Boost your savings while staying on top of finances with Thriday's latest offering!

By

Danielle F.

- Replies 2

Here’s one for anyone hustling to bring in some extra cash!

With the costs of essentials always on the rise, we’re all looking for ways to be financially stable*.

Traditional savings accounts and term deposits often come with limits, which can stop you from reaching your money goals*.

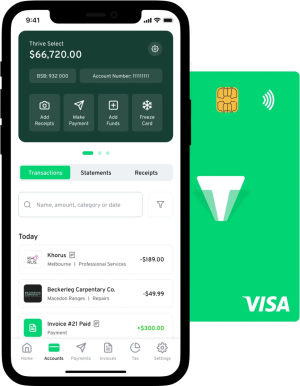

However, one online banking app* wants to change how Aussie business owners stay on top of their finances*, all while providing more value for money*!

In partnership with the Regional Australia Bank, Thriday* is introducing a new interest savings account with a competitive 3.35% p.a.* interest rate*!

This new offering is perfect for small business owners* who want to earn more from their funds. Whether you run a brick-and-mortar store, or market stall, or earn some extra cash doing something more freelance like Uber driving, Thriday wants to help!

Thriday's innovative solution* offers a seamless way to earn interest on your business transaction account balances.

Thriday's 3.35% p.a.* interest rate* applies to all funds stored in Thriday accounts, including money allocated into their Visa Debit card.

Whether you're saving for a rainy day or retirement*, setting aside money for bills*, or ready to splurge for your grandchildren*, your funds stored in Thriday will be working for you!

Thriday takes the hassle out of banking*, accounting*, and filing taxes*—making it an easy, all-in-one financial tool*.

Thriday CEO and co-founder Michael Nuciforo emphasised the significance of this new feature.

'Our new interest feature* makes it easier and faster for small businesses to try and make a profit*. Every bit of extra money can make a big difference* in today's economic climate. We are committed to providing our customers with the best tools to help them succeed*.'

Thriday users* have already reaped the benefits of keeping their funds* in a digital bank.

'Earning 3.35% interest across all my accounts* is effortless and incredibly beneficial for my cash flow management,' Lauren Deuble, a customer, shared.

'With the amount of money I have coming into my accounts and the money I set aside for tax, the interest more than pays for my Thriday subscription*!'

If you want to optimise your business savings and streamline your finances*, Thriday's new interest savings account* is a compelling option you should check out.

With no restrictive terms and a robust interest rate*, your money will definitely work for you as you invest back into your business or goals.

Time to boost your savings—visit Thriday’s* website now to learn more about its financial management tools and hop on to a journey to meet your financial goals*.

*Interest rates are current as of 1 August 2024 and are subject to change. T&Cs apply.

**Please note, members, that this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission when you click on a link—at no cost to you! We do this to assist with the costs of running the SDC. Thank you!

With the costs of essentials always on the rise, we’re all looking for ways to be financially stable*.

Traditional savings accounts and term deposits often come with limits, which can stop you from reaching your money goals*.

However, one online banking app* wants to change how Aussie business owners stay on top of their finances*, all while providing more value for money*!

In partnership with the Regional Australia Bank, Thriday* is introducing a new interest savings account with a competitive 3.35% p.a.* interest rate*!

This new offering is perfect for small business owners* who want to earn more from their funds. Whether you run a brick-and-mortar store, or market stall, or earn some extra cash doing something more freelance like Uber driving, Thriday wants to help!

Thriday's innovative solution* offers a seamless way to earn interest on your business transaction account balances.

Thriday's 3.35% p.a.* interest rate* applies to all funds stored in Thriday accounts, including money allocated into their Visa Debit card.

Whether you're saving for a rainy day or retirement*, setting aside money for bills*, or ready to splurge for your grandchildren*, your funds stored in Thriday will be working for you!

Thriday takes the hassle out of banking*, accounting*, and filing taxes*—making it an easy, all-in-one financial tool*.

Thriday CEO and co-founder Michael Nuciforo emphasised the significance of this new feature.

'Our new interest feature* makes it easier and faster for small businesses to try and make a profit*. Every bit of extra money can make a big difference* in today's economic climate. We are committed to providing our customers with the best tools to help them succeed*.'

Thriday users* have already reaped the benefits of keeping their funds* in a digital bank.

'Earning 3.35% interest across all my accounts* is effortless and incredibly beneficial for my cash flow management,' Lauren Deuble, a customer, shared.

'With the amount of money I have coming into my accounts and the money I set aside for tax, the interest more than pays for my Thriday subscription*!'

If you want to optimise your business savings and streamline your finances*, Thriday's new interest savings account* is a compelling option you should check out.

With no restrictive terms and a robust interest rate*, your money will definitely work for you as you invest back into your business or goals.

Time to boost your savings—visit Thriday’s* website now to learn more about its financial management tools and hop on to a journey to meet your financial goals*.

*Interest rates are current as of 1 August 2024 and are subject to change. T&Cs apply.

**Please note, members, that this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission when you click on a link—at no cost to you! We do this to assist with the costs of running the SDC. Thank you!