ACCC report exposes how Aussies lost $2.7 billion to scams in 2023

The latest figures from the Australian Competition and Consumer Commission (ACCC) are in, and they paint a concerning picture of the state of scams in Australia.

In 2023, Australians reported a staggering $2.7 billion in losses due to scams, setting a new and unfortunate record.

The ACCC's report, which compiles data from multiple agencies, including Scamwatch, ReportCyber, the Australian Financial Crimes Exchange, IDCARE, and the Australian Securities and Investments Commission, indicates a sharp increase in scam reports last year.

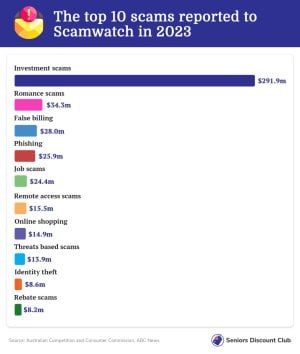

Over 601,000 incidents were reported, up from 507,000 in 2022. Investment scams were the most lucrative for fraudsters, accounting for over $1.3 billion in losses.

Alarmingly, the demographic most affected by these scams were Australians over the age of 65.

This age group was not only more likely to lose money to scams but also reported higher losses in 2023 compared to the previous year.

This trend is particularly distressing as it targets older Australians, many of whom are managing retirement savings and may be seeking investment opportunities.

One harrowing example highlighted by ACCC Deputy Chair Catriona Lowe involved an elderly woman who lost her life savings after engaging in a deepfake video of Elon Musk on social media.

She was lured into a scam that presented her with a 'financial adviser' and an online dashboard showing false returns, only to find out later that she couldn't withdraw any funds.

It was understood that the total losses recorded by all agencies may exceed the Scamwatch data.

Despite the increase in reported scams, the total amount lost in 2023 was actually down from the record $3.1 billion in 2022.

This decrease is attributed to heightened efforts from banks and the government, including the launch of a national anti-scams centre and promises from the banking sector to bolster security measures.

‘While we are cautiously optimistic that our combined efforts will see this downward trend in scam losses continue, we know that behind the losses remain real people who have lost money, often their life savings, to scam,’ the report stated.

The report also sheds light on the methods scammers are using. While losses to scams conducted via text message or phone calls decreased, those perpetrated over email and social media saw an increase.

Job scams, in particular, surged by 151 per cent to $24.3 million, with culturally and linguistically diverse (CALD) communities being disproportionately affected.

It's important to note that the true extent of scam losses is likely even greater than reported, as an estimated one in three scam victims do not report the crime.

This underreporting is especially prevalent among First Nations and CALD communities, according to research commissioned by the Treasury.

The government acknowledges that while the reduction in losses is a positive sign, the figures are still 'far too high’.

‘Over the next two years, we will continue to invest in technology-based solutions that will centralise intelligence and distribute information to those who can act on it—such as banks to freeze accounts, telcos to block calls or SMSs and digital platforms to take down websites or accounts,’ Ms Lowe shared.

Financial Services Minister Stephen Jones announced that the government will soon introduce new mandatory scam codes for banks, telcos, and digital platforms, with strong penalties for non-compliance.

‘We want Australia to be a world leader in combating scammers, and our mandatory codes will put us well ahead,’ he said.

‘While the report shows positive early signs, scam losses remain far too high and we urge Australians to remain alert to the threat of scammers and report any suspicious activity.

For our members, the message is clear: remain vigilant and informed. Scammers are constantly evolving their tactics, and it's crucial to stay up-to-date with the latest scam alerts.

If you encounter any suspicious activity, report it immediately. Remember, your financial security is paramount, and there are resources available to help protect it.

We have featured several investment scam stories on our Scam Watch forum:

Do you have tips or advice on how to avoid scams? Share them in the comments below!

Do you have tips or advice on how to avoid scams? Share them in the comments below!

In 2023, Australians reported a staggering $2.7 billion in losses due to scams, setting a new and unfortunate record.

