Aussie Seniors Stung by Record Home Insurance Hike: Here's Your Secret Weapon!

- Replies 23

Are you one of the 87% of Australians who've seen their home insurance premiums skyrocket with their most recent renewal notice? If so, you're not alone. According to a recent national survey by Choice, nearly nine out of ten policyholders are feeling the pinch*.

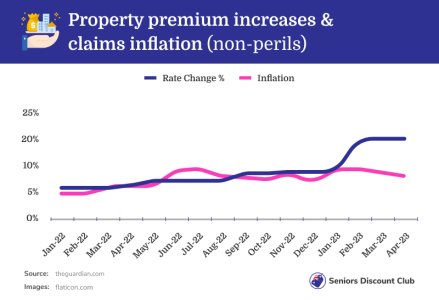

The Actuaries Institute’s research reveals a staggering 28% rise in median home insurance premiums in the year to March, with an average cost of $1,894 across all states. For high-risk properties, including those in flood-prone areas, the increase is even more alarming at 50%.

This is the biggest rise in two decades, and it's causing serious concern among peak bodies. The fear is that households may abandon insurance altogether due to these prohibitive costs. In fact, nearly one in eight Australian households (1.24m) are now considered “affordability stressed”, spending more than four weeks of their annual income on home insurance.

But there's a silver lining.

Enter Compare the Market*, a comparison business that could be your secret weapon in the fight against these rising costs. They compare up to 7 different home insurers*, helping you look for a better deal for your situation.

Adrian Taylor, a home insurance expert at Compare the Market*, offers some valuable advice. "When comparing policies to your current insurance, make sure that you are comparing the same sum insured, same excesses and same optional cover. That way, you can be sure your results are accurate to your situation."

Taylor also suggests playing around with the excess amount to see if it lowers the cost of the insurance premium, and considering a home security system for potential discounts. He also advises seniors to let their insurer know their retirement status, as this may help lower the premium.

"Don’t wait for your renewal notice to arrive to see if you can save money on home and contents insurance. If you have an existing policy, you can cancel anytime. Just keep in mind there may be a cancellation fee, but the savings you could get from switching may well outweigh the cost to cancel," Taylor adds.

So, if you're feeling the sting of the biggest home insurance premium increase in two decades, it's time to fight back. Compare the Market* is here to help you navigate these turbulent waters and look for a policy that suits your needs and budget. Don't let rising costs get you down - take action today!*

*Please note, members, this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission to write an article or post a deal. We simply do this to assist with the costs of running the SDC. Thank you!

The Actuaries Institute’s research reveals a staggering 28% rise in median home insurance premiums in the year to March, with an average cost of $1,894 across all states. For high-risk properties, including those in flood-prone areas, the increase is even more alarming at 50%.

This is the biggest rise in two decades, and it's causing serious concern among peak bodies. The fear is that households may abandon insurance altogether due to these prohibitive costs. In fact, nearly one in eight Australian households (1.24m) are now considered “affordability stressed”, spending more than four weeks of their annual income on home insurance.

But there's a silver lining.

Enter Compare the Market*, a comparison business that could be your secret weapon in the fight against these rising costs. They compare up to 7 different home insurers*, helping you look for a better deal for your situation.

Adrian Taylor, a home insurance expert at Compare the Market*, offers some valuable advice. "When comparing policies to your current insurance, make sure that you are comparing the same sum insured, same excesses and same optional cover. That way, you can be sure your results are accurate to your situation."

Taylor also suggests playing around with the excess amount to see if it lowers the cost of the insurance premium, and considering a home security system for potential discounts. He also advises seniors to let their insurer know their retirement status, as this may help lower the premium.

"Don’t wait for your renewal notice to arrive to see if you can save money on home and contents insurance. If you have an existing policy, you can cancel anytime. Just keep in mind there may be a cancellation fee, but the savings you could get from switching may well outweigh the cost to cancel," Taylor adds.

So, if you're feeling the sting of the biggest home insurance premium increase in two decades, it's time to fight back. Compare the Market* is here to help you navigate these turbulent waters and look for a policy that suits your needs and budget. Don't let rising costs get you down - take action today!*

*Please note, members, this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission to write an article or post a deal. We simply do this to assist with the costs of running the SDC. Thank you!

Last edited: