‘$3.10 isn't even a litre of milk’: Centrelink recipients slam latest payment increase

By

Maan

- Replies 201

Rising living costs continue to put immense pressure on Australians relying on welfare support.

While government payments are adjusted in line with inflation, many recipients argue these increases fail to keep pace with real-world expenses.

For those on JobSeeker, the Age Pension, and Commonwealth Rent Assistance, the latest payment adjustment has sparked frustration rather than relief.

Welfare recipients have slammed the latest Centrelink increase, saying the adjustment fails to ease the financial strain they are facing.

From today, payments such as JobSeeker, the Age Pension, and Commonwealth Rent Assistance have risen in line with inflation.

However, many on welfare said the increase was too small to keep up with the soaring cost of essentials.

Damien, 62, said the change was ‘paltry’ and did nothing to help him afford food or medication.

‘I just scoffed at it. I just feel like not accepting it. It's not going to do us any benefit at all,’ he shared.

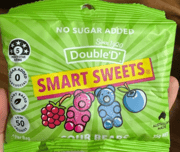

‘$3.10 isn't even a litre of milk. We're supposed to be the lucky country.’

He had been on JobSeeker since 2019 and briefly took on a part-time job last year to break free from the welfare cycle.

Despite earning $400 a week, the increased income meant his Centrelink payments were cut, and his social housing rent—calculated as a portion of his income—rose.

He quit after a few months, saying it ‘wasn’t worth the trouble’.

With rent set to increase again in May, the JobSeeker indexation would leave him $4.50 worse off.

Social housing tenants have long criticised the system, where any increase in Centrelink payments triggers a rent hike.

Trudi, a disability pensioner, said she had grown frustrated with the cycle.

‘We get absolutely nothing, it's b*******,’ she said.

‘The government is slapping itself on the back, beating its chest... it's not enough, it will never be enough.’

Emily, 25, said she was forced to choose between basic needs, often skipping meals to afford essentials.

‘I am living on one meal per day,’ she said.

‘If I run out of both my medications at around the same time, I must choose between medicine for my chronic pain or medication for my PCOS.’

She said her rent accounted for 55 per cent of her income, leaving her unable to afford internet and sometimes struggling to recharge her phone.

‘This is my reality, and the reality of countless others,’ she said.

The rising cost of living had made it harder for JobSeeker recipients to get by, with many now relying on charity organisations for essentials.

Even dual-income households had turned to outreach services as food prices surged.

Since March 2020, grocery prices had risen by 17 per cent, while rental costs had increased by 37.6 per cent, according to CoreLogic data.

Petrol had jumped 42 per cent since 2022, while insurance costs had risen by 20 per cent.

JobSeeker had increased from $565.70 per fortnight in 2020 to $781.10 today—an adjustment of 27.5 per cent.

Despite these increases, many argued the payment was still not enough to cover necessities.

The Economic Inclusion Advisory Committee reported that JobSeeker payments remained below all benchmarks, causing severe hardship for many Australians.

It recommended raising JobSeeker to 90 per cent of the Age Pension, which would bring the payment to $942.39 per fortnight.

The Australian Council of Social Services had called for an even higher increase to at least $82 per day.

Damien said even an extra $100 per week would not be enough for a comfortable life.

Mission Australia’s Marion Bennett warned that failing to raise JobSeeker would have wider consequences.

‘If people are able to receive an adequate income, then they actually will be less frequently needing to use other government services,’ she said.

‘So there's actually a return on that investment of $1.24 for every dollar invested in JobSeeker.’

Social Services Minister Amanda Rishworth said today’s increase would ‘help ease some pressure’ but did not indicate whether further changes were planned.

She pointed to other government measures, including an $11.5 billion investment in welfare support.

Shadow Social Services Minister Michael Sukkar said the opposition had no plans to change JobSeeker, arguing that employment was the best way to improve living standards.

‘Few countries provide the strong safety net available to Australians,’ he said.

He added that since JobSeeker was taxpayer-funded, any changes needed to be handled ‘responsibly’.

In a previous story, the government announced a separate Centrelink change aimed at providing relief for pensioners.

While some welcomed the update, others questioned whether it would make a real difference.

Read more about how this change could impact pensioners.

With the cost of living continuing to rise, do you think current welfare payments are enough to support those in need? Let us know your thoughts in the comments.

