Why you should be wary of Afterpay Plus according to financial experts

Buy now, pay later (BNPL) services like Afterpay and Zip have exploded in popularity recently. Their success is built on allowing shoppers to split purchase payments into multiple instalments with no upfront costs.

But consumer advocates warn these services can also lead customers into debt traps.

Now, Afterpay has launched a paid subscription service called Afterpay Plus, which makes it even easier to access loans.

What is Afterpay Plus, and how does it work?

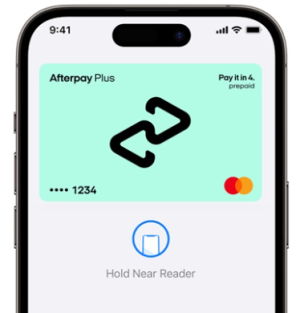

Afterpay Plus costs $10 per month and links your Afterpay account to payment services like Apple Pay, Google Pay or Samsung Pay.

This means Afterpay users can get instant access to an Afterpay loan simply by tapping their phone anytime with limited checks on whether it is appropriate for their financial situation and no oversight over whether the user is paying for essentials.

According to financial counsellors and consumer rights groups, the new product allows Afterpay to dodge regulations and could tempt users into bad financial habits.

Afterpay claims the paid subscription model is currently invitation-only and aimed at their most engaged users for now.

‘Invitation to Afterpay Plus is limited and considers credit eligibility criteria,’ according to the Afterpay website.

However, advocates argued making BNPL credit even more seamless is concerning.

'Afterpay Plus takes poorly regulated loans, combines it with a costly subscription model, and allows people to sign up for a new loan just by swiping their phone at the checkout,' said Andy Kelly, Head of Campaigns and Mobilisation at CHOICE.

CEO of Financial Counselling Australia, Fiona Guthrie, said Afterpay Plus raises red flags because it could tempt even careful spenders into bad habits.

‘I guess the more seamless it becomes, the less people kind of stop and think about it as a product and taking out a loan. People don't think of it as credit, generally, but you're using someone else's money,’ she explained.

Sally Jungwirth, a Financial Counselor at Consumer Action Law Centre, takes calls from struggling Australians through the National Debt Helpline. She shared that BNPL services like Afterpay are often used by people who can’t get loans from banks and fall into debt traps.

‘A lot of clients don't know about alternatives like no-interest loans. You know, these are people who aren't able to access conventional credit because they wouldn't meet the responsible lending criteria, so they turn to BNPL,’ she revealed.

Consumer advocates also pointed out that the Afterpay Plus terms state if you unsubscribe from the $10 per month service, you can’t sign back up again for 12 months. This makes people reluctant to stop payments.

Tom Abourizk from the Consumer Action Law Centre believes this requirement is deliberately designed to avoid regulation.

However, Afterpay shared that their 12-month break is ‘in alignment with the current BNPL regulatory framework and its requirements’.

'Like all BNPL products, Afterpay Plus is designed to fall within an exemption to the definition of credit. Under this loophole, a provider can only charge fees on one credit contract within 12 months,' Mr Abourizk said.

'We have been telling Afterpay for years that we are seeing people use their product to pay for essentials. It is concerning that they have made this even easier with Afterpay Plus while still going to lengths to avoid the consumer safeguards in the credit law,' he added.

Calls to close BNPL regulation loopholes

The government has announced upcoming reforms to the BNPL sector, including requiring responsible lending checks. But the exact details are still being worked out.

Mr Kelly from CHOICE argued that Afterpay Plus proves the need for air-tight regulations.

'It's crucial that any new regulations to rein in buy now, pay later providers include safe lending obligations, including a requirement to verify income before approving a loan,' he explained.

As for consumers, experts suggest being cautious with services like Afterpay Plus:

Members, have you used BNPL services like Afterpay? What has your experience been? Let us know in the comments below.

But consumer advocates warn these services can also lead customers into debt traps.

