Customers question Commonwealth Bank transfer policy: ‘This is outrageous’

By

Seia Ibanez

- Replies 10

Commonwealth Bank customers have voiced their exasperation over a policy seemingly infringing on their financial freedom.

A restriction on transferring cryptocurrency has sparked a heated debate, leaving many wondering where the line between customer protection and financial autonomy should be drawn.

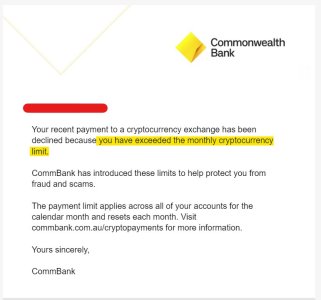

One customer recently ran afoul of these controversial measures when they were barred from completing a transaction.

The bank's justification? A safeguard against potential scammers—a $10,000 monthly limit on transfers to cryptocurrency exchanges.

Introduced last July, the $10,000 cap has been touted as a protective barrier for customers who might become victims of increasingly sophisticated scams in the cryptocurrency domain.

Other major Australian banks, such as National Australia Bank (NAB), Westpac, and ANZ, introduced similar policies last year.

NAB said this measure would stop ‘transactions made to high-risk cryptocurrency exchanges' to save customers from 'a scam epidemic'.

Westpac introduced cryptocurrency payments protection, and ANZ will block payments to ‘high-risk cryptocurrency platforms’.

However, critics are wary of the stifling effect such regulations might have on the burgeoning cryptocurrency trading scene.

An astonished customer was informed about reaching this limit, only to be further frustrated by the bank's stipulation that they would have to wait until the new month commenced to make additional purchases.

The bank's notification prompted an instant uproar online, with customers and social media users denouncing the bank's approach to managing clients' finances.

'This is outrageous. The bank deciding whether you can spend your money or not,' one customer lamented online.

‘Such parenting from bank...which knows "better" how you should and can spend your own money,' another wrote.

'I would close my account immediately.’

However, some supported the bank's decision.

Supporters of the policy cited the threat of cryptocurrency scams and fraud as justification for the bank's vigilant approach, arguing for the necessity of protective measures in a largely unregulated digital financial landscape.

'CommBank has introduced these limits to keep you within our frauds and scams ecosystem,' one wrote.

'If you really want to buy more bitcoin, then do it through our listed bitcoin ETFs [exchange traded funds], it’s so much better than self-custody.’

CommBank has yet to respond to the matter as of writing.

A cryptocurrency exchange permits investors to purchase and sell digital currencies like bitcoin. It operates like a stock exchange, where individuals trade shares in publicly listed companies.

The Australian Competition and Consumer Commission (ACCC) reported that in 2022 alone, Australians fell victim to investment scams, with losses totalling $1.5 billion.

Has a similar banking restriction affected your financial plans? Let us know in the comments below!

Has a similar banking restriction affected your financial plans? Let us know in the comments below!

A restriction on transferring cryptocurrency has sparked a heated debate, leaving many wondering where the line between customer protection and financial autonomy should be drawn.

One customer recently ran afoul of these controversial measures when they were barred from completing a transaction.

The bank's justification? A safeguard against potential scammers—a $10,000 monthly limit on transfers to cryptocurrency exchanges.

A Commonwealth Bank customer was barred from transferring money to a cryptocurrency platform. Credit: @SimplyBitcoinTV / Twitter

Introduced last July, the $10,000 cap has been touted as a protective barrier for customers who might become victims of increasingly sophisticated scams in the cryptocurrency domain.

Other major Australian banks, such as National Australia Bank (NAB), Westpac, and ANZ, introduced similar policies last year.

NAB said this measure would stop ‘transactions made to high-risk cryptocurrency exchanges' to save customers from 'a scam epidemic'.

Westpac introduced cryptocurrency payments protection, and ANZ will block payments to ‘high-risk cryptocurrency platforms’.

However, critics are wary of the stifling effect such regulations might have on the burgeoning cryptocurrency trading scene.

An astonished customer was informed about reaching this limit, only to be further frustrated by the bank's stipulation that they would have to wait until the new month commenced to make additional purchases.

The bank's notification prompted an instant uproar online, with customers and social media users denouncing the bank's approach to managing clients' finances.

'This is outrageous. The bank deciding whether you can spend your money or not,' one customer lamented online.

‘Such parenting from bank...which knows "better" how you should and can spend your own money,' another wrote.

'I would close my account immediately.’

However, some supported the bank's decision.

Supporters of the policy cited the threat of cryptocurrency scams and fraud as justification for the bank's vigilant approach, arguing for the necessity of protective measures in a largely unregulated digital financial landscape.

'CommBank has introduced these limits to keep you within our frauds and scams ecosystem,' one wrote.

'If you really want to buy more bitcoin, then do it through our listed bitcoin ETFs [exchange traded funds], it’s so much better than self-custody.’

CommBank has yet to respond to the matter as of writing.

A cryptocurrency exchange permits investors to purchase and sell digital currencies like bitcoin. It operates like a stock exchange, where individuals trade shares in publicly listed companies.

The Australian Competition and Consumer Commission (ACCC) reported that in 2022 alone, Australians fell victim to investment scams, with losses totalling $1.5 billion.

Key Takeaways

- Commonwealth Bank customers are outraged after a limit was placed on transfers to cryptocurrency exchanges, preventing a customer from making a payment due to a cap.

- The bank has imposed a $10,000 monthly cap on transactions to cryptocurrency exchanges in an effort to protect customers from scams and fraud.

- Social media users have responded with criticism, claiming the bank is overstepping by deciding how customers can use their money.

- Commonwealth Bank, along with other major Australian banks, has introduced these protective measures amidst a rising number of scams associated with cryptocurrency trading.