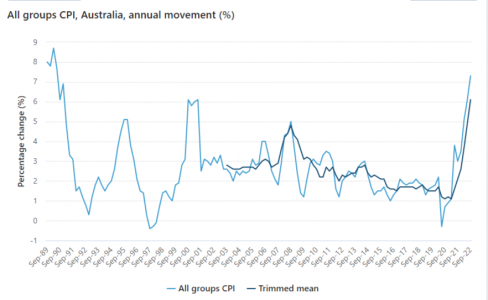

Brace yourselves, the RBA announced CPI hit a 32-year high

By

- Replies 5

The cost of living is set to rise by as much as 58 per cent in the coming year, according to recent projections from the federal government.

The government stated in its 2022 Federal Budget that pensions will continue to provide financially vulnerable Australians with an income safety net in the future.

However, they acknowledged that the cost of living is rising and pledged to consult with state and territory governments and pensioners on these issues.

The forecast Consumer Price Index (CPI) for the fourth quarter of 2022 is projected to reach 7.3 per cent — the highest rate in 32 years.

According to the Australian Bureau of Statistics (ABS), the past four quarters have seen strong quarterly rises off the back of higher prices for new dwelling construction, petrol and food.

It should be noted that the quarterly CPI is the country's key measure of inflation and it usually dictates the prices of commodities for specific trading periods.

Keeping this in mind, the data suggested that annual price increases for fruit and vegetables reached 16.2 per cent over the same period, while dairy prices increased by 12.1 per cent.

In contrast, the cost of fuel fell substantially during the same period, with petrol prices dropping by as much as 18 per cent. For the first time in two years, motorists saw prices decrease. Not that it lasted for long…

It should be noted that the federal government's decision to restore the fuel excise to 46 cents per litre, up from 22 cents per litre, will contribute to the upcoming increase in December prices.

The quarterly CPI rose 1.8 per cent, according to statistics released by the ABS.

The video summarises how raising the interest rate could affect inflation. Credit: YouTube/The Economist

A little more than three-quarters (76.1 per cent) of the 7.3 per cent increase in the CPI over the past year was accounted for by non-discretionary inflation, which includes goods and services that households are less likely to reduce their consumption of. This is due to high freight costs, supply limitations, and persistent high demand.

With things already looking bleak, there is one silver lining: working pensioners will be able to earn an extra $4,000 before their payments are reduced.

However, given the huge price increases we’ve seen recently, even a few thousand dollars could soon prove to be inadequate to cover the cost of living.

With inflation this high, it's only a matter of time before the Reserve Bank raises interest rates in an effort to combat the downward pressure on the Australian dollar.

It will be a double-edged sword for most Australians, who have a lot more debt than they did three years ago.

On the one hand, higher interest rates will make it more expensive to borrow money; on the other, they will cushion the currency, making imports more costly, which will slow the inflation rate and help drive down living costs.

One user asked: 'Surely it will go down in a couple of years right? that should offset the increase for this coming year (I'm just guessing, hopefully, someone knows based on historical indexations).'

However, another replied saying: 'it won't ever "offset" the increase this year. The CPI increase will be less in future, but that just means the number is growing, just by lesser amounts.'

Another pointed out: 'That says it all: "Non-discretionary annual inflation increased to 8.4 per cent in the September quarter, up from 7.6 per cent in the June quarter. This continues to be well above Discretionary annual inflation of 5.5 per cent.” Heaps of “non-discretionary money” hanging around still.'

Another said: 'It's almost like the RBA and Federal Gov grossly grossly grossly enriched the asset class during COVID and all these newly printed millionaire Aussies have plenty of cash to spend. No one could have predicted this!'

'Every single group went up dramatically and this is going to continue for many months or years. Wake up call for the RBA,' a third added.

What does this all mean?

Prices of essentials are still rising and while inflation is set to peak at the end of this financial year, not much help is in place for pensioners until then.

In somewhat good news, the Energy Ministers are meeting to discuss a potential price cap that would stop the expected 50 per cent increase. We'll provide information on this once it's available.

We encourage our members to check out the Money Saving Hacks section of the SDC website to stay on top of the latest tips on how to minimise spending.

