Australia’s biggest chemist is merging with a giant wholesaler. Could we soon be paying more?

- Replies 10

Dr. Victor Wong/Shutterstock

Corporate Australia loves a big merger. And amid a growing flurry of them across the business scene, a new blockbuster has emerged.

All eyes are on two titans of the pharmacy industry – Chemist Warehouse and Sigma Healthcare. They are poised to join forces under an A$8.8 billion deal, which could radically reshape the way Australians access medication and other health products.

Mergers can lower business operating costs and make companies more efficient. But reduced competition in any sector typically leads to higher prices for consumers.

What could this deal by “Australia’s cheapest chemist” mean for everyday Australians and their wallets?

An unmatched pharmacy giant

If the proposed merger goes ahead, the new entity will be enormous – far bigger than any of its individual competitors.

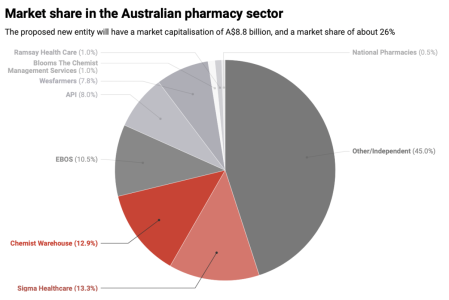

It will combine the market power of about 600 existing Chemist Warehouse outlets with more than 1,200 pharmacies currently aligned to Sigma as a wholesaler, giving it more than 26% market share.

Sigma is listed on the Australian Stock Exchange (ASX), meaning its shares can already be bought and sold by the public.

Through the merger, privately owned Chemist Warehouse, whose surging profits have excited potential investors, will also get a backdoor entrance to the ASX without undergoing a lengthy initial public offering process.

Who the players are

Chemist Warehouse has earned a reputation as the “Bunnings of pharmacies”, famous for its perceived affordability.

It has established a strong retail presence nationally, with franchise outlets stocking not only prescription and over-the-counter medicines, but also a huge range of other health products such as vitamins, cosmetics and toiletries.

Sigma owns retail pharmacy brands, including Amcal. Nils Versemann/Shutterstock

Sigma Healthcare, on the other hand, operates retail pharmacy chains including Amcal and Discount Drug Store.

It is also one of top three largest pharmaceutical wholesalers in Australia, with a broad customer base.

This merger is a masterful blend of two business strategies:

- vertical integration – buying part of your own supply chain

- horizontal integration – acquiring a competing business.

How could this affect competition and consumers?

Economic theory tells us that for consumers, mergers can be a double-edged sword.

On the one hand, they often increase business efficiency, scale and bargaining power. These cost savings may translate into lower prices for consumers.

In some industries, mergers have reduced prices by more than 5%.

However, the decrease in competition brought about through a merger can allow companies to get away with charging higher prices, or even lowering the quality of their product offering.

Evidence from the US shows that in the consumer packaged goods sector, which includes drugs and other healthcare products, mergers increased prices by 1.5% on average and lowered the total volume of goods sold by 2.3%.

The prices of many prescriptions in Australia are tightly regulated under the pharmaceutical benefits scheme (PBS). Gerry H/Shutterstock

In Australia, tight regulation of prescription medications means there isn’t much leeway to increase prices for medicines covered under the Pharmaceutical Benefits Scheme (PBS).

But Chemist Warehouse earns a whopping 67% of its revenue from its non-prescription “front of store” sales, compared to a rate of 27% at other Australian pharmacies.

This gives the giant a unique opportunity to capitalise on increased market power in the Australian context.

Calls to increase competition

There have long been calls to enhance competition in Australia’s pharmacy sector.

The Harper National Competition Policy Review singled out the Community Pharmacy Agreement for stifling competition, saying its rigid location and ownership restrictions pose significant barriers for new players.

This has largely prevented Australia following in the steps of the United States and Europe, where deregulation in this industry has allowed consumers to buy over-the-counter medicines in supermarkets and gas stations.

This merger stands to further weaken competition in an industry already held back by such restrictions.

Australian retail is already highly concentrated

Australia’s high level of industry concentration – where markets are controlled by a small number of large players – has found itself in the spotlight amid a stubborn cost of living crisis.

One way to assess market concentration is to measure the share of the market held by the top four companies.

In Australia, the top four players in the pharmacy sector collectively hold over 50% of the market.

As industry concentration has intensified across other sectors, many larger Australian corporations have been seen to increase their price mark-ups and suppress wage growth.

If successful, this merger will further entrench the pharmacy sector among banks, supermarkets and petrol retailers in the ranks of the most concentrated Australian industries.

Will it go ahead?

There are still significant hurdles for this merger to go ahead.

The move has to be approved by shareholders in both companies, and more importantly, receive a green light from the ACCC, Australia’s competition watchdog.

The ACCC is not always able to block large mergers. T. Schneider/Shutterstock

Submissions to the ACCC’s formal enquiry into the merger will close this week.

However, the ACCC has struggled to block similar mergers in the past, such as the seismic ANZ-Suncorp deal that was finally approved in February. Regulatory obstacles alone may not be enough to prevent this consolidation.

Australians have a vested interest in a healthy competitive landscape. Reduced competition in the pharmacy sector will affect the pricing pressures on every store, not just the major players.

Don’t be surprised down the road if a visit to your local pharmacy shocks you with pricier cosmetics, sunglasses and even jellybeans!

This article was first published on The Conversation, and was written by , Angel Zhong, Associate Professor of Finance, RMIT University