Why are your energy bills not getting cheaper even though supply costs have halved?

Have you ever wondered why the cost of supplying energy to Australian households has significantly reduced, but this decrease is yet to be reflected in your energy bills?

And while there is potential for a double-digit decline in energy prices, this is not guaranteed.

If energy prices do decrease, it would aid the Reserve Bank of Australia (RBA) in achieving its inflation target of between 2 and 3 per cent and potentially lower interest payments on mortgages, providing a double boost to household budgets.

But how likely is this scenario? David Taylor, a senior reporter at The Drum, shared his analysis.

Understanding the Wholesale Electricity Market

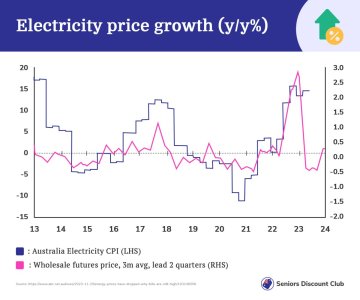

The wholesale price of electricity has halved this year, largely due to the end of 'hyper' commodity inflation.

To understand this, we must delve into the workings of the National Electricity Market (NEM). The NEM is the power system that connects the east coast of Australia, including Queensland, New South Wales, the Australian Capital Territory, Victoria, South Australia and Tasmania.

In the NEM, generators (coal-fired power stations, which use coal to generate electricity) sell electricity to retailers, who then on-sell it to households.

Each state has its own 'spot' price for electricity—the price the electricity generators receive for the power they supply. This spot price also signals to generators how much electricity the market needs at any given moment to ensure the lights stay on.

Climate Energy Finance Director Tim Buckley explained: ‘The wholesale cost of electricity has come down more than 50 per cent year on year in [calendar year] 2023 because the hyperinflation of gas and coal commodity prices internationally over 2022 has now in 2023 progressively come off [more than] 70 per cent from their peak.’

The pandemic, war in Ukraine, and local flooding contributed to the soaring price of commodities, like coal, through 2021 and half of 2022.

Coal is crucial for electricity production. Luckily, its global supply has increased since mid-2020.

‘Export thermal coal prices are still double long-term averages, but way down on the near 1000 per cent increase that precipitated the collapse of the National Energy Market (NEM) last June,’ Mr Buckley stated.

He also mentioned other factors that have helped lower the cost of wholesale prices, including the Albanese government price cap and the progressive introduction of new replacement zero emissions generation capacity and battery firming capacity, particularly more than 3.2GW of new rooftop solar capacity in the last 12 months alone.

Why Your Bills Aren't Decreasing

Despite the significant decrease in the wholesale cost of energy, households are yet to see a significant cost change in their energy bill.

This is largely because, over recent decades, big Australian coal producers have been incentivised to export their product offshore because there's been no mechanism in place to ensure a certain amount stays onshore.

‘On the east coast, at least,’ said Taylor.

Meanwhile, Mr Buckley called it ‘a long-term Australian government failure’.

‘Coal miners and gas extraction companies [could] choose to supply either market and so they take the best price available,’ he said. ‘As such, Australians now have to compete with international buyers when sourcing our energy from our own public resources.’

He further explained: ‘Our successive governments failed to put in safeguards to ensure long-term domestic demand is covered, and only the surplus is exported. We now face the hard choice of paying export price parity to use our coal and gas, or we miss out if we can't afford it.’

He continued: ‘It had a choice of not operating or buying coal at export prices of up to US$500/tonne at the end of 2022,10 [times] the price Eraring paid for coal for its first 40 years of operation.’

This has led to what’s known as the Default Market Offer (DMO), set by the Australian Energy Regulator (AER).

The DMO ensures households don't pay ridiculously high energy bills while allowing retailers to recover costs. However, the retail price of electricity is deliberately designed to have a 12-month lag.

The default market offer is set annually with effect from July 1. This means that energy bill relief cannot be implemented at present due to limitations in the system.

The Impact on Inflation and Interest Rates

The wholesale price of electricity is roughly 30 per cent of the total cost that goes into the bill everyone receives.

In any case, David Taylor believes that millions of Australians would welcome any household bill relief. If the wholesale price of electricity continues to decrease, this should lead to lower electricity prices from July 1 next year.

Mr Bukley said: ‘So Climate Energy Finance expects electricity price relief to be on the horizon, we expect a double-digit decline in the DMO in some Eastern states come July 2024.’

This could potentially lower inflation in the second half of next year. AMP Deputy Economist Diana Mousina predicted: ‘Our June 2024 CPI (inflation) forecast is 3.7 per cent year on year—a bit lower than RBA at 3.9 per cent.’

This could nudge the inflation rate to within a mere 0.7 percentage points of the RBA's inflation target.

In conclusion, while the cost of supplying energy has halved, a combination of policy failures, market mechanisms and global commodity price fluctuations have prevented these savings from being passed on to consumers.

However, with the right policy adjustments and continued investment in renewable energy, Australians could see a significant reduction in their energy bills.

What are your thoughts on this issue, members? Have you noticed any changes in your energy bills? Share your experiences in the comments below.

And while there is potential for a double-digit decline in energy prices, this is not guaranteed.

