You might be paying way too much for alcoholic drinks because of this 'inefficient tax'

The Australian government's tax policy on alcohol has long been a contentious issue, and it's about to hit your wallet even harder.

The next round of excise tax hikes, set to take effect in February, could see the cost of a pint of beer surpass $15, while a cocktail could set you back a whopping $24.

This is not just a blow to consumers but also to local manufacturers struggling to stay afloat amidst these rising costs.

The federal government is under increasing pressure to halt the excise tax, with industry insiders calling for urgent reforms to keep local manufacturing viable.

Victorian distillers, in particular, are sounding the alarm, warning that the expected 2-3 per cent rise in the biannual tax could force them to consider relocating their businesses overseas.

The spirits excise is set to soar above the current $100 per litre, making it increasingly difficult for these businesses to compete.

The upcoming February 1 indexation will also see the beer tax rise to over $60 per litre of pure alcohol. This is a significant increase that beer lovers nationwide will undoubtedly feel.

Greg Holland, the Chief Executive of Spirits & Cocktails Australia, has criticised the tax, arguing that it drives inflation and makes spirits unaffordable for consumers.

He also pointed out that government revenue from the tax is projected to fall this year, making the continued increases ‘nonsensical’.

'Consumers, manufacturers and the government all lose out to this inefficient tax,' he said.

John Preston, the Chief Executive of the Brewers Association of Australia, echoed these sentiments, stating that the latest increase is also bad news for brewers and beer drinkers.

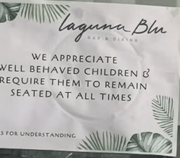

'In many venues, people are paying over $15 for a pint. This is a huge amount considering how tight the family budget is,' Mr Preston said.

The tax hike will take the excise on a pint to about 90 cents and the tax on a $55 carton of beer to more than $20 plus goods and services tax (GST).

GST is a 10 per cent tax applied to most goods and services consumed or sold in the country.

In July last year, the tax on spirits jumped to a staggering $100 per litre for the first time.

A month later, the tax on a keg of beer increased by approximately $2, bringing the total cost to $78.

Stephen Ferguson, the Chief Executive of the Australian Hotels Association, has called on the government to consider freezing the excise for the next couple of years in light of the increasing cost of living pressures many Australians face.

Australia's spirits tax is the third highest globally, trailing only Iceland and Norway.

This has led some Australian distillers, such as David Vitale, Founder of Port Melbourne’s Starward Whisky, to establish their brands in the US, where the spirits excise is a mere $10 a litre.

'We’ve invested a lot in the local economy here in Melbourne with our visitor experience and workforce, but our sights have to be set on export markets because it’s simply uncompetitive to operate here in Australia,' Mr Vitale said.

Trent Fraser, the Chief Executive of Top Shelf International, said his company was also looking to expand its operations into the US, describing Australia as the 'worst market' he'd operated in after two decades abroad.

Executives of other distilleries also expressed their frustration. Amanda Lampe, Chairwoman of Bundaberg Distilling Co, called it 'outrageous' that 63 per cent of the cost of a one-litre bottle was tax as the company tried to keep production costs down.

'We know this isn’t a problem that the current federal government created, but today we’re asking them to help fix it by freezing the excise on spirits,' she said.

Australia's alcohol tax system is complex and multifaceted, with different types of alcohol taxed at different rates.

The system is based on the alcohol content of the beverage rather than the volume of the drink. This means stronger drinks, such as spirits, are taxed more than lower-alcohol beverages like beer and wine.

The tax on alcohol is adjusted twice a year, in line with the Consumer Price Index (CPI). This is known as indexation and is designed to ensure the tax keeps pace with inflation.

However, critics argue that this system unfairly penalises consumers and manufacturers, particularly in the spirits industry.

Nonetheless, there are supporters of the system who argue that it helps to discourage excessive alcohol consumption and provides vital funding for public services.

What do you think about the upcoming increase in alcohol tax, members? Do you think the government should freeze or reduce the excise on spirits? Let us know in the comments below.

The next round of excise tax hikes, set to take effect in February, could see the cost of a pint of beer surpass $15, while a cocktail could set you back a whopping $24.