What do you think, folks? Do you believe interest rates will be raised again in the near future? Will they actually make a difference? Better yet, did you also experience a rise in the price of your daily essentials? Let us know in the comments section below!

The government stated in its 2022 Federal Budget that pensions will continue to provide financially vulnerable Australians with an income safety net in the future.

However, they acknowledged that the cost of living is rising and pledged to consult with state and territory governments and pensioners on these issues.

The forecast Consumer Price Index (CPI) for the fourth quarter of 2022 is projected to reach 7.3 per cent — the highest rate in 32 years.

According to the Australian Bureau of Statistics (ABS), the past four quarters have seen strong quarterly rises off the back of higher prices for new dwelling construction, petrol and food.

It should be noted that the quarterly CPI is the country's key measure of inflation and it usually dictates the prices of commodities for specific trading periods.

Keeping this in mind, the data suggested that annual price increases for fruit and vegetables reached 16.2 per cent over the same period, while dairy prices increased by 12.1 per cent.

In contrast, the cost of fuel fell substantially during the same period, with petrol prices dropping by as much as 18 per cent. For the first time in two years, motorists saw prices decrease. Not that it lasted for long…

It should be noted that the federal government's decision to restore the fuel excise to 46 cents per litre, up from 22 cents per litre, will contribute to the upcoming increase in December prices.

The quarterly CPI rose 1.8 per cent, according to statistics released by the ABS.

The video summarises how raising the interest rate could affect inflation. Credit: YouTube/The Economist

A little more than three-quarters (76.1 per cent) of the 7.3 per cent increase in the CPI over the past year was accounted for by non-discretionary inflation, which includes goods and services that households are less likely to reduce their consumption of. This is due to high freight costs, supply limitations, and persistent high demand.

With things already looking bleak, there is one silver lining: working pensioners will be able to earn an extra $4,000 before their payments are reduced.

However, given the huge price increases we’ve seen recently, even a few thousand dollars could soon prove to be inadequate to cover the cost of living.

With inflation this high, it's only a matter of time before the Reserve Bank raises interest rates in an effort to combat the downward pressure on the Australian dollar.

It will be a double-edged sword for most Australians, who have a lot more debt than they did three years ago.

On the one hand, higher interest rates will make it more expensive to borrow money; on the other, they will cushion the currency, making imports more costly, which will slow the inflation rate and help drive down living costs.

Key Takeaways

- Inflation is on the rise in Australia, hitting a 32-year high.

- The budget is not great news for pensioners in terms of cost of living, with prices expected to increase by up to 58 per cent in the coming year.

- The most significant price rises were seen in new dwelling purchases, gas and electricity.

One user asked: 'Surely it will go down in a couple of years right? that should offset the increase for this coming year (I'm just guessing, hopefully, someone knows based on historical indexations).'

However, another replied saying: 'it won't ever "offset" the increase this year. The CPI increase will be less in future, but that just means the number is growing, just by lesser amounts.'

Another pointed out: 'That says it all: "Non-discretionary annual inflation increased to 8.4 per cent in the September quarter, up from 7.6 per cent in the June quarter. This continues to be well above Discretionary annual inflation of 5.5 per cent.” Heaps of “non-discretionary money” hanging around still.'

Another said: 'It's almost like the RBA and Federal Gov grossly grossly grossly enriched the asset class during COVID and all these newly printed millionaire Aussies have plenty of cash to spend. No one could have predicted this!'

'Every single group went up dramatically and this is going to continue for many months or years. Wake up call for the RBA,' a third added.

What does this all mean?

Prices of essentials are still rising and while inflation is set to peak at the end of this financial year, not much help is in place for pensioners until then.

In somewhat good news, the Energy Ministers are meeting to discuss a potential price cap that would stop the expected 50 per cent increase. We'll provide information on this once it's available.

We encourage our members to check out the Money Saving Hacks section of the SDC website to stay on top of the latest tips on how to minimise spending.

What do you think, folks? Do you believe interest rates will be raised again in the near future? Will they actually make a difference? Better yet, did you also experience a rise in the price of your daily essentials? Let us know in the comments section below!

Last edited by a moderator: