Why are retirees turning to share houses?

As we grow older, most of us hope to enjoy our time in the comfort of our own homes.

But as house prices continue to rise across Australia, retirees are increasingly finding themselves locked out of the rental market.

Now, there’s a concerning trend in Australian cities: more retirees are finding themselves having to live with strangers just to keep a roof over their heads.

As housing costs surge once more and the search for a rental property turns into a real challenge, a significant shift is reshaping the Australian living scene.

Recent data on households also revealed a noteworthy resurgence of beloved Aussie share houses.

The sheer number of share houses is experiencing a sudden rise, marking a considerable trend and signifying a significant transformation in the very essence of the share house experience.

Before, having a share house next door was a bit of a headache for everyone. But now, it might not be all that bad.

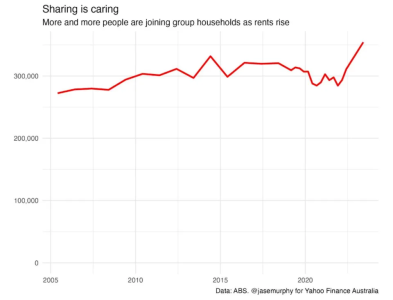

In the chart below, a noticeable increase in the number of group households in Australia can be seen, especially since rents started rising in 2021-22.

Over the last two decades, the dynamics of share houses have undergone significant changes.

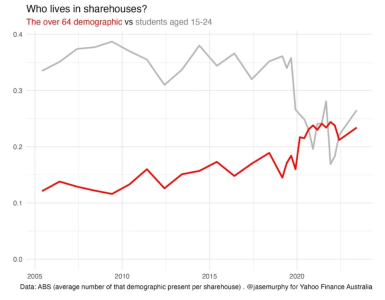

The presence of young students in share houses has decreased by 20 per cent, while individuals aged over 65 sharing a house have surged by 93 per cent, as shown in the following chart.

The increase in retirement-age Aussies in share houses has been so substantial that it’s nearly on par with the number of students.

However, this trend is indicative of a housing shortage.

Older Aussies aren’t opting for share houses to relive their youthful days. Instead, it’s a response to dwindling superannuation funds and the pension falling short to cover rent.

On the other hand, young people aren’t necessarily living independently; many are still residing with their parents.

Queensland has the highest proportion of older individuals choosing share houses, fueled partly by a notable increase in average rents for Brisbane homes—from $431 weekly in January 2020 to $635 a week in October 2023.

The state’s popularity among both Aussies and foreigners has intensified the pressure on its rental system.

For many facing financial constraints, the decision to live in a share house has become a practical one.

The increase in rent, along with rising expenses for groceries, bills, and fuel, has made sharing living spaces a sensible financial choice.

Pensions have seen inflation-adjusted increases during the pandemic, with a full pension for a single person now just under $1,100 per fortnight.

However, this may not be sufficient for those living alone, prompting consideration of sharing living spaces to manage costs.

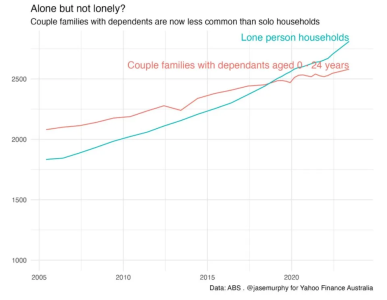

Data also indicated a decline in average household size since 2005, dropping from 2.6 to 2.5 people.

This trend aligns with the extensive construction of one-bedroom apartments, fueling a significant rise in solo living—the fastest-growing household category.

The chart above shows a shift in where living alone has become more popular in recent years.

This change raises concerns for the Reserve Bank, which closely monitors the number of people per household as a key factor in managing population growth without resorting to an unsustainable building boom.

In a previous story from August, we featured Rachelle Chilcott, a pensioner from Brisbane, who grappled with finding affordable housing.

However, she transformed her situation by living in adopting the concept of a share house.

Now, Rachelle enjoys comfortable living at $250 per week, inclusive of water, electricity, and internet. For more details, read the full story here.

Members, how do you feel about living in a share house? Write your views in the comments below!

But as house prices continue to rise across Australia, retirees are increasingly finding themselves locked out of the rental market.

Now, there’s a concerning trend in Australian cities: more retirees are finding themselves having to live with strangers just to keep a roof over their heads.

As housing costs surge once more and the search for a rental property turns into a real challenge, a significant shift is reshaping the Australian living scene.

Recent data on households also revealed a noteworthy resurgence of beloved Aussie share houses.

The sheer number of share houses is experiencing a sudden rise, marking a considerable trend and signifying a significant transformation in the very essence of the share house experience.

Before, having a share house next door was a bit of a headache for everyone. But now, it might not be all that bad.

In the chart below, a noticeable increase in the number of group households in Australia can be seen, especially since rents started rising in 2021-22.

Over the last two decades, the dynamics of share houses have undergone significant changes.

The presence of young students in share houses has decreased by 20 per cent, while individuals aged over 65 sharing a house have surged by 93 per cent, as shown in the following chart.

The increase in retirement-age Aussies in share houses has been so substantial that it’s nearly on par with the number of students.

However, this trend is indicative of a housing shortage.

Older Aussies aren’t opting for share houses to relive their youthful days. Instead, it’s a response to dwindling superannuation funds and the pension falling short to cover rent.

On the other hand, young people aren’t necessarily living independently; many are still residing with their parents.

Queensland has the highest proportion of older individuals choosing share houses, fueled partly by a notable increase in average rents for Brisbane homes—from $431 weekly in January 2020 to $635 a week in October 2023.

The state’s popularity among both Aussies and foreigners has intensified the pressure on its rental system.

For many facing financial constraints, the decision to live in a share house has become a practical one.

The increase in rent, along with rising expenses for groceries, bills, and fuel, has made sharing living spaces a sensible financial choice.

Pensions have seen inflation-adjusted increases during the pandemic, with a full pension for a single person now just under $1,100 per fortnight.

However, this may not be sufficient for those living alone, prompting consideration of sharing living spaces to manage costs.

Data also indicated a decline in average household size since 2005, dropping from 2.6 to 2.5 people.

This trend aligns with the extensive construction of one-bedroom apartments, fueling a significant rise in solo living—the fastest-growing household category.

The chart above shows a shift in where living alone has become more popular in recent years.

This change raises concerns for the Reserve Bank, which closely monitors the number of people per household as a key factor in managing population growth without resorting to an unsustainable building boom.

In a previous story from August, we featured Rachelle Chilcott, a pensioner from Brisbane, who grappled with finding affordable housing.

However, she transformed her situation by living in adopting the concept of a share house.

Now, Rachelle enjoys comfortable living at $250 per week, inclusive of water, electricity, and internet. For more details, read the full story here.

Key Takeaways

- There has been a sharp increase in the number of group households or share houses in Australia due to soaring rental prices.

- The demographic of share houses has changed over the past 20 years, with a 20 per cent decrease in young students and a 93 per cent increase in people over 65.

- Older Australians are being forced into share houses as their superannuation funds dry up and the pension fails to cover rent.