Will you have enough? The rising amount of super you need for retirement

- Replies 13

Ah, retirement: it’s the time in life when you can finally relax, unwind, and (hopefully) enjoy all that life has to offer. But it's no secret that living your golden years comfortably and worry-free isn't cheap.In fact, if new reports are anything to go by, you’re going to need to set aside more money to maintain your desired lifestyle in retirement.

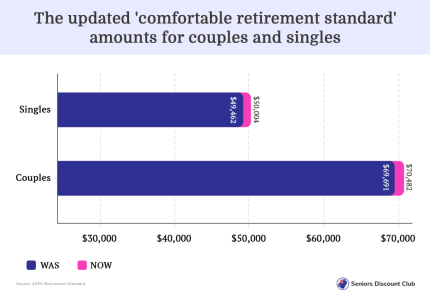

The Association of Superannuation Funds of Australia (ASFA) has recently lifted their 'comfortable retirement standard' to a record-high of $70,482 per year for couples, and $50,004 for singles, representing a 1.1 per cent increase in the March quarter.

This means the anticipated cost of retirement has gone up 7.7 per cent in the past year. That's a lot of money, especially for those who have already retired or who are actively saving towards it.

Speaking on the matter, ASFA's CEO, Dr Martin Fahy, said: 'Retiree budgets have been under substantial pressure for over 18 months due to the higher cost of essential goods and services, namely food, fuel and electricity, with the latter up 15 per cent over the past year.’

Dr Fahy goes on to detail how self-funded retirees will not benefit from Federal Budget measures aimed at reducing cost-of-living pressures and, despite recent changes to the Age Pension, the payments continue to lag behind inflation.

‘Self-funded retirees will not be eligible for Federal Budget measures aimed at relieving cost-of-living pressures, and despite recent adjustments to the Age Pension, payments continue to lag inflation.' continued Fahy.

An ASFA report also found that medical and hospital services costs, pharmaceutical products, and insurance costs all increased by 4.2 per cent, 4.5 per cent, and 3.5 per cent, respectively, in the March quarter.

Despite all this, Dr Fahy remains positive: 'Fortunately, we are seeing a turnaround in term deposit income, and critically, the July 1 increase in the super guarantee (SG) rate to 11 per cent will put a greater number of Australians on track to achieve the dignified retirements they deserve.'

The Association of Superannuation Funds of Australia

The Association of Superannuation Funds of Australia (ASFA) is the peak body for the supervised funds sector which covers both superannuation and retirement income. Established in 1977, the ASFA serves to protect the rights and interests of retirees and those preparing for retirement with the long-term vision of achieving a system which delivers financial security and comfort for current and future retirees. ASFA advocates for better government policies, regulations and practices in support of those individuals.

As Dr Martin Fahy, CEO of ASFA explains, ‘Retirees need to be aware of the increasing costs of living and budget their finances carefully. The ASFA Retirement Standard is a valuable resource to help them with this.’

The Association actively collects, analyses and disseminates data related to superannuation and retirement incomes, providing insights into how the various funds are responding to the changing needs of society. The data produced by the ASFA team provides Australians and their advisers with an invaluable tool for understanding the cost-of-living impacts on retirees in the current economic environment, and enables them to have a better understanding of how their current retirement plans are tracking.

Key Takeaways

- The cost of maintaining a comfortable retirement in Australia is hitting record highs, with the Association of Superannuation Funds of Australia (ASFA) raising the 'comfortable retirement standard' by 1.1 per cent in the March quarter.

- The new standard for couples is now at $70,482 per year, and $50,004 for singles, resulting in an annual increase of 7.7 per cent.

- Higher costs of essential goods and services such as food, fuel, electricity, and healthcare are putting pressure on retiree budgets.

- Some relief may come from the July 1 increase in the super guarantee rate to 11 per cent, which aims to put more Australians on track for a dignified retirement.

What can we take away from this news? It might be time to review your financial position, and perhaps consider speaking to a financial adviser to ensure that you're on track to maintain a comfortable retirement. After all, security and peace of mind allow us to enjoy life's true treasures - time with family, new experiences, and savouring the golden years without financial stress.

Remember, the more informed you are, the better you can manage your retirement savings and expenses, ensuring the quality of life you all deserve. So, dear members, stay clever, stay informed, and be ready to enjoy the best your golden years have to offer!

We recently wrote about a survey that revealed two-thirds of Aussies are worried about retirement savings. You can read the full article here.

What do you think about this news, members? We’d love to hear from you in the comments below.