The ACCC's report, which compiles data from multiple agencies, including Scamwatch, ReportCyber, the Australian Financial Crimes Exchange, IDCARE, and the Australian Securities and Investments Commission, indicates a sharp increase in scam reports last year.

Over 601,000 incidents were reported, up from 507,000 in 2022. Investment scams were the most lucrative for fraudsters, accounting for over $1.3 billion in losses.

The ACCC reported that Australians lost a total of $2.7 billion to scams in 2023. Image source: Freepik

Alarmingly, the demographic most affected by these scams were Australians over the age of 65.

This age group was not only more likely to lose money to scams but also reported higher losses in 2023 compared to the previous year.

This trend is particularly distressing as it targets older Australians, many of whom are managing retirement savings and may be seeking investment opportunities.

One harrowing example highlighted by ACCC Deputy Chair Catriona Lowe involved an elderly woman who lost her life savings after engaging in a deepfake video of Elon Musk on social media.

She was lured into a scam that presented her with a 'financial adviser' and an online dashboard showing false returns, only to find out later that she couldn't withdraw any funds.

It was understood that the total losses recorded by all agencies may exceed the Scamwatch data.

Despite the increase in reported scams, the total amount lost in 2023 was actually down from the record $3.1 billion in 2022.

This decrease is attributed to heightened efforts from banks and the government, including the launch of a national anti-scams centre and promises from the banking sector to bolster security measures.

‘While we are cautiously optimistic that our combined efforts will see this downward trend in scam losses continue, we know that behind the losses remain real people who have lost money, often their life savings, to scam,’ the report stated.

The report also sheds light on the methods scammers are using. While losses to scams conducted via text message or phone calls decreased, those perpetrated over email and social media saw an increase.

Job scams, in particular, surged by 151 per cent to $24.3 million, with culturally and linguistically diverse (CALD) communities being disproportionately affected.

It's important to note that the true extent of scam losses is likely even greater than reported, as an estimated one in three scam victims do not report the crime.

This underreporting is especially prevalent among First Nations and CALD communities, according to research commissioned by the Treasury.

The government acknowledges that while the reduction in losses is a positive sign, the figures are still 'far too high’.

‘Over the next two years, we will continue to invest in technology-based solutions that will centralise intelligence and distribute information to those who can act on it—such as banks to freeze accounts, telcos to block calls or SMSs and digital platforms to take down websites or accounts,’ Ms Lowe shared.

Financial Services Minister Stephen Jones announced that the government will soon introduce new mandatory scam codes for banks, telcos, and digital platforms, with strong penalties for non-compliance.

‘We want Australia to be a world leader in combating scammers, and our mandatory codes will put us well ahead,’ he said.

‘While the report shows positive early signs, scam losses remain far too high and we urge Australians to remain alert to the threat of scammers and report any suspicious activity.

For our members, the message is clear: remain vigilant and informed. Scammers are constantly evolving their tactics, and it's crucial to stay up-to-date with the latest scam alerts.

If you encounter any suspicious activity, report it immediately. Remember, your financial security is paramount, and there are resources available to help protect it.

We have featured several investment scam stories on our Scam Watch forum:

- How one man lost his $500,000 retirement savings to an investment scam: ‘It’s like being brainwashed’

- Alan G.’s Investment Scam Saga

- BEWARE: Deepfake scams leave Aussies over $8 million out of pocket

- Retiree loses $110K in life savings to scam using Gina Rinehart’s image

Key Takeaways

- Australians reported a record number of scams in 2023, with losses amounting to $2.7 billion, according to the ACCC.

- Investment scams were the most costly, accounting for over $1.3 billion in losses, with people over 65 being the most targeted age group.

- Efforts from banks and the government, including the launch of a national anti-scams centre, have seen a downward trend in losses for the first time in six years.

- The government is planning to introduce new mandatory scam codes for banks, telcos, and digital platforms to combat the high level of scam losses, which are still considered 'far too high'.