If energy prices do decrease, it would aid the Reserve Bank of Australia (RBA) in achieving its inflation target of between 2 and 3 per cent and potentially lower interest payments on mortgages, providing a double boost to household budgets.

But how likely is this scenario? David Taylor, a senior reporter at The Drum, shared his analysis.

Understanding the Wholesale Electricity Market

The wholesale price of electricity has halved this year, largely due to the end of 'hyper' commodity inflation.

To understand this, we must delve into the workings of the National Electricity Market (NEM). The NEM is the power system that connects the east coast of Australia, including Queensland, New South Wales, the Australian Capital Territory, Victoria, South Australia and Tasmania.

In the NEM, generators (coal-fired power stations, which use coal to generate electricity) sell electricity to retailers, who then on-sell it to households.

Each state has its own 'spot' price for electricity—the price the electricity generators receive for the power they supply. This spot price also signals to generators how much electricity the market needs at any given moment to ensure the lights stay on.

Climate Energy Finance Director Tim Buckley explained: ‘The wholesale cost of electricity has come down more than 50 per cent year on year in [calendar year] 2023 because the hyperinflation of gas and coal commodity prices internationally over 2022 has now in 2023 progressively come off [more than] 70 per cent from their peak.’

The pandemic, war in Ukraine, and local flooding contributed to the soaring price of commodities, like coal, through 2021 and half of 2022.

Coal is crucial for electricity production. Luckily, its global supply has increased since mid-2020.

‘Export thermal coal prices are still double long-term averages, but way down on the near 1000 per cent increase that precipitated the collapse of the National Energy Market (NEM) last June,’ Mr Buckley stated.

He also mentioned other factors that have helped lower the cost of wholesale prices, including the Albanese government price cap and the progressive introduction of new replacement zero emissions generation capacity and battery firming capacity, particularly more than 3.2GW of new rooftop solar capacity in the last 12 months alone.

Why Your Bills Aren't Decreasing

Despite the significant decrease in the wholesale cost of energy, households are yet to see a significant cost change in their energy bill.

This is largely because, over recent decades, big Australian coal producers have been incentivised to export their product offshore because there's been no mechanism in place to ensure a certain amount stays onshore.

‘On the east coast, at least,’ said Taylor.

Meanwhile, Mr Buckley called it ‘a long-term Australian government failure’.

‘Coal miners and gas extraction companies [could] choose to supply either market and so they take the best price available,’ he said. ‘As such, Australians now have to compete with international buyers when sourcing our energy from our own public resources.’

He further explained: ‘Our successive governments failed to put in safeguards to ensure long-term domestic demand is covered, and only the surplus is exported. We now face the hard choice of paying export price parity to use our coal and gas, or we miss out if we can't afford it.’

He continued: ‘It had a choice of not operating or buying coal at export prices of up to US$500/tonne at the end of 2022,10 [times] the price Eraring paid for coal for its first 40 years of operation.’

This has led to what’s known as the Default Market Offer (DMO), set by the Australian Energy Regulator (AER).

The DMO ensures households don't pay ridiculously high energy bills while allowing retailers to recover costs. However, the retail price of electricity is deliberately designed to have a 12-month lag.

The default market offer is set annually with effect from July 1. This means that energy bill relief cannot be implemented at present due to limitations in the system.

The Impact on Inflation and Interest Rates

The wholesale price of electricity is roughly 30 per cent of the total cost that goes into the bill everyone receives.

In any case, David Taylor believes that millions of Australians would welcome any household bill relief. If the wholesale price of electricity continues to decrease, this should lead to lower electricity prices from July 1 next year.

Mr Bukley said: ‘So Climate Energy Finance expects electricity price relief to be on the horizon, we expect a double-digit decline in the DMO in some Eastern states come July 2024.’

This could potentially lower inflation in the second half of next year. AMP Deputy Economist Diana Mousina predicted: ‘Our June 2024 CPI (inflation) forecast is 3.7 per cent year on year—a bit lower than RBA at 3.9 per cent.’

This could nudge the inflation rate to within a mere 0.7 percentage points of the RBA's inflation target.

In conclusion, while the cost of supplying energy has halved, a combination of policy failures, market mechanisms and global commodity price fluctuations have prevented these savings from being passed on to consumers.

However, with the right policy adjustments and continued investment in renewable energy, Australians could see a significant reduction in their energy bills.

Key Takeaways

- The wholesale price of electricity has halved this year due to the end of 'hyper' commodity inflation, government intervention, and increasing renewable energy capacity.

- Despite the drop in wholesale prices, Australian domestic energy bills are not likely to decrease immediately due to no current mechanisms that ensure a set amount of energy sourced stays in the country, causing domestic and international prices to compete.

- The retail price of electricity has a built-in 12-month lag by design, meaning that even if the cost of supply decreases, the Australian Energy Regulator (AER) cannot adjust the Default Market Offer (DMO) to reflect this until the next financial year.

- Climate Energy Finance expects a significant decrease in energy bills after July 1, 2024, which could potentially cause a decline in inflation.

What are your thoughts on this issue, members? Have you noticed any changes in your energy bills? Share your experiences in the comments below.

Last edited: