Discover what big change Woolworths has made to their checkouts–will this affect you?

Are you one of the folks who routinely withdraw cash at Woolworths? We have some news for you.

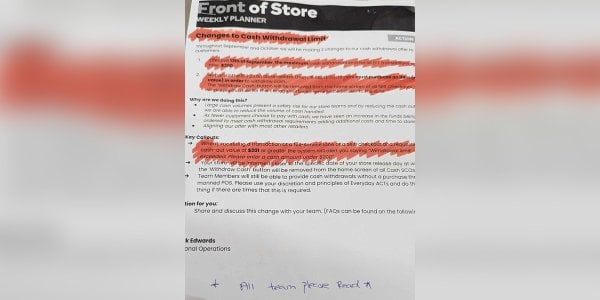

Recently, an internal memo about Woolworths’ cash-withdrawal policies was leaked online, prompting the supermarket to issue a statement confirming some big changes.

The note stated that the cash withdrawal limit is being reduced to $200 per store transaction, a significant drop from their previous limit of $500.

Currently, customers can withdraw money without making a purchase, but the leaked document states that cash withdrawals will only be available for those who bought at the store.

According to reports, the changes will be rolled out over the coming weeks, and all cash withdrawals won’t be possible without a purchase by the end of October.

It’s worth nothing though that in the leaked memo, the stated effectivity of the lowered cash withdrawal limit is September 12.

Offering an explanation for the change, Woolies spokesperson said reducing the amount of cash handled in stores corresponds with customer habits.

'This is due to the lack of cash being used in transactions, with the majority of customers opting for card-only transactions such as Everyday Pay,' the spokesperson stated.

The retailer also assured that they’re not planning on removing cash transactions altogether: ‘We understand cash remains an important payment option for some customers, and that’s why we'll continue to offer the ability to withdraw cash.’

Social media users have mixed reactions to this change. Some will be affected by this new policy, as one user wrote: ‘Oh, that's unfortunate because sometimes I get rent money out from the supermarket.’

‘The worst part of this change is that you are now required to purchase an item to withdraw cash rather than the current system where you don’t need to make a purchase,’ another user pointed out.

On the other hand, some shoppers claimed they don’t have an issue with this. ‘I don't really have any issue with this. They aren't a bank,’ a person commented.

‘Good. It's a grocery store, not a bank,’ another said.

The leaked document also states that keeping large volumes of cash in stores presents a security risk for team members. While the spokesperson didn't elaborate on this aspect of the memo, the retailer recently revealed it is introducing a raft of security measures to combat rampant shoplifting amid the cost-of-living crisis.

It’s not just Woolies under the gun and dealing with increasing retail crime. Coles has also reported 'an increase in theft which is an issue affecting all retailers across Australia and internationally.'

Recently, we reported a Woolies shopper who was denied a cash-out request at the supermarket. Our members shared their thoughts on the retailer’s policy.

Member @JKM_Storyteller wrote: ‘Honestly, I don't think it's fair to expect supermarkets to be treated like a bank where you can rock up and make a cash withdrawal over the counter. And using their checkouts as ATMs? Nah.’

Member @AlanQ pointed out: ‘Just use the self-serve checkout, maybe even buy something, then take out cash. It's a supermarket offering something that is purely for the convenience of THEIR customers, not a substitute for a bank.’

However, other members reiterated the convenience of withdrawing at the supermarket. Member @siameezer said: ‘Post offices are NOT convenient for many, ATMS are NOT always close by, and some banks are NOT allowing cash withdrawals.’

‘I regularly get $200 and sometimes more at the (manned) checkout. It’s a service they offer, and there’s nothing wrong in using it,’ member @Thecheesequeen shared.

What do you think of this story, members? Do you get cash out regularly at Woolworths? Let us know in the comments!

Recently, an internal memo about Woolworths’ cash-withdrawal policies was leaked online, prompting the supermarket to issue a statement confirming some big changes.

The note stated that the cash withdrawal limit is being reduced to $200 per store transaction, a significant drop from their previous limit of $500.

Currently, customers can withdraw money without making a purchase, but the leaked document states that cash withdrawals will only be available for those who bought at the store.

According to reports, the changes will be rolled out over the coming weeks, and all cash withdrawals won’t be possible without a purchase by the end of October.

It’s worth nothing though that in the leaked memo, the stated effectivity of the lowered cash withdrawal limit is September 12.

Offering an explanation for the change, Woolies spokesperson said reducing the amount of cash handled in stores corresponds with customer habits.

'This is due to the lack of cash being used in transactions, with the majority of customers opting for card-only transactions such as Everyday Pay,' the spokesperson stated.

The retailer also assured that they’re not planning on removing cash transactions altogether: ‘We understand cash remains an important payment option for some customers, and that’s why we'll continue to offer the ability to withdraw cash.’

Social media users have mixed reactions to this change. Some will be affected by this new policy, as one user wrote: ‘Oh, that's unfortunate because sometimes I get rent money out from the supermarket.’

‘The worst part of this change is that you are now required to purchase an item to withdraw cash rather than the current system where you don’t need to make a purchase,’ another user pointed out.

On the other hand, some shoppers claimed they don’t have an issue with this. ‘I don't really have any issue with this. They aren't a bank,’ a person commented.

‘Good. It's a grocery store, not a bank,’ another said.

The leaked document also states that keeping large volumes of cash in stores presents a security risk for team members. While the spokesperson didn't elaborate on this aspect of the memo, the retailer recently revealed it is introducing a raft of security measures to combat rampant shoplifting amid the cost-of-living crisis.

It’s not just Woolies under the gun and dealing with increasing retail crime. Coles has also reported 'an increase in theft which is an issue affecting all retailers across Australia and internationally.'

Recently, we reported a Woolies shopper who was denied a cash-out request at the supermarket. Our members shared their thoughts on the retailer’s policy.

Member @JKM_Storyteller wrote: ‘Honestly, I don't think it's fair to expect supermarkets to be treated like a bank where you can rock up and make a cash withdrawal over the counter. And using their checkouts as ATMs? Nah.’

Member @AlanQ pointed out: ‘Just use the self-serve checkout, maybe even buy something, then take out cash. It's a supermarket offering something that is purely for the convenience of THEIR customers, not a substitute for a bank.’

However, other members reiterated the convenience of withdrawing at the supermarket. Member @siameezer said: ‘Post offices are NOT convenient for many, ATMS are NOT always close by, and some banks are NOT allowing cash withdrawals.’

‘I regularly get $200 and sometimes more at the (manned) checkout. It’s a service they offer, and there’s nothing wrong in using it,’ member @Thecheesequeen shared.

Key Takeaways

- Woolworths has changed its cash-withdrawal policies, reducing the withdrawal limit to $200 per transaction.

- Reports say that starting late October, customers can only withdraw cash during a purchase.

- These changes, confirmed by Woolworths, are being implemented due to the majority of customers preferring card transactions.

- Security concerns over maintaining large quantities of cash in stores have instigated various new security measures.

What do you think of this story, members? Do you get cash out regularly at Woolworths? Let us know in the comments!