Aussies Overpaying by $274 on Car Insurance in 2023? Discover How Seniors Can Save Big with This Comparison Service!

- Replies 12

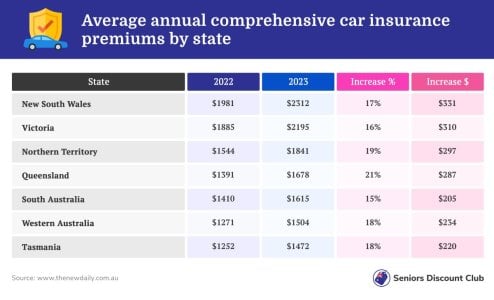

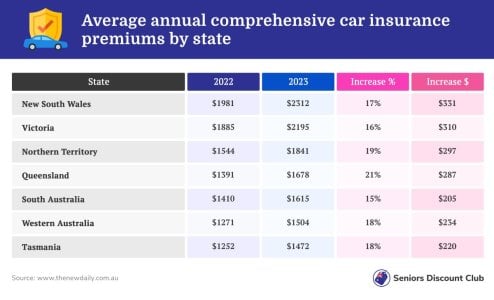

Are you aware that Australians are shelling out an average of $274 more on their car insurance in 2023? That's a whopping 18 per cent increase compared to last year, according to Canstar’s Steve Mickenbecker. But don't despair, there's a solution that could help you save big on your car insurance - Compare the Market*.

Compare the Market* is a comparison service that scrutinises up to 10 different car insurance companies to help find you a better deal. They recently saved one customer a staggering $418 on her car insurance. Imagine what you could do with that extra cash!

But how can seniors and pensioners specifically benefit from this service? Here are a few ways:

1. Restrict the age of drivers: While this might mean your grandkids can't take your car for a spin, it can help reduce the price of premiums.

2. Pay-as-you-drive policies: If you don't drive often, these policies could offer you a discounted premium. But remember, you could pay more in the long run if you drive over the specified limit.

3. No claim bonuses and discounts: If you have a clean driving history, you could benefit from a no claim bonus.

4. Purchasing cover online*: Some companies offer discounts if you purchase your car insurance through their website.

5. Compare insurance annually: Car insurance policies often increase in price every year, even if you haven’t made a claim. Comparing policies every year can help you find a better deal elsewhere.

6. Increase your excess: Opting for a higher excess can reduce your insurance premiums. Just remember, this means your excess will be more expensive if you make a claim.

Adrian Taylor, Executive General Manager of General Insurance at Compare the Market, offers some additional tips. He suggests comparing new policies with the same features for a fairer comparison. He also recommends considering who is driving your car, as drivers under the age of 25 can increase your premium.

Remember, you don't have to wait for your renewal to save money. You can cancel your existing policies at any time and switch insurers*. Just be aware of any cancellation fees that may apply.

So, why not give Compare the Market* a try? With potential savings of hundreds of dollars, it's a no-brainer for savvy seniors looking to cut costs. Don't let the rising car insurance premiums catch you off guard. Start comparing* and see if you can start saving today!

*Please note, members, this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission to write an article or post a deal. We simply do this to assist with the costs of running the SDC. Thank you!

Compare the Market* is a comparison service that scrutinises up to 10 different car insurance companies to help find you a better deal. They recently saved one customer a staggering $418 on her car insurance. Imagine what you could do with that extra cash!

Car insurance rates are surging across the country, with double digit percentage increases compared to 2022

But how can seniors and pensioners specifically benefit from this service? Here are a few ways:

1. Restrict the age of drivers: While this might mean your grandkids can't take your car for a spin, it can help reduce the price of premiums.

2. Pay-as-you-drive policies: If you don't drive often, these policies could offer you a discounted premium. But remember, you could pay more in the long run if you drive over the specified limit.

3. No claim bonuses and discounts: If you have a clean driving history, you could benefit from a no claim bonus.

4. Purchasing cover online*: Some companies offer discounts if you purchase your car insurance through their website.

5. Compare insurance annually: Car insurance policies often increase in price every year, even if you haven’t made a claim. Comparing policies every year can help you find a better deal elsewhere.

6. Increase your excess: Opting for a higher excess can reduce your insurance premiums. Just remember, this means your excess will be more expensive if you make a claim.

Adrian Taylor, Executive General Manager of General Insurance at Compare the Market, offers some additional tips. He suggests comparing new policies with the same features for a fairer comparison. He also recommends considering who is driving your car, as drivers under the age of 25 can increase your premium.

Remember, you don't have to wait for your renewal to save money. You can cancel your existing policies at any time and switch insurers*. Just be aware of any cancellation fees that may apply.

So, why not give Compare the Market* a try? With potential savings of hundreds of dollars, it's a no-brainer for savvy seniors looking to cut costs. Don't let the rising car insurance premiums catch you off guard. Start comparing* and see if you can start saving today!

*Please note, members, this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission to write an article or post a deal. We simply do this to assist with the costs of running the SDC. Thank you!

Last edited: