Ben Fordham's ‘embarrassing’ scam discovery: ‘I swear I have not spent any money with OnlyFans’

- Replies 21

When it comes to managing our finances, we all like to think we're on top of things.

However, as a well-known radio host recently discovered, even the most diligent can fall prey to scammers' sneaky tactics.

Their experience serves as a cautionary tale for all of us, especially those of us who have been around the block a few times and might think we're too savvy to be caught out.

Australian radio host Ben Fordham's ‘embarrassing’ discovery occurred when he visited his local Commonwealth Bank branch to close the accounts linked to his and his wife's travel cards.

He intended to transfer any remaining funds back to his regular bank account—a sensible move to consolidate his finances.

However, what should have been a straightforward transaction took a turn for the awkward when the bank clerk pulled up his account details.

To Fordham's shock, ‘OnlyFans’—a platform known for its adult content subscription services—was listed in the transaction history.

Imagine the scene: there you are, in the middle of a busy bank, with a transaction on your statement that's enough to raise an eyebrow or two.

Fordham recounted the uncomfortable moment on air, ‘I had this embarrassing conversation with the gentleman behind the counter…he was pretending he didn't see it.’

‘It was an uncomfortable moment where I said to him, “Look, I'm sure you hear this all the time, but I swear I have not spent any money with OnlyFans.”’

Thankfully, the bank employee quickly clarified that Fordham had been targeted by a scammer.

The transaction history revealed that US$50 had been siphoned off to ‘OnlyFans.com’ and then curiously returned to the account minutes later.

This rapid reversal was the bank's doing, recognising the fraudulent activity and nipping it in the bud.

Commonwealth Bank CEO Matt Comyn described the incident as a ‘garden variety fraud’.

‘Hopefully, it wasn't too awkward or embarrassing for you,’ Mr Comyn told Fordham.

‘In this case, you as the account holder had no involvement in that actual transaction as it was undertaken by another third party. That's an easier problem to deal with because you had nothing to do with it.’

‘You're covered by our fraud guarantee, which is our ability to reverse and give you back all of your funds,’ he added.

Fordham expressed his gratitude to the Commonwealth Bank for quickly identifying the fraud and reversing the charges.

He then advised his listeners to stay vigilant and regularly check their travel cards, as these are often overlooked after returning from trips.

Mr Comyn concurred, noting that fraudsters often target these accounts because they are infrequently monitored.

‘Unfortunately, we all need to be really alert to all sorts of different types of frauds and scams,’ he advised.

Mr Comyn mentioned that the Commonwealth Bank would be hosting around 800 seminars over the next 12 months to educate customers on recognising frauds and scams.

According to the Australian Competition & Consumer Commission's ScamWatch, Australians have already lost over $208.2 million to scams this year.

In the wake of controversy over an erroneous transaction involving high-profile personalities like Ben Fordham, Commonwealth Bank has faced backlash for what many are calling a ‘dodgy’ payment error.

This comes as a larger issue for the bank, with numerous customers reporting similar unexpected debits from their accounts. Amid these concerns, the bank is now making efforts to rectify the situation and restore trust with its customers.

This follows another apology issued by the Commonwealth Bank, acknowledging a significant blunder that has affected several accounts.

The ongoing issue highlights growing frustrations from account holders, especially older Australians, who are increasingly voicing concerns about how such mishaps impact their financial security and trust in banking institutions.

Members, have you ever had a similar experience with unexpected transactions popping up on your account? How did you handle it, and what advice would you give to others to protect themselves? Share your stories and tips in the comments below, and let's help each other stay one step ahead of the scammers.

Members, have you ever had a similar experience with unexpected transactions popping up on your account? How did you handle it, and what advice would you give to others to protect themselves? Share your stories and tips in the comments below, and let's help each other stay one step ahead of the scammers.

However, as a well-known radio host recently discovered, even the most diligent can fall prey to scammers' sneaky tactics.

Their experience serves as a cautionary tale for all of us, especially those of us who have been around the block a few times and might think we're too savvy to be caught out.

Australian radio host Ben Fordham's ‘embarrassing’ discovery occurred when he visited his local Commonwealth Bank branch to close the accounts linked to his and his wife's travel cards.

He intended to transfer any remaining funds back to his regular bank account—a sensible move to consolidate his finances.

However, what should have been a straightforward transaction took a turn for the awkward when the bank clerk pulled up his account details.

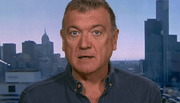

Radio host Ben Fordham had an awkward moment at Commonwealth Bank when he noticed an ‘OnlyFans’ transaction on his travel card. Credit: Facebook / Ben Fordham

To Fordham's shock, ‘OnlyFans’—a platform known for its adult content subscription services—was listed in the transaction history.

Imagine the scene: there you are, in the middle of a busy bank, with a transaction on your statement that's enough to raise an eyebrow or two.

Fordham recounted the uncomfortable moment on air, ‘I had this embarrassing conversation with the gentleman behind the counter…he was pretending he didn't see it.’

‘It was an uncomfortable moment where I said to him, “Look, I'm sure you hear this all the time, but I swear I have not spent any money with OnlyFans.”’

Thankfully, the bank employee quickly clarified that Fordham had been targeted by a scammer.

The transaction history revealed that US$50 had been siphoned off to ‘OnlyFans.com’ and then curiously returned to the account minutes later.

This rapid reversal was the bank's doing, recognising the fraudulent activity and nipping it in the bud.

Commonwealth Bank CEO Matt Comyn described the incident as a ‘garden variety fraud’.

‘Hopefully, it wasn't too awkward or embarrassing for you,’ Mr Comyn told Fordham.

‘In this case, you as the account holder had no involvement in that actual transaction as it was undertaken by another third party. That's an easier problem to deal with because you had nothing to do with it.’

‘You're covered by our fraud guarantee, which is our ability to reverse and give you back all of your funds,’ he added.

Fordham expressed his gratitude to the Commonwealth Bank for quickly identifying the fraud and reversing the charges.

He then advised his listeners to stay vigilant and regularly check their travel cards, as these are often overlooked after returning from trips.

Mr Comyn concurred, noting that fraudsters often target these accounts because they are infrequently monitored.

‘Unfortunately, we all need to be really alert to all sorts of different types of frauds and scams,’ he advised.

Mr Comyn mentioned that the Commonwealth Bank would be hosting around 800 seminars over the next 12 months to educate customers on recognising frauds and scams.

According to the Australian Competition & Consumer Commission's ScamWatch, Australians have already lost over $208.2 million to scams this year.

In the wake of controversy over an erroneous transaction involving high-profile personalities like Ben Fordham, Commonwealth Bank has faced backlash for what many are calling a ‘dodgy’ payment error.

This comes as a larger issue for the bank, with numerous customers reporting similar unexpected debits from their accounts. Amid these concerns, the bank is now making efforts to rectify the situation and restore trust with its customers.

This follows another apology issued by the Commonwealth Bank, acknowledging a significant blunder that has affected several accounts.

The ongoing issue highlights growing frustrations from account holders, especially older Australians, who are increasingly voicing concerns about how such mishaps impact their financial security and trust in banking institutions.

Key Takeaways

- Radio host Ben Fordham experienced an embarrassing moment at a Commonwealth Bank branch when he discovered a transaction for ‘OnlyFans’ on his travel card account.

- The bank employee and Commonwealth Bank CEO Matt Comyn assured Fordham the suspicious transaction was the result of a scam and had been quickly reversed by the bank.

- Fordham was reassured by the bank's fraud guarantee, which ensured that any lost funds due to fraud would be reimbursed.

- Matt Comyn highlighted the importance of regular account monitoring to prevent fraud and mentioned Commonwealth Bank's initiative of running educational seminars on fraud and scams for its customers.