You won't believe how a $70 travel insurance plan saved this young woman's life during her dream Bali holiday

By

- Replies 9

Graphic Content Warning: This story contains images and descriptions that some may find disturbing or unsettling. Reader discretion is advised.

Travelling is a wonderful way to connect with new cultures and indulge in relaxing activities, such as sipping tiki cocktails on white sandy beaches.

However, adventures also come with risks, and it's crucial for all travellers to be prepared for unexpected setbacks like accidents, illnesses, or severe weather.

As the world slowly opens up again, people are dreaming of much-needed holidays. While packing the right shoes and planning your itinerary is important, there's one thing that could save you in unimaginable circumstances - travel insurance.

Travel insurance is essential, as it provides a safety net in emergencies, such as unexpected illness, flight cancellations, or lost luggage.

Jordon Hunt, a 23-year-old medical science student from Sydney, knows this all too well after venturing to Bali with a friend in 2022 to celebrate the end of their university exams.

During a blissful holiday, the young travellers had just enjoyed dinner on their last night when a seemingly normal decision to hitch a ride back to their hotel turned into her worst nightmare.

After climbing onto the back of a scooter, the 23-year-old's final vivid memory was of a car hurtling towards her at full speed.

'I remember being face-to-face with this white four-wheel drive coming straight towards me,' Jordon said.

'Then I just tightly closed my eyes as you’d expect you’d do in a dangerous situation like that.'

For what seemed like hours, Jordon lay helpless on the pavement, with little protection and no pain relief.

'You think to yourself, “I’m just going to wake up and find out it was all a bad dream”,’ she continued.

‘I woke up, looking at the sky, with the bike still across my legs.’

‘The first thing I did was wiggle my toes, thinking to myself, if I can wiggle my toes, then I’m not paralysed.’

‘I knew it was bad because I had a look at my knee before they were able to bandage it up.’

‘I could see my kneecap, which wasn’t the best experience.’

‘Luckily, we had a towel which we wrapped around my knee.’

‘There were quite a lot of people helping me, which I was very thankful for, and they were able to lift me and move me off the road to the sidewalk.’

Afterwards, she was transported to a public hospital, where her initial treatment fell short of her expectations.

Jordon recalled: ‘They had splinted my leg, so I had one plank of wood underneath and two to the side with a bandage just holding it together.’

‘I’d been told I wasn’t allowed to eat or drink any water, so I was very dehydrated at that point.’

‘It was quite hard to communicate with everyone, especially in the public hospital.’

Jordon's treatment significantly improved after she was transferred to a private hospital.

‘Once we got to the international hospital it was amazing,’ she added.

‘I got X-rays done, emergency surgery performed on my leg - I had one doctor working on my femur and one working on my knee.’

‘I was given my own private room where my friends could visit.’

‘It was great from that point. Before that, my boyfriend, who had arrived from Vietnam, thought I might lose my leg.’

Despite incurring a medical bill of $48,000, Jordon's travel insurance, which cost her only $70, fully covered her expenses.

After receiving the news that she could finally return home, Jordon felt a wave of relief.

‘It was about the ninth day when the insurance company rang and said: “Okay, we’ve got you a flight”. I just thought, “Oh, thank goodness I’m going home.”’

However, Jordon's journey to recovery was far from over. Despite the surgery, she still struggled with bending her knee and performing physical activities.

‘I had developed quite a lot of scar tissue around my knee, so I couldn’t bend it,’ she explained.

‘It was touch and go as to whether I would have any mobility in my leg.’

Jordon acknowledged that her recovery process would have taken a significant emotional and financial toll if she had not had travel insurance.

Her ongoing health issues have also prevented her from returning to work as a pharmacy assistant.

Nevertheless, she expressed gratitude towards her insurer for providing loss-of-income payments of $400 a week, which helped cover her mortgage and medical expenses.

‘I was really thankful for that,’ she said.

Jordon hopes that her story will encourage all travellers to prioritise travel insurance, regardless of where they are going, to protect themselves against unexpected events.

‘If it wasn’t for my travel insurance, I’d be out of pocket by like $50,000,’ she emphasised.

Jordon's experience in Bali highlights the importance of having travel insurance, no matter where you're going or what you plan to do.

We hope her story has reminded you to add travel insurance to your pre-vacation checklist, so you can have peace of mind knowing you're covered in case of any unexpected events.

Remember, it's always better to have it and not need it than to need it and not have it.

And of course, when purchasing insurance, it’s best to do research and read reviews before pushing through with the transaction. We do not want to be in a case where insurance companies, such as the incident presented in this article, dupe customers of their hard-earned money.

Safe travels, and we look forward to hearing about your next adventure!

Members, what do you think about Jordon’s story? Do you have a similar experience? Share your thoughts and any tips you may have for travel insurance in the comments below!

Travelling is a wonderful way to connect with new cultures and indulge in relaxing activities, such as sipping tiki cocktails on white sandy beaches.

However, adventures also come with risks, and it's crucial for all travellers to be prepared for unexpected setbacks like accidents, illnesses, or severe weather.

As the world slowly opens up again, people are dreaming of much-needed holidays. While packing the right shoes and planning your itinerary is important, there's one thing that could save you in unimaginable circumstances - travel insurance.

Travel insurance is essential, as it provides a safety net in emergencies, such as unexpected illness, flight cancellations, or lost luggage.

Jordon Hunt, a 23-year-old medical science student from Sydney, knows this all too well after venturing to Bali with a friend in 2022 to celebrate the end of their university exams.