This is not just a blow to consumers but also to local manufacturers struggling to stay afloat amidst these rising costs.

The federal government is under increasing pressure to halt the excise tax, with industry insiders calling for urgent reforms to keep local manufacturing viable.

Victorian distillers, in particular, are sounding the alarm, warning that the expected 2-3 per cent rise in the biannual tax could force them to consider relocating their businesses overseas.

The spirits excise is set to soar above the current $100 per litre, making it increasingly difficult for these businesses to compete.

The upcoming February 1 indexation will also see the beer tax rise to over $60 per litre of pure alcohol. This is a significant increase that beer lovers nationwide will undoubtedly feel.

Greg Holland, the Chief Executive of Spirits & Cocktails Australia, has criticised the tax, arguing that it drives inflation and makes spirits unaffordable for consumers.

He also pointed out that government revenue from the tax is projected to fall this year, making the continued increases ‘nonsensical’.

'Consumers, manufacturers and the government all lose out to this inefficient tax,' he said.

John Preston, the Chief Executive of the Brewers Association of Australia, echoed these sentiments, stating that the latest increase is also bad news for brewers and beer drinkers.

'In many venues, people are paying over $15 for a pint. This is a huge amount considering how tight the family budget is,' Mr Preston said.

The tax hike will take the excise on a pint to about 90 cents and the tax on a $55 carton of beer to more than $20 plus goods and services tax (GST).

GST is a 10 per cent tax applied to most goods and services consumed or sold in the country.

In July last year, the tax on spirits jumped to a staggering $100 per litre for the first time.

A month later, the tax on a keg of beer increased by approximately $2, bringing the total cost to $78.

Stephen Ferguson, the Chief Executive of the Australian Hotels Association, has called on the government to consider freezing the excise for the next couple of years in light of the increasing cost of living pressures many Australians face.

Australia's spirits tax is the third highest globally, trailing only Iceland and Norway.

This has led some Australian distillers, such as David Vitale, Founder of Port Melbourne’s Starward Whisky, to establish their brands in the US, where the spirits excise is a mere $10 a litre.

'We’ve invested a lot in the local economy here in Melbourne with our visitor experience and workforce, but our sights have to be set on export markets because it’s simply uncompetitive to operate here in Australia,' Mr Vitale said.

Trent Fraser, the Chief Executive of Top Shelf International, said his company was also looking to expand its operations into the US, describing Australia as the 'worst market' he'd operated in after two decades abroad.

Executives of other distilleries also expressed their frustration. Amanda Lampe, Chairwoman of Bundaberg Distilling Co, called it 'outrageous' that 63 per cent of the cost of a one-litre bottle was tax as the company tried to keep production costs down.

'We know this isn’t a problem that the current federal government created, but today we’re asking them to help fix it by freezing the excise on spirits,' she said.

Australia's alcohol tax system is complex and multifaceted, with different types of alcohol taxed at different rates.

The system is based on the alcohol content of the beverage rather than the volume of the drink. This means stronger drinks, such as spirits, are taxed more than lower-alcohol beverages like beer and wine.

The tax on alcohol is adjusted twice a year, in line with the Consumer Price Index (CPI). This is known as indexation and is designed to ensure the tax keeps pace with inflation.

However, critics argue that this system unfairly penalises consumers and manufacturers, particularly in the spirits industry.

Nonetheless, there are supporters of the system who argue that it helps to discourage excessive alcohol consumption and provides vital funding for public services.

Key Takeaways

- Drinkers in Australia are set to experience further cost-of-living challenges with another government tax hike on alcohol.

- The spirits excise is expected to increase by 2-3 per cent, causing drinks such as beer and cocktails to become more expensive.

- Industry leaders are urging the federal government to freeze the excise, arguing that the tax is inefficient and negatively impacting local manufacturing and consumers.

- Australia's spirits tax is one of the highest in the world, prompting some local distilleries to consider expansion overseas due to the uncompetitive tax environment.

What do you think about the upcoming increase in alcohol tax, members? Do you think the government should freeze or reduce the excise on spirits? Let us know in the comments below.