ALDI shoppers are divided over tap-and-go fees—where do you stand?

By

Maan

- Replies 78

An ALDI shopper thought her grocery run was business as usual—until she noticed something unexpected on her receipt.

It was only a small amount, but enough to spark confusion and frustration.

What she saw left other shoppers equally shocked when she shared it online.

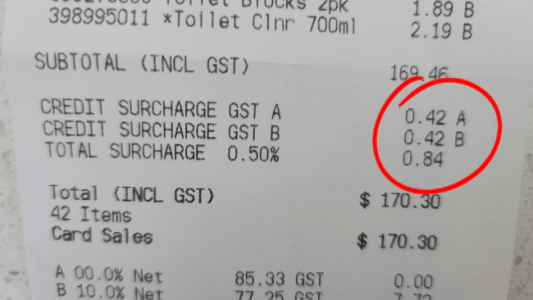

The woman posted to social media after spotting two separate ‘Credit Surcharge GST’ charges—labelled A and B—totalling 84 cents.

‘I only just noticed it,’ she wrote, asking others if this had always been a thing.

Responses poured in, with many admitting they had also been caught off guard.

‘I noticed it too for the first time the other day. Was surprised,’ one shopper said.

‘I’ve never noticed before either. Appreciate your sharing,’ another added.

‘I didn’t know this!’ said a third.

The fee, shoppers explained, came down to the way people paid.

Depending on the card type and bank, tapping rather than inserting could trigger the surcharge.

‘I always insert my card into the machine and don’t have extra charges. If you tap there is a surcharge. Very sneaky,’ one person said.

Another agreed: ‘Insert your card, just make sure you remember your pin. Be interesting to know just how much profit is made by people tapping their cards and being charged this surcharge.’

Not everyone was willing to accept it so lightly.

‘[It’s] the main reason I don’t shop at ALDI… Hopefully the government goes through with stopping businesses from charging these surcharges to use card, especially as they are wanting to steer towards cashless,’ one shopper wrote.

‘Complete BS!! I don’t carry my physical card on me so it’s annoying,’ another fumed.

When approached, ALDI confirmed that the charge was nothing new.

The retailer said the surcharge applied to all credit card and contactless purchases as a way of keeping product prices low, instead of inflating them to cover transaction fees.

Customers could avoid the extra cost by inserting their card and selecting savings or cheque.

If you thought ALDI’s card surcharge was frustrating, it turns out this is part of a bigger conversation happening across the checkout.

Experts have started warning that these extra fees are popping up in more places than ever, raising questions about fairness and transparency.

One recent story highlights just how concerning this trend has become.

Read more: ‘Where do we stop?’: Expert slams shocking new surcharge trend

Would you be willing to change how you pay just to avoid a few cents in fees?

It was only a small amount, but enough to spark confusion and frustration.

What she saw left other shoppers equally shocked when she shared it online.

The woman posted to social media after spotting two separate ‘Credit Surcharge GST’ charges—labelled A and B—totalling 84 cents.

‘I only just noticed it,’ she wrote, asking others if this had always been a thing.

Responses poured in, with many admitting they had also been caught off guard.

‘I noticed it too for the first time the other day. Was surprised,’ one shopper said.

‘I’ve never noticed before either. Appreciate your sharing,’ another added.

‘I didn’t know this!’ said a third.

The fee, shoppers explained, came down to the way people paid.

Depending on the card type and bank, tapping rather than inserting could trigger the surcharge.

‘I always insert my card into the machine and don’t have extra charges. If you tap there is a surcharge. Very sneaky,’ one person said.

Another agreed: ‘Insert your card, just make sure you remember your pin. Be interesting to know just how much profit is made by people tapping their cards and being charged this surcharge.’

Not everyone was willing to accept it so lightly.

‘[It’s] the main reason I don’t shop at ALDI… Hopefully the government goes through with stopping businesses from charging these surcharges to use card, especially as they are wanting to steer towards cashless,’ one shopper wrote.

‘Complete BS!! I don’t carry my physical card on me so it’s annoying,’ another fumed.

When approached, ALDI confirmed that the charge was nothing new.

The retailer said the surcharge applied to all credit card and contactless purchases as a way of keeping product prices low, instead of inflating them to cover transaction fees.

Customers could avoid the extra cost by inserting their card and selecting savings or cheque.

If you thought ALDI’s card surcharge was frustrating, it turns out this is part of a bigger conversation happening across the checkout.

Experts have started warning that these extra fees are popping up in more places than ever, raising questions about fairness and transparency.

One recent story highlights just how concerning this trend has become.

Read more: ‘Where do we stop?’: Expert slams shocking new surcharge trend

Key Takeaways

- An ALDI shopper noticed an unfamiliar fee on her receipt.

- The charges appeared as ‘Credit Surcharge GST A’ and ‘B’, totalling 84 cents.

- Shoppers revealed the fee applied mainly to contactless card payments.

- ALDI confirmed it was a long-standing policy designed to keep shelf prices lower.

Would you be willing to change how you pay just to avoid a few cents in fees?