Australian Seniors Vote to Tax the Rich!

- Replies 12

Last Sunday, we posed yet another controversial question:

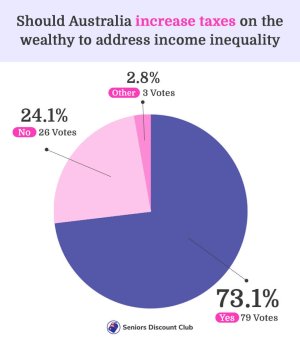

‘Should Australia increase taxes on the wealthy to address income inequality?’

Here’s what you had to say.

*drum roll please*

With 79 votes and a whopping 73.1%, the majority of SDC members who cast their vote believe Australia SHOULD increase taxes on the wealthy to address income inequality.

On the flip side, 26 SDC members voted ‘No’, making up 24.1% of poll respondents.

We also received 3 votes for ‘Other’, making up 2.8% of respondents. These SDC members chose to explain their thoughts in the comments instead.

Shall we dive into the comments? There are some juicy ones!

Yes

Member @mazzie08: ‘YES When they have the money to pay more tax, they can afford to do so and take up the slack that the “poor and struggling people” cannot afford to. It is like robbing the poor to give to the rich. YES YES YES’

Member @Ducky 2: ‘The problem is a lot of rich people don’t pay tax. They are able to avoid it by sending money to tax havens or family trusts this needs to be investigated and they make their money off the general population so yes, they should be taxed at a higher rate.’

Member @G. A. Ridd: ‘I believe the majority of working folk work hard, regardless of their type of job and education. All those who are successful and make a lot of money haven't done it entirely on their own as there are people who work for them, around them, beside them. "The little people" who are doing their jobs, whatever those jobs may be. And then there's also being there at the right time. It's only fair they are taxed more and any loopholes should be closed.’

Interestingly, while the ‘yes’ votes came out on top, they made up the minority of comments.

No

On the other hand, those against increasing taxes on the wealthy were vocal in the comments and shared their reasoning.

Member @Mr Chips: ‘We should actually be reducing taxes for the wealthy. When I say wealthy I mean the young entrepreneurs who are challenging themselves to be successful. Not the "old money" families who are kind and generous anyhow. We need them. We are a country that relies on the entrepreneurial activities of individuals to guide our economy.’

Member @Philpy: ‘The last I heard we live in a Free Enterprise Economy, the more you put in the more you are rewarded. You don’t penalise incentive!’

Member @Suzanne rose: ‘My thoughts are why should a person on high income have to pay more tax than someone on a low income?’

‘What I feel needs to be done and implemented is the rich people need to pay tax. The government needs to look at how they are getting out of paying tax and fix any loopholes that allow this.’

Member @Flyfox: ‘Let's not forget there are many rich people who do so much good but very quietly. If they are taxed more will they stop giving? The criminal element of being rich must somehow be stopped, But to punish those who worked hard for what they have seems very unfair.’

Member @I’m Mal: ‘I am by no means rich but I do not believe for one millisecond that those who are rich should pay extra tax. Sure there are CEOs such as the Qantas boss who are paid many orders of magnitude more than they are worth but there are also a great many more who worked very hard to build a very healthy self-funded retirement nest egg who should not be punished for their efforts. They have already paid extra tax on their Superannuation and now there is an expectation that they will pay tax again. Is this not double dipping? I am not at all surprised that there are so many yes votes in this poll. There seems to be an innate jealousy and even hatred toward the wealthy in Australia. The rich are not the enemy and being rich is not some kind of evil. Far too many people are so green with envy of the rich and constantly appear to want to drag them down. For those who treat rich people with contempt, why do you feel the need to do that? Are you just jealous that you are not rich? This attitude of "you are rich so you can afford to pay more tax" is nothing more than self-entitlement. Unless wealth is accumulated by crime or ill-gotten gain, it is not some kind of sin that must be atoned for by being taxed yet again.’

Other

Member @Roscoe44: ‘Before you tax people, Businesses should be taxed on their annual turnover instead of what they currently claim on after-tax income. They get too many opportunities to shuffle money elsewhere but with what I see to be corrupt Governments, this will never happen.’

It seems there is one thing SDC members can agree on, there needs to be work done to improve the tax loopholes.

Interested in reading more? You can find the poll and full comment section here. The comment section is one of the most interesting things I’ve read all week with some fantastic points being made. I wish I could have included them all here but I highly recommend you peruse them with a cuppa.

Be sure to keep your eyes peeled for the next question and don’t forget to have your say!

‘Should Australia increase taxes on the wealthy to address income inequality?’

Here’s what you had to say.

*drum roll please*

With 79 votes and a whopping 73.1%, the majority of SDC members who cast their vote believe Australia SHOULD increase taxes on the wealthy to address income inequality.

On the flip side, 26 SDC members voted ‘No’, making up 24.1% of poll respondents.

We also received 3 votes for ‘Other’, making up 2.8% of respondents. These SDC members chose to explain their thoughts in the comments instead.

Shall we dive into the comments? There are some juicy ones!

Yes

Member @mazzie08: ‘YES When they have the money to pay more tax, they can afford to do so and take up the slack that the “poor and struggling people” cannot afford to. It is like robbing the poor to give to the rich. YES YES YES’

Member @Ducky 2: ‘The problem is a lot of rich people don’t pay tax. They are able to avoid it by sending money to tax havens or family trusts this needs to be investigated and they make their money off the general population so yes, they should be taxed at a higher rate.’

Member @G. A. Ridd: ‘I believe the majority of working folk work hard, regardless of their type of job and education. All those who are successful and make a lot of money haven't done it entirely on their own as there are people who work for them, around them, beside them. "The little people" who are doing their jobs, whatever those jobs may be. And then there's also being there at the right time. It's only fair they are taxed more and any loopholes should be closed.’

Interestingly, while the ‘yes’ votes came out on top, they made up the minority of comments.

No

On the other hand, those against increasing taxes on the wealthy were vocal in the comments and shared their reasoning.

Member @Mr Chips: ‘We should actually be reducing taxes for the wealthy. When I say wealthy I mean the young entrepreneurs who are challenging themselves to be successful. Not the "old money" families who are kind and generous anyhow. We need them. We are a country that relies on the entrepreneurial activities of individuals to guide our economy.’

Member @Philpy: ‘The last I heard we live in a Free Enterprise Economy, the more you put in the more you are rewarded. You don’t penalise incentive!’

Member @Suzanne rose: ‘My thoughts are why should a person on high income have to pay more tax than someone on a low income?’

‘What I feel needs to be done and implemented is the rich people need to pay tax. The government needs to look at how they are getting out of paying tax and fix any loopholes that allow this.’

Member @Flyfox: ‘Let's not forget there are many rich people who do so much good but very quietly. If they are taxed more will they stop giving? The criminal element of being rich must somehow be stopped, But to punish those who worked hard for what they have seems very unfair.’

Member @I’m Mal: ‘I am by no means rich but I do not believe for one millisecond that those who are rich should pay extra tax. Sure there are CEOs such as the Qantas boss who are paid many orders of magnitude more than they are worth but there are also a great many more who worked very hard to build a very healthy self-funded retirement nest egg who should not be punished for their efforts. They have already paid extra tax on their Superannuation and now there is an expectation that they will pay tax again. Is this not double dipping? I am not at all surprised that there are so many yes votes in this poll. There seems to be an innate jealousy and even hatred toward the wealthy in Australia. The rich are not the enemy and being rich is not some kind of evil. Far too many people are so green with envy of the rich and constantly appear to want to drag them down. For those who treat rich people with contempt, why do you feel the need to do that? Are you just jealous that you are not rich? This attitude of "you are rich so you can afford to pay more tax" is nothing more than self-entitlement. Unless wealth is accumulated by crime or ill-gotten gain, it is not some kind of sin that must be atoned for by being taxed yet again.’

Other

Member @Roscoe44: ‘Before you tax people, Businesses should be taxed on their annual turnover instead of what they currently claim on after-tax income. They get too many opportunities to shuffle money elsewhere but with what I see to be corrupt Governments, this will never happen.’

It seems there is one thing SDC members can agree on, there needs to be work done to improve the tax loopholes.

Interested in reading more? You can find the poll and full comment section here. The comment section is one of the most interesting things I’ve read all week with some fantastic points being made. I wish I could have included them all here but I highly recommend you peruse them with a cuppa.

Be sure to keep your eyes peeled for the next question and don’t forget to have your say!