2023 Health Insurance Rate Rise: How Much More Can Aussies Take?

- Replies 40

The news is out: 2023 is the year of health insurance premium increases*. It’s unsurprising, with the price of everything seemingly on the rise these days.

Despite health insurers claiming this year’s increase is ‘only slightly higher’, it’s another hit to our wallets that the majority of us just cannot take. What is ‘only slighter higher’, you may ask? The industry average health insurance premium increase is 2.90% this year.

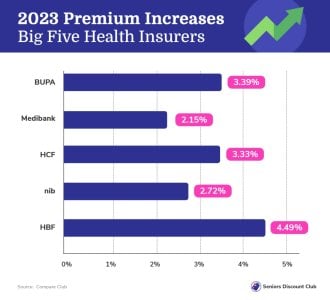

If you’re with one of the ‘Big Five’ health insurers*—think BUPA, Medibank, HCF, nib and HBF—you’re looking at an average premium increase of 3.38%*.

Now, there are several health insurers out there, so what if you’re not with the ‘Big Five’?

If you are over 65 and you’re NOT with one of the ‘Big Five’ health insurers, your premium could still be increasing by an average of $167 per year*; in fact, it likely already increased in April or September this year.

For those of you with one of the ‘Big Five’, your premiums could be increasing by $194 per year*. A cost that we know isn’t something a lot of our members just have ‘lying around’.

Did you know that on 1 September 2023, HCF increased their premiums by 3.33%*? And other insurers aren’t far behind. BUPA increased their premiums on 1 October 2023 by 3.39%*, while nib is increased their premiums on 1 October 2023 by 2.72%*.

Of the increase, the Hon. Mark Butler MP said*: ‘Private Health Insurers must ensure their members are getting value for their money, and when costs rise, they want to know higher premiums are contributing to system-wide improvements, like higher wages for nurses and other health workers.’

‘All Australians deserve access to affordable treatments and the devices they need to stay healthy and live full and productive lives.’ he continued.

What can you do?

There is some good news. Your health insurer* will let you know your policy’s exact increase before the increase takes effect—and if you can afford to prepay a full year’s premium, you can lock in 12 (or in some cases up to 18) months of cover at the current year's prices.

For example, nib allows you to prepay 13 months, and HCF and HBF allow 18 months*. If you’re a nib member, you can lock in your current premium until November 2024, potentially saving hundreds of dollars*. But we know this isn’t financially feasible for many of our members, so what are the other options?

Luckily, it’s not all doom and gloom. Over the past four years, we know over 44,000 Australians over the age of 50* who have managed to save an average of $259.50* on their health insurance just by comparing and switching their cover with Compare Club*.

How to save

It broke our heart when we were told this, but Aussies over 60 are often left to fend for themselves, unknowingly paying for health cover they will never be able to use. Compare Club* have seen Aussies in their 60s, 70s and even 80s paying for pregnancy and IVF cover without even knowing it, and this should never be the case.

Compare Club can help* our dear members compare multiple health insurers, cover options and pricing all in one place. Their service can save you time, but the biggest benefit for most is how much money you can save off your yearly premiums*, especially when health insurance premiums aren’t the only thing increasing in cost! Compare Club* can help you find health insurance that is more affordable and better suited to your needs*.

Why Compare Club?*

You get the peace of mind that comes with working with trusted professionals who have the years of experience* needed to navigate the complicated health insurance system and keep you from any further confusion. For example, many Aussies worry about not being with ‘one of the big five’ when there is no such thing as a ‘dodgy’ health fund in Australia, as the industry is heavily governed.

How do we know they’re trusted? They’re one of our long-term partners* with whom we have personally compared health insurers! You can read about Maddie’s experience here*.

The team at Compare Club* will make sure you have the health cover you need while paying a price you’re comfortable with*.

So, if you’re sick of endlessly researching health insurers, are looking to save money or simply find cover better suited to your needs, Compare Club is ready to help*.