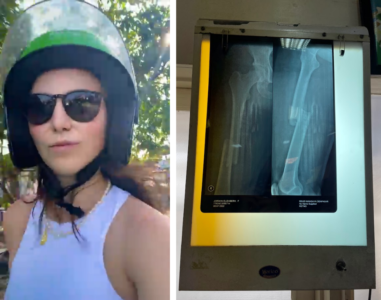

Jordon Hunt shares her harrowing experience during a Bali holiday that turned into a nightmare after an accident. Credit: Jordon Hunt/1Cover.

During a blissful holiday, the young travellers had just enjoyed dinner on their last night when a seemingly normal decision to hitch a ride back to their hotel turned into her worst nightmare.

After climbing onto the back of a scooter, the 23-year-old's final vivid memory was of a car hurtling towards her at full speed.

'I remember being face-to-face with this white four-wheel drive coming straight towards me,' Jordon said.

'Then I just tightly closed my eyes as you’d expect you’d do in a dangerous situation like that.'

For what seemed like hours, Jordon lay helpless on the pavement, with little protection and no pain relief.

'You think to yourself, “I’m just going to wake up and find out it was all a bad dream”,’ she continued.

‘I woke up, looking at the sky, with the bike still across my legs.’

‘The first thing I did was wiggle my toes, thinking to myself, if I can wiggle my toes, then I’m not paralysed.’

‘I knew it was bad because I had a look at my knee before they were able to bandage it up.’

‘I could see my kneecap, which wasn’t the best experience.’

‘Luckily, we had a towel which we wrapped around my knee.’

‘There were quite a lot of people helping me, which I was very thankful for, and they were able to lift me and move me off the road to the sidewalk.’

Afterwards, she was transported to a public hospital, where her initial treatment fell short of her expectations.

Jordon recalled: ‘They had splinted my leg, so I had one plank of wood underneath and two to the side with a bandage just holding it together.’

‘I’d been told I wasn’t allowed to eat or drink any water, so I was very dehydrated at that point.’

‘It was quite hard to communicate with everyone, especially in the public hospital.’

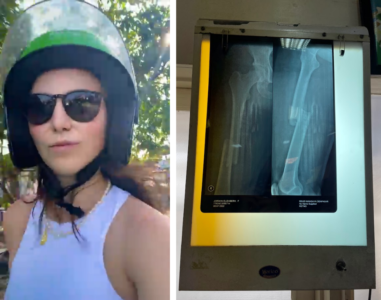

It took nine days for Jordon to be discharged from the Indonesian hospital and return to Sydney. Credit: Jordon Hunt/1Cover.

Jordon's treatment significantly improved after she was transferred to a private hospital.

‘Once we got to the international hospital it was amazing,’ she added.

‘I got X-rays done, emergency surgery performed on my leg - I had one doctor working on my femur and one working on my knee.’

‘I was given my own private room where my friends could visit.’

‘It was great from that point. Before that, my boyfriend, who had arrived from Vietnam, thought I might lose my leg.’

Despite incurring a medical bill of $48,000, Jordon's travel insurance, which cost her only $70, fully covered her expenses.

After receiving the news that she could finally return home, Jordon felt a wave of relief.

‘It was about the ninth day when the insurance company rang and said: “Okay, we’ve got you a flight”. I just thought, “Oh, thank goodness I’m going home.”’

However, Jordon's journey to recovery was far from over. Despite the surgery, she still struggled with bending her knee and performing physical activities.

‘I had developed quite a lot of scar tissue around my knee, so I couldn’t bend it,’ she explained.

‘It was touch and go as to whether I would have any mobility in my leg.’

Jordon acknowledged that her recovery process would have taken a significant emotional and financial toll if she had not had travel insurance.

Her ongoing health issues have also prevented her from returning to work as a pharmacy assistant.

Nevertheless, she expressed gratitude towards her insurer for providing loss-of-income payments of $400 a week, which helped cover her mortgage and medical expenses.

‘I was really thankful for that,’ she said.

Jordon hopes that her story will encourage all travellers to prioritise travel insurance, regardless of where they are going, to protect themselves against unexpected events.

‘If it wasn’t for my travel insurance, I’d be out of pocket by like $50,000,’ she emphasised.

Key Takeaways

- Jordon Hunt, a 23-year-old medical science student, experienced the importance of travel insurance coverage during her trip to Bali when she had an accident that incurred a $48,000 medical bill, which her $70 travel insurance fully covered.

- Jordon's ongoing health issues have prevented her from returning to work, but her insurer provided loss-of-income payments of $400 a week to help cover her mortgage and medical expenses.

- Jordon hopes her story will encourage all travellers to prioritise travel insurance, regardless of their destination, to protect themselves against unexpected events.

Jordon's experience in Bali highlights the importance of having travel insurance, no matter where you're going or what you plan to do.

We hope her story has reminded you to add travel insurance to your pre-vacation checklist, so you can have peace of mind knowing you're covered in case of any unexpected events.

Remember, it's always better to have it and not need it than to need it and not have it.

And of course, when purchasing insurance, it’s best to do research and read reviews before pushing through with the transaction. We do not want to be in a case where insurance companies, such as the incident presented in this article, dupe customers of their hard-earned money.

Safe travels, and we look forward to hearing about your next adventure!

Members, what do you think about Jordon’s story? Do you have a similar experience? Share your thoughts and any tips you may have for travel insurance in the comments below!