Now, Afterpay has launched a paid subscription service called Afterpay Plus, which makes it even easier to access loans.

What is Afterpay Plus, and how does it work?

Afterpay Plus costs $10 per month and links your Afterpay account to payment services like Apple Pay, Google Pay or Samsung Pay.

This means Afterpay users can get instant access to an Afterpay loan simply by tapping their phone anytime with limited checks on whether it is appropriate for their financial situation and no oversight over whether the user is paying for essentials.

According to financial counsellors and consumer rights groups, the new product allows Afterpay to dodge regulations and could tempt users into bad financial habits.

Afterpay claims the paid subscription model is currently invitation-only and aimed at their most engaged users for now.

‘Invitation to Afterpay Plus is limited and considers credit eligibility criteria,’ according to the Afterpay website.

However, advocates argued making BNPL credit even more seamless is concerning.

'Afterpay Plus takes poorly regulated loans, combines it with a costly subscription model, and allows people to sign up for a new loan just by swiping their phone at the checkout,' said Andy Kelly, Head of Campaigns and Mobilisation at CHOICE.

CEO of Financial Counselling Australia, Fiona Guthrie, said Afterpay Plus raises red flags because it could tempt even careful spenders into bad habits.

‘I guess the more seamless it becomes, the less people kind of stop and think about it as a product and taking out a loan. People don't think of it as credit, generally, but you're using someone else's money,’ she explained.

Sally Jungwirth, a Financial Counselor at Consumer Action Law Centre, takes calls from struggling Australians through the National Debt Helpline. She shared that BNPL services like Afterpay are often used by people who can’t get loans from banks and fall into debt traps.

‘A lot of clients don't know about alternatives like no-interest loans. You know, these are people who aren't able to access conventional credit because they wouldn't meet the responsible lending criteria, so they turn to BNPL,’ she revealed.

Consumer advocates also pointed out that the Afterpay Plus terms state if you unsubscribe from the $10 per month service, you can’t sign back up again for 12 months. This makes people reluctant to stop payments.

Tom Abourizk from the Consumer Action Law Centre believes this requirement is deliberately designed to avoid regulation.

However, Afterpay shared that their 12-month break is ‘in alignment with the current BNPL regulatory framework and its requirements’.

'Like all BNPL products, Afterpay Plus is designed to fall within an exemption to the definition of credit. Under this loophole, a provider can only charge fees on one credit contract within 12 months,' Mr Abourizk said.

'We have been telling Afterpay for years that we are seeing people use their product to pay for essentials. It is concerning that they have made this even easier with Afterpay Plus while still going to lengths to avoid the consumer safeguards in the credit law,' he added.

Calls to close BNPL regulation loopholes

The government has announced upcoming reforms to the BNPL sector, including requiring responsible lending checks. But the exact details are still being worked out.

Mr Kelly from CHOICE argued that Afterpay Plus proves the need for air-tight regulations.

'It's crucial that any new regulations to rein in buy now, pay later providers include safe lending obligations, including a requirement to verify income before approving a loan,' he explained.

As for consumers, experts suggest being cautious with services like Afterpay Plus:

Tip

If you need help managing debts or bills, contact the National Debt Helpline at 1800 007 007 for free, confidential and independent information and advice.

Key Takeaways

- Afterpay has introduced a new service, Afterpay Plus, that links with Apple Pay, Google Pay, and Samsung Pay, providing easy access to instant loans.

- Consumer advocacy groups are raising concerns about Afterpay Plus, stating it may worsen financial situations for users by enabling too easy access to credit.

- People who unsubscribe from Afterpay Plus will be banned from using the service for 12 months, a stipulation being criticised as a deterrent from cancelling.

- Advocacy groups are urging reforms and new regulations, including safe lending obligations, as the BNPL sector lacks consumer protections.

Members, have you used BNPL services like Afterpay? What has your experience been? Let us know in the comments below.