‘Scary’ trend alert: Aussies are risking their health to save money

- Replies 22

Money is tight for a lot of people these days. With the after-effects of the pandemic still putting a strain on people’s bank accounts and interest rates rising at their fastest pace in decades, it’s no wonder Aussies are cutting back on non-essentials like entertainment and leisure activities.

However, now a worrying new trend has emerged.

To make up for spending a bit too much, people are also now cutting back on necessities like medical care.

According to a recent study conducted by the price comparison website Compare the Market, far too many Australians are taking extreme steps to cut back on costs by neglecting their health and skipping doctors’ visits—which can have major repercussions in the future, especially for those with chronic conditions, such as diabetes, hypertension, and cholesterol.

The research revealed that an alarming one in five people have delayed going to the doctor in the past three months due to cost reasons.

Compare the Market’s Chris Ford said it was a worrying statistic, considering the importance of regular doctor appointments for Aussies overall health. ‘Healthcare is paramount. No Australian should have to put off their GP check-up because they can’t afford it,’ he said.

‘Unfortunately, there’s no magic bullet that’s going to fix this issue anytime soon, which is scary to think, considering almost a fifth of Australians are foregoing vital GP visits because they simply can’t afford it,’ he added.

It’s not just GP check-ups Aussies are skipping out on either – if you need to visit a specialist or require an operation, you may have to pay hefty costs.

‘If your specialist charges more than the Medical Benefits Schedule (MBS) fee, you may have to pay out-of-pocket costs,’ he explained.

He continued: ‘Your out-of-pocket cost is the difference between the amount charged and the combined amount paid by Medicare and, if you have health insurance, your insurer.’

The good news is that if you have health insurance, you may find some relief for certain hospital charges depending on your level of coverage.

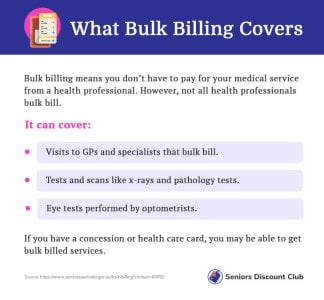

Treasurer Jim Chalmers announced last week in the federal budget that the incentive paid to doctors who bulk bill certain patients would be tripled.

The move was met with a lukewarm reception. According to Ford, not every GP would start bulk billing again, and many are struggling to keep up with the cost of running a practice.

From November 1, many common GP consultations, such as face-to-face, telehealth and video-conference appointments, will be bulk billed.

The initiative is expected to benefit 11 million people, including families with children aged under 16, pensioners, and Commonwealth Concession Card holders.

For Tasmanian GP Eleanor Woolveridge, who co-owns the Sorell Family Practice, bulk billing is a ‘vital service’ for the most vulnerable members of her community.

‘Bulk billing means that some of our patients can see a doctor, and these are the patients who really live on the fringe and live day to day and week to week,’ she said.

‘Or [they could be] the patients who have significant multiple chronic health issues and need to see the GP every two weeks to stay out of the hospital or every month to get higher complicated prescriptions.’

However, Charles Maskell-Knight, a Health Policy Analyst, said that this incentive might not reverse the ‘trend of practices’ where some would charge patients a private fee or would scrap bulk billing altogether.

‘If you are a GP currently charging patients a gap fee of $50, then unless you get the same amount of money from changing to bulk billing, you’re not going to change as the extra incentives are nothing close to that much,’ Maskell-Knight said.

He added that it did not make ‘economic sense’.

‘It might stop bulk billing from going backwards for now, but it’s not a long-term solution,’ he stated.

According to Maskell-Knight, rather than a GP being paid with incentives for giving short consultations, they should also be incentivised to provide ‘holistic, integrated care across a number of services’.

‘We need to also pay people for being doctors, and pay them a capitation payment, which would cover following up with family, following up with staff, talking to specialists and all of that care,’ he claimed.

Have you ever found yourself in a situation where you’ve had to miss a doctor’s appointment due to cost? Share your experience in the comments below.

However, now a worrying new trend has emerged.

To make up for spending a bit too much, people are also now cutting back on necessities like medical care.

According to a recent study conducted by the price comparison website Compare the Market, far too many Australians are taking extreme steps to cut back on costs by neglecting their health and skipping doctors’ visits—which can have major repercussions in the future, especially for those with chronic conditions, such as diabetes, hypertension, and cholesterol.

The research revealed that an alarming one in five people have delayed going to the doctor in the past three months due to cost reasons.

Compare the Market’s Chris Ford said it was a worrying statistic, considering the importance of regular doctor appointments for Aussies overall health. ‘Healthcare is paramount. No Australian should have to put off their GP check-up because they can’t afford it,’ he said.

‘Unfortunately, there’s no magic bullet that’s going to fix this issue anytime soon, which is scary to think, considering almost a fifth of Australians are foregoing vital GP visits because they simply can’t afford it,’ he added.

It’s not just GP check-ups Aussies are skipping out on either – if you need to visit a specialist or require an operation, you may have to pay hefty costs.

‘If your specialist charges more than the Medical Benefits Schedule (MBS) fee, you may have to pay out-of-pocket costs,’ he explained.

He continued: ‘Your out-of-pocket cost is the difference between the amount charged and the combined amount paid by Medicare and, if you have health insurance, your insurer.’

The good news is that if you have health insurance, you may find some relief for certain hospital charges depending on your level of coverage.

Treasurer Jim Chalmers announced last week in the federal budget that the incentive paid to doctors who bulk bill certain patients would be tripled.

The move was met with a lukewarm reception. According to Ford, not every GP would start bulk billing again, and many are struggling to keep up with the cost of running a practice.

From November 1, many common GP consultations, such as face-to-face, telehealth and video-conference appointments, will be bulk billed.

The initiative is expected to benefit 11 million people, including families with children aged under 16, pensioners, and Commonwealth Concession Card holders.

For Tasmanian GP Eleanor Woolveridge, who co-owns the Sorell Family Practice, bulk billing is a ‘vital service’ for the most vulnerable members of her community.

‘Bulk billing means that some of our patients can see a doctor, and these are the patients who really live on the fringe and live day to day and week to week,’ she said.

‘Or [they could be] the patients who have significant multiple chronic health issues and need to see the GP every two weeks to stay out of the hospital or every month to get higher complicated prescriptions.’

However, Charles Maskell-Knight, a Health Policy Analyst, said that this incentive might not reverse the ‘trend of practices’ where some would charge patients a private fee or would scrap bulk billing altogether.

‘If you are a GP currently charging patients a gap fee of $50, then unless you get the same amount of money from changing to bulk billing, you’re not going to change as the extra incentives are nothing close to that much,’ Maskell-Knight said.

He added that it did not make ‘economic sense’.

‘It might stop bulk billing from going backwards for now, but it’s not a long-term solution,’ he stated.

According to Maskell-Knight, rather than a GP being paid with incentives for giving short consultations, they should also be incentivised to provide ‘holistic, integrated care across a number of services’.

‘We need to also pay people for being doctors, and pay them a capitation payment, which would cover following up with family, following up with staff, talking to specialists and all of that care,’ he claimed.

Key Takeaways

- Nearly one in five Australians have delayed doctor visits due to cost-of-living pressures.

- In response to this issue, the federal budget announced that the incentive paid to doctors who bulk-bill certain patients would be tripled.

- Compare the Market's Chris Ford believes that not every GP will start bulk billing again, and healthcare affordability will remain a problem for many Australians.

- As of November 1, the government will triple the amount paid to GPs who choose to bulk bill certain patients, benefiting more than 11 million people.

Last edited: