Cafe's ‘hidden fees’ sparks fury among Aussies: ‘The total was way too steep’

By

Seia Ibanez

- Replies 25

The simple pleasure of enjoying a coffee or a bite to eat at a local cafe is one of life's small joys.

It's a chance to sit back, relax, and indulge in a little treat. But what happens when that treat comes with an unexpected and hefty price tag?

This is the question on many Australians' lips after a recent incident at a Sydney cafe left customers feeling more than just a little short-changed.

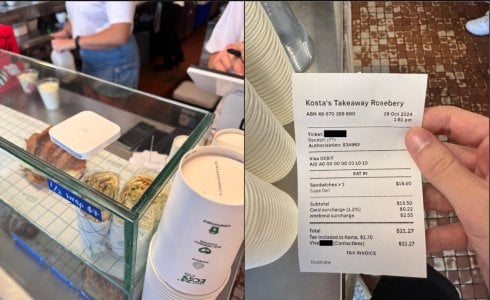

A customer's leisurely visit to a trendy Inner West Sydney eatery turned sour when, after paying for his food, he received a bank notification that revealed a series of 'hidden surcharges' had been added to his bill.

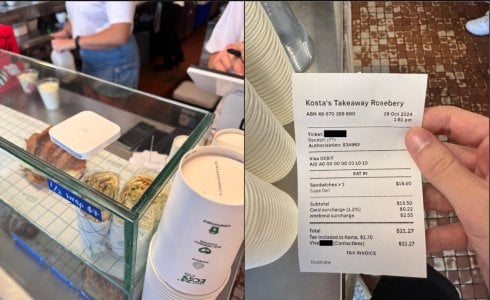

The unsuspecting diner had ordered a sandwich priced at $18.50, but after a 1.2 per cent card surcharge and a weekend surcharge were tacked on, he found himself paying an additional $2.77, bringing his total to a steep $21.27.

The disgruntled customer took to social media to express his outrage, claiming there were no visible signs in the cafe indicating the presence of these extra charges.

It was only after he received the bank notification that he became aware of the surcharges.

He criticised the cafe for its 'sneaky' payment process and also blamed Square Readers, the contactless payment system used, for facilitating this issue.

According to the Reserve Bank of Australia, Australians are losing a staggering $960 million a year in surcharges by using cards over cash.

While Australian retailers are permitted to pass on the cost of card transactions to customers, the Australian Competition and Consumer Commission (ACCC) mandates that these surcharges must not exceed the actual cost incurred by the business and must be clearly displayed to customers.

The rules are clear: for weekend surcharges, venues must prominently display a statement such as 'a surcharge of [percentage] applies on [day or days]' on their menu.

This means all venues must clearly display any surcharges, and ‘hidden fees’ are deemed illegal.

However, despite these regulations, the customer claimed that there was no signage about surcharges on the menu, display board, or at the cashier, and there was no forward-facing screen showing the total amount being charged.

He said he was ‘surprised’ to be charged extra because ‘the menu price is high, but the total was way too steep’.

When he returned to the café to ask about his bill, an employee mentioned the weekend surcharge.

The man's social media post, which included photos of the menu and point-of-sale area, has since garnered support from hundreds of other individuals who shared his frustration.

One person told him to file a complaint with the ACCC as ‘the more data and complaints we give, the better they can do their job and get an understanding of what’s happening’.

Others also urged him to complain to NSW Fair Trading, the local council, and the business owner and to leave a Google review to warn potential customers.

‘This is too common nowadays. Staff don’t say how much the transaction costs and just point to the Square,’ one person commented.

Another said that was ‘why I’ve reverted to cash’, while another called hidden surcharges a ‘systemic’ issue.

Have you experienced similar issues with hidden fees at cafes or restaurants? How do you ensure you're getting what you pay for? Share your stories and tips in the comments below!

Have you experienced similar issues with hidden fees at cafes or restaurants? How do you ensure you're getting what you pay for? Share your stories and tips in the comments below!

It's a chance to sit back, relax, and indulge in a little treat. But what happens when that treat comes with an unexpected and hefty price tag?

This is the question on many Australians' lips after a recent incident at a Sydney cafe left customers feeling more than just a little short-changed.

A customer's leisurely visit to a trendy Inner West Sydney eatery turned sour when, after paying for his food, he received a bank notification that revealed a series of 'hidden surcharges' had been added to his bill.

The unsuspecting diner had ordered a sandwich priced at $18.50, but after a 1.2 per cent card surcharge and a weekend surcharge were tacked on, he found himself paying an additional $2.77, bringing his total to a steep $21.27.

A customer was surprised that he paid an additional $2.77 from his bill. Credit: u/shane_957 / Reddit

The disgruntled customer took to social media to express his outrage, claiming there were no visible signs in the cafe indicating the presence of these extra charges.

It was only after he received the bank notification that he became aware of the surcharges.

He criticised the cafe for its 'sneaky' payment process and also blamed Square Readers, the contactless payment system used, for facilitating this issue.

According to the Reserve Bank of Australia, Australians are losing a staggering $960 million a year in surcharges by using cards over cash.

While Australian retailers are permitted to pass on the cost of card transactions to customers, the Australian Competition and Consumer Commission (ACCC) mandates that these surcharges must not exceed the actual cost incurred by the business and must be clearly displayed to customers.

The rules are clear: for weekend surcharges, venues must prominently display a statement such as 'a surcharge of [percentage] applies on [day or days]' on their menu.

This means all venues must clearly display any surcharges, and ‘hidden fees’ are deemed illegal.

However, despite these regulations, the customer claimed that there was no signage about surcharges on the menu, display board, or at the cashier, and there was no forward-facing screen showing the total amount being charged.

He said he was ‘surprised’ to be charged extra because ‘the menu price is high, but the total was way too steep’.

When he returned to the café to ask about his bill, an employee mentioned the weekend surcharge.

The man's social media post, which included photos of the menu and point-of-sale area, has since garnered support from hundreds of other individuals who shared his frustration.

One person told him to file a complaint with the ACCC as ‘the more data and complaints we give, the better they can do their job and get an understanding of what’s happening’.

Others also urged him to complain to NSW Fair Trading, the local council, and the business owner and to leave a Google review to warn potential customers.

‘This is too common nowadays. Staff don’t say how much the transaction costs and just point to the Square,’ one person commented.

Another said that was ‘why I’ve reverted to cash’, while another called hidden surcharges a ‘systemic’ issue.

Key Takeaways

- A customer voiced his frustration on social media after encountering hidden surcharges at a Sydney cafe with no signage indicating the extra fees.

- The diner was charged a 1.2 per cent card surcharge and a weekend surcharge, totalling an additional $2.77 on his already expensive sandwich.

- According to ACCC regulations, businesses must clearly display any surcharges, but the customer claimed there was no such signage at the cafe.

- The customer's post on social media led others to advise him to lodge complaints with the ACCC and NSW Fair Trading and to inform others through a Google review.