It’s worth comparing your health insurance* to see if you can save money. You won’t lose anything by comparing; you only stand to save*! After all, if you don’t like the quote you receive from Compare Club*, you don’t have to do anything.

*Please note, members, that this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission to write an article or post a deal. We do this to assist with the costs of running the SDC. Thank you!

Despite health insurers claiming this year’s increase is ‘only slightly higher’, it’s another hit to our wallets that the majority of us just cannot take. What is ‘only slighter higher’, you may ask? The industry average health insurance premium increase is 2.90% this year.

If you’re with one of the ‘Big Five’ health insurers*—think BUPA, Medibank, HCF, nib and HBF—you’re looking at an average premium increase of 3.38%*.

Now, there are several health insurers out there, so what if you’re not with the ‘Big Five’?

If you are over 65 and you’re NOT with one of the ‘Big Five’ health insurers, your premium could still be increasing by an average of $167 per year*; in fact, it likely already increased in April or September this year.

For those of you with one of the ‘Big Five’, your premiums could be increasing by $194 per year*. A cost that we know isn’t something a lot of our members just have ‘lying around’.

Did you know that on 1 September 2023, HCF increased their premiums by 3.33%*? And other insurers aren’t far behind. BUPA increased their premiums on 1 October 2023 by 3.39%*, while nib is increased their premiums on 1 October 2023 by 2.72%*.

Of the increase, the Hon. Mark Butler MP said*: ‘Private Health Insurers must ensure their members are getting value for their money, and when costs rise, they want to know higher premiums are contributing to system-wide improvements, like higher wages for nurses and other health workers.’

‘All Australians deserve access to affordable treatments and the devices they need to stay healthy and live full and productive lives.’ he continued.

What can you do?

There is some good news. Your health insurer* will let you know your policy’s exact increase before the increase takes effect—and if you can afford to prepay a full year’s premium, you can lock in 12 (or in some cases up to 18) months of cover at the current year's prices.

For example, nib allows you to prepay 13 months, and HCF and HBF allow 18 months*. If you’re a nib member, you can lock in your current premium until November 2024, potentially saving hundreds of dollars*. But we know this isn’t financially feasible for many of our members, so what are the other options?

Luckily, it’s not all doom and gloom. Over the past four years, we know over 44,000 Australians over the age of 50* who have managed to save an average of $259.50* on their health insurance just by comparing and switching their cover with Compare Club*.

How to save

It broke our heart when we were told this, but Aussies over 60 are often left to fend for themselves, unknowingly paying for health cover they will never be able to use. Compare Club* have seen Aussies in their 60s, 70s and even 80s paying for pregnancy and IVF cover without even knowing it, and this should never be the case.

Compare Club can help* our dear members compare multiple health insurers, cover options and pricing all in one place. Their service can save you time, but the biggest benefit for most is how much money you can save off your yearly premiums*, especially when health insurance premiums aren’t the only thing increasing in cost! Compare Club* can help you find health insurance that is more affordable and better suited to your needs*.

Why Compare Club?*

You get the peace of mind that comes with working with trusted professionals who have the years of experience* needed to navigate the complicated health insurance system and keep you from any further confusion. For example, many Aussies worry about not being with ‘one of the big five’ when there is no such thing as a ‘dodgy’ health fund in Australia, as the industry is heavily governed.

How do we know they’re trusted? They’re one of our long-term partners* with whom we have personally compared health insurers! You can read about Maddie’s experience here*.

The team at Compare Club* will make sure you have the health cover you need while paying a price you’re comfortable with*.

So, if you’re sick of endlessly researching health insurers, are looking to save money or simply find cover better suited to your needs, Compare Club is ready to help*.

It’s worth comparing your health insurance* to see if you can save money. You won’t lose anything by comparing; you only stand to save*! After all, if you don’t like the quote you receive from Compare Club*, you don’t have to do anything.

*Please note, members, that this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission to write an article or post a deal. We do this to assist with the costs of running the SDC. Thank you!

Last edited: