...] Hackers can fix the problem,' one user commented.

The Optus outage has also drawn attention to the steady decline of ATMs and bank branches in regional parts of Australia.

Data from the Australian Prudential Regulation Authority revealed that 424 bank branches closed in the year to June, and since 2017, 1,600 bank branches have closed across Australia.

Business owners also have the same sentiments towards cashless transactions. Peggy Zaromias, the owner of Nick's Handbags in Bankstown, Sydney, stated that abandoning cash would significantly impact many small and family-run businesses.

'I'm old-school—I still prefer cash, not just business-wise but for everything,' Ms Zaromias shared. 'When they turn around and say, “We're going to go cashless”—well, that's ridiculous. If something like (the Optus crash) happens, then what?'

Despite the backlash, some believe that going cashless is inevitable. Independent Payments Market Expert Lance Blockley estimated that by 2025, traditional cash would make up less than 4 per cent of total retail purchases across the country.

Major banks like the Commonwealth Bank, ANZ, and NAB have already opened cashless branches where customers are directed to ATMs for 'everyday banking'.

While digital transactions offer convenience and efficiency, the reliance on technology exposed consumers and businesses to potential disruptions.

As Australia continues its march towards becoming a cashless society, it's crucial to ensure that adequate safeguards are in place to prevent similar incidents from causing widespread disruption in the future.

Key Takeaways

- The recent Optus network outage forced many Australians to revert back to cash payments, sparking frustrations about the country's rapid move towards becoming a cashless society.

- The blackout, which affected at least 10 million users for more than nine hours, leaving businesses unable to operate their EFTPOS machines, resulted in Australians expressing their concerns about the reduction of ATMs and bank branches.

- Several online users and business owners opposed a cashless economy, emphasising that cash remains essential for system outages.

- Despite the outage, experts predict that by 2025, traditional cash will make up less than 4 per cent of total retail purchases across the country, with some banks even opening cashless branches.

What are your thoughts on this issue, members? How were you affected by the Optus outage? Do you believe Australia is ready to go cashless, or do you think cash still has a place in our society? Share your thoughts in the comments below.