While government payments are adjusted in line with inflation, many recipients argue these increases fail to keep pace with real-world expenses.

For those on JobSeeker, the Age Pension, and Commonwealth Rent Assistance, the latest payment adjustment has sparked frustration rather than relief.

Welfare recipients have slammed the latest Centrelink increase, saying the adjustment fails to ease the financial strain they are facing.

From today, payments such as JobSeeker, the Age Pension, and Commonwealth Rent Assistance have risen in line with inflation.

However, many on welfare said the increase was too small to keep up with the soaring cost of essentials.

Damien, 62, said the change was ‘paltry’ and did nothing to help him afford food or medication.

‘I just scoffed at it. I just feel like not accepting it. It's not going to do us any benefit at all,’ he shared.

‘$3.10 isn't even a litre of milk. We're supposed to be the lucky country.’

He had been on JobSeeker since 2019 and briefly took on a part-time job last year to break free from the welfare cycle.

Despite earning $400 a week, the increased income meant his Centrelink payments were cut, and his social housing rent—calculated as a portion of his income—rose.

He quit after a few months, saying it ‘wasn’t worth the trouble’.

With rent set to increase again in May, the JobSeeker indexation would leave him $4.50 worse off.

Social housing tenants have long criticised the system, where any increase in Centrelink payments triggers a rent hike.

Trudi, a disability pensioner, said she had grown frustrated with the cycle.

‘We get absolutely nothing, it's b*******,’ she said.

‘The government is slapping itself on the back, beating its chest... it's not enough, it will never be enough.’

Emily, 25, said she was forced to choose between basic needs, often skipping meals to afford essentials.

‘I am living on one meal per day,’ she said.

‘If I run out of both my medications at around the same time, I must choose between medicine for my chronic pain or medication for my PCOS.’

She said her rent accounted for 55 per cent of her income, leaving her unable to afford internet and sometimes struggling to recharge her phone.

‘This is my reality, and the reality of countless others,’ she said.

The rising cost of living had made it harder for JobSeeker recipients to get by, with many now relying on charity organisations for essentials.

Even dual-income households had turned to outreach services as food prices surged.

Since March 2020, grocery prices had risen by 17 per cent, while rental costs had increased by 37.6 per cent, according to CoreLogic data.

Petrol had jumped 42 per cent since 2022, while insurance costs had risen by 20 per cent.

JobSeeker had increased from $565.70 per fortnight in 2020 to $781.10 today—an adjustment of 27.5 per cent.

Despite these increases, many argued the payment was still not enough to cover necessities.

The Economic Inclusion Advisory Committee reported that JobSeeker payments remained below all benchmarks, causing severe hardship for many Australians.

It recommended raising JobSeeker to 90 per cent of the Age Pension, which would bring the payment to $942.39 per fortnight.

The Australian Council of Social Services had called for an even higher increase to at least $82 per day.

Damien said even an extra $100 per week would not be enough for a comfortable life.

Mission Australia’s Marion Bennett warned that failing to raise JobSeeker would have wider consequences.

‘If people are able to receive an adequate income, then they actually will be less frequently needing to use other government services,’ she said.

‘So there's actually a return on that investment of $1.24 for every dollar invested in JobSeeker.’

Social Services Minister Amanda Rishworth said today’s increase would ‘help ease some pressure’ but did not indicate whether further changes were planned.

She pointed to other government measures, including an $11.5 billion investment in welfare support.

Shadow Social Services Minister Michael Sukkar said the opposition had no plans to change JobSeeker, arguing that employment was the best way to improve living standards.

‘Few countries provide the strong safety net available to Australians,’ he said.

He added that since JobSeeker was taxpayer-funded, any changes needed to be handled ‘responsibly’.

In a previous story, the government announced a separate Centrelink change aimed at providing relief for pensioners.

While some welcomed the update, others questioned whether it would make a real difference.

Read more about how this change could impact pensioners.

Key Takeaways

- Welfare recipients said the latest Centrelink increase failed to keep up with the rising cost of living.

- Many struggled to afford essentials, with some skipping meals or choosing between medications.

- Experts called for a higher JobSeeker rate, warning that inadequate payments caused severe hardship.

- The government defended its welfare measures, while the opposition said any changes must be handled responsibly.

With the cost of living continuing to rise, do you think current welfare payments are enough to support those in need? Let us know your thoughts